Bitcoin To Reach $250,000? Expert Analysis Connects Crypto's Rise To Stablecoin Adoption And A Select Group

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin to Hit $250,000? Expert Prediction Links Crypto Surge to Stablecoin Growth and Elite Investor Activity

Bitcoin's price has been a rollercoaster ride, but a bold new prediction has sent ripples through the crypto community: will Bitcoin truly reach a quarter of a million dollars? A prominent financial analyst, whose identity remains undisclosed for confidentiality reasons, believes this astronomical figure is not only possible but increasingly probable, connecting the potential surge to a fascinating confluence of factors – the burgeoning adoption of stablecoins and the strategic maneuvers of a select group of high-net-worth investors.

The Stablecoin Connection: A Foundation for Explosive Growth?

The analyst's argument hinges on the growing mainstream acceptance and utilization of stablecoins. These cryptocurrencies, pegged to the value of fiat currencies like the US dollar, are providing a crucial bridge for institutional investors hesitant to navigate the volatility inherent in Bitcoin. "Stablecoins act as a gateway," explains the anonymous expert. "They offer a low-risk entry point into the crypto market, allowing institutions to gradually accumulate Bitcoin without the fear of significant short-term losses." This influx of institutional capital, fueled by the comfort and stability provided by stablecoins, is posited as a primary driver for Bitcoin's potential price explosion.

Beyond Stablecoins: The Role of High-Net-Worth Investors

But the story doesn't end with stablecoins. The analyst points to the secretive activities of a select group of high-net-worth individuals and institutions, hinting at large-scale, strategic Bitcoin accumulation. While details are scarce due to the secretive nature of these transactions, the expert suggests this group is strategically accumulating Bitcoin, viewing it as a hedge against inflation and a potential store of value in an increasingly uncertain global economic landscape. This "whale" activity, coupled with the stablecoin-driven institutional inflow, is presented as a potent combination capable of propelling Bitcoin to unprecedented heights.

Challenges and Counterarguments:

This bullish prediction is not without its challenges. Critics point to the inherent volatility of the cryptocurrency market, the regulatory uncertainty surrounding Bitcoin, and the potential for unforeseen market corrections. Furthermore, the anonymous nature of the analyst's identity raises questions about the credibility and validity of the prediction.

However, the analyst counters these concerns by highlighting the growing maturity of the Bitcoin ecosystem, the increasing acceptance of cryptocurrencies by mainstream financial institutions, and the persistent scarcity of Bitcoin – only 21 million Bitcoin will ever exist.

Key Factors Contributing to the $250,000 Prediction:

- Increased Stablecoin Adoption: Providing a smoother on-ramp for institutional investors.

- Strategic Accumulation by High-Net-Worth Individuals: Large-scale purchases driving up demand.

- Bitcoin's Scarcity: Limited supply creates inherent value and potential for price appreciation.

- Growing Institutional Interest: More institutional investors are allocating assets to Bitcoin.

- Inflation Hedge: Bitcoin's decentralized nature makes it an attractive hedge against inflation.

Conclusion: A Bold Claim with Potential Merit?

Whether Bitcoin will truly reach $250,000 remains to be seen. The anonymous analyst's prediction, while bold, highlights the complex interplay of factors influencing Bitcoin's price. The convergence of stablecoin adoption, strategic institutional investment, and Bitcoin's inherent scarcity presents a compelling case for significant price appreciation. However, investors should approach such predictions with caution, conducting their own thorough research and risk assessment before making any investment decisions. The cryptocurrency market remains inherently volatile, and substantial price fluctuations are to be expected. Only time will tell if this audacious prediction will become reality.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin To Reach $250,000? Expert Analysis Connects Crypto's Rise To Stablecoin Adoption And A Select Group. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

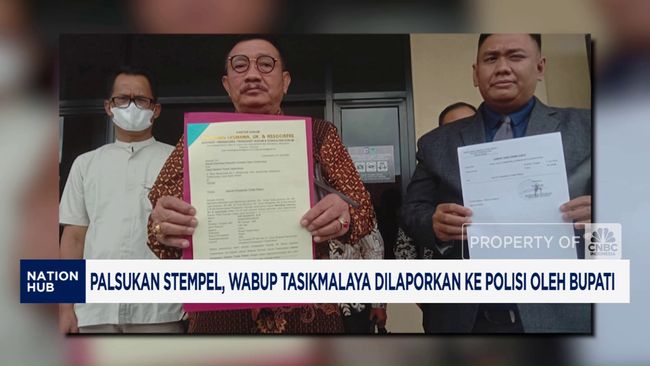

Video Detik Detik Wabup Tasikmalaya Dilaporkan Ke Kepolisian Oleh Bupati

Apr 12, 2025

Video Detik Detik Wabup Tasikmalaya Dilaporkan Ke Kepolisian Oleh Bupati

Apr 12, 2025 -

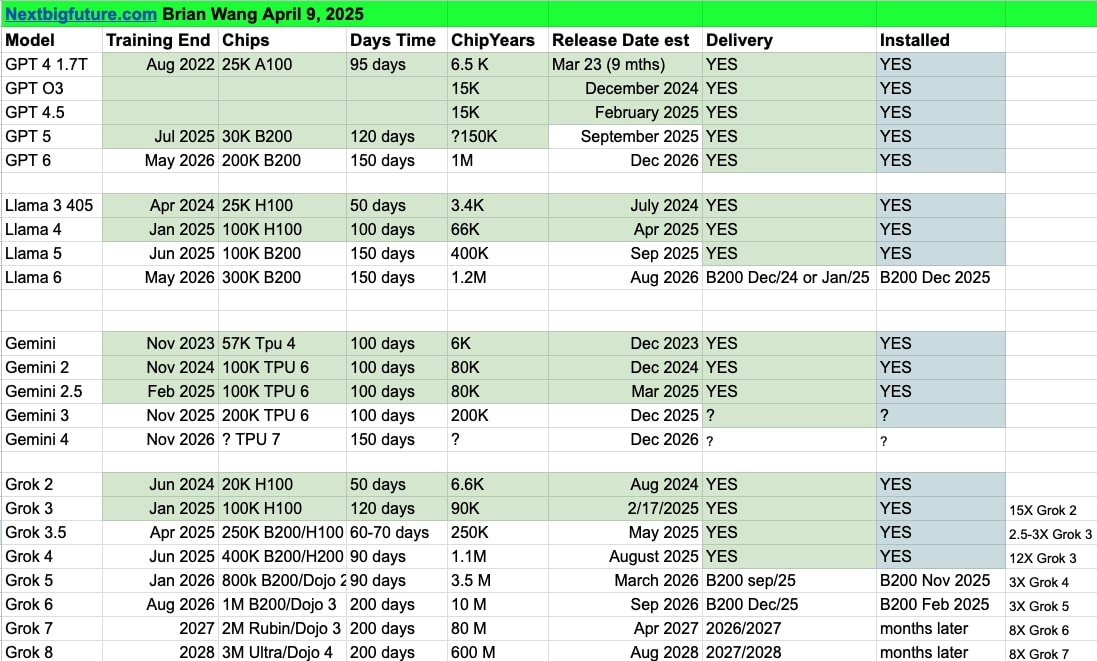

Grok 3 5 And Grok 4 Anticipated Release Dates From X Ai

Apr 12, 2025

Grok 3 5 And Grok 4 Anticipated Release Dates From X Ai

Apr 12, 2025 -

Canli Skor Samsunspor Galatasaray Maci Detaylari Ve Yorumlar

Apr 12, 2025

Canli Skor Samsunspor Galatasaray Maci Detaylari Ve Yorumlar

Apr 12, 2025 -

Galatasaray Samsun Da Coskulu Bir Karsilama Aldi Cicekler Ve Mourinho Anlami

Apr 12, 2025

Galatasaray Samsun Da Coskulu Bir Karsilama Aldi Cicekler Ve Mourinho Anlami

Apr 12, 2025 -

Canadian Tour And New Album