Bitcoin To Hit $500K? Standard Chartered's Bullish Forecast And The Role Of Government Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin to Hit $500K? Standard Chartered's Bullish Forecast Ignites Crypto Debate

Standard Chartered's audacious prediction that Bitcoin could reach a staggering $500,000 by 2024 has sent shockwaves through the cryptocurrency market. This bold forecast, issued by the multinational banking giant, is not just another speculative opinion; it highlights a growing belief in Bitcoin's long-term potential, fueled by increasing institutional adoption and the intriguing role of government investments in digital assets. But is this prediction realistic, and what factors could drive – or hinder – Bitcoin's ascent to such lofty heights?

The Bullish Case: Why $500,000 Bitcoin?

Standard Chartered's prediction rests on several key pillars. Firstly, they point to the increasing adoption of Bitcoin by institutional investors. Large corporations and financial institutions are increasingly viewing Bitcoin as a viable asset class, diversifying their portfolios and hedging against inflation. This growing institutional interest is injecting significant capital into the market, driving up demand and price.

Secondly, the bank highlights the potential impact of government investments in Bitcoin and other cryptocurrencies. While still nascent, several countries are exploring the potential benefits of incorporating digital assets into their national strategies. This could involve direct investments in Bitcoin, the creation of national digital currencies, or the development of regulatory frameworks that foster crypto adoption. Such governmental backing could significantly legitimize Bitcoin and boost its appeal to a wider audience.

- Increased Institutional Adoption: This is a crucial factor, bringing stability and legitimacy to the market.

- Government Investments: Government involvement could signal a major shift in global perception of Bitcoin.

- Limited Supply: Bitcoin's capped supply of 21 million coins creates inherent scarcity, driving up value over time.

- Inflation Hedge: Many see Bitcoin as a hedge against traditional fiat currency inflation.

Challenges and Potential Headwinds

Despite the optimistic forecast, several challenges could hinder Bitcoin's journey to $500,000. Regulatory uncertainty remains a significant obstacle. Differing regulatory approaches across various jurisdictions create confusion and hamper widespread adoption. Stricter regulations could stifle growth, while a lack of clear guidelines could lead to market volatility.

Furthermore, volatility continues to be a defining characteristic of Bitcoin. While institutional investment is reducing volatility, significant price swings are still possible, potentially deterring some investors. Environmental concerns surrounding Bitcoin mining also remain a significant point of contention. The energy consumption associated with mining could lead to stricter regulations and hamper adoption.

- Regulatory Uncertainty: Clear and consistent global regulations are crucial for sustained growth.

- Market Volatility: While decreasing, volatility remains a risk factor for potential investors.

- Environmental Concerns: The energy consumption of Bitcoin mining is a growing concern.

- Competition: The emergence of other cryptocurrencies could dilute Bitcoin's market dominance.

The Verdict: Realistic or Overly Optimistic?

Whether Bitcoin will truly reach $500,000 by 2024 remains to be seen. Standard Chartered's prediction is undeniably bullish, but it's based on a confluence of factors suggesting a significant upward trajectory for Bitcoin. The increasing institutional adoption, the potential for government investment, and Bitcoin's inherent scarcity all contribute to a compelling narrative. However, regulatory hurdles, market volatility, and environmental concerns represent significant headwinds.

The future of Bitcoin remains uncertain, but Standard Chartered's bold prediction underscores the growing significance of this digital asset in the global financial landscape. The coming years will be crucial in determining whether this ambitious forecast becomes reality. Continued monitoring of regulatory developments, institutional investment trends, and technological advancements is essential for navigating the dynamic world of Bitcoin and cryptocurrencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin To Hit $500K? Standard Chartered's Bullish Forecast And The Role Of Government Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

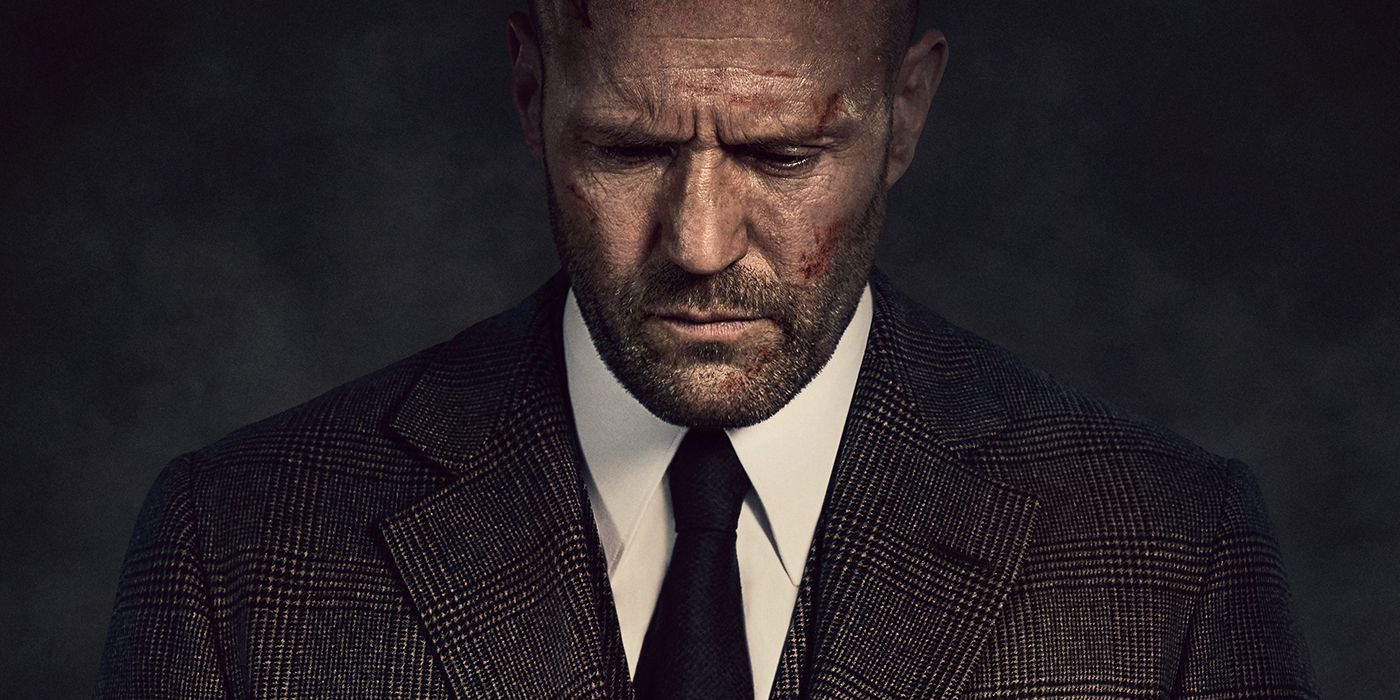

Jason Stathams Critical Darling A 90 Audience Score Propels Streaming Success

May 22, 2025

Jason Stathams Critical Darling A 90 Audience Score Propels Streaming Success

May 22, 2025 -

Barkley And Millers Disagreement Unpacking The Indiana Pacers Dynasty

May 22, 2025

Barkley And Millers Disagreement Unpacking The Indiana Pacers Dynasty

May 22, 2025 -

Google I O 2025 Android Xr Gemini And Project Astra Updates

May 22, 2025

Google I O 2025 Android Xr Gemini And Project Astra Updates

May 22, 2025 -

Elle Fanning And More The Complete Cast Of Hunger Games Sunrise On The Reaping

May 22, 2025

Elle Fanning And More The Complete Cast Of Hunger Games Sunrise On The Reaping

May 22, 2025 -

Bitcoins Historic High Exploring The Factors Fueling The Rise

May 22, 2025

Bitcoins Historic High Exploring The Factors Fueling The Rise

May 22, 2025

Latest Posts

-

Check The Winning Lotto And Thunderball Numbers For Wednesday May 21 2025

May 23, 2025

Check The Winning Lotto And Thunderball Numbers For Wednesday May 21 2025

May 23, 2025 -

Could Dalton Knecht Fuel A Lakers Pacers Trade For A 16 1 Ppg Wing

May 23, 2025

Could Dalton Knecht Fuel A Lakers Pacers Trade For A 16 1 Ppg Wing

May 23, 2025 -

Pete De Boers Second Western Conference Final Appearance A Look At His Coaching Success

May 23, 2025

Pete De Boers Second Western Conference Final Appearance A Look At His Coaching Success

May 23, 2025 -

Live Game Coverage Edmonton Oilers Vs Dallas Stars Play By Play

May 23, 2025

Live Game Coverage Edmonton Oilers Vs Dallas Stars Play By Play

May 23, 2025 -

Gta Vis Ai Characters A Hollywood Reality Check

May 23, 2025

Gta Vis Ai Characters A Hollywood Reality Check

May 23, 2025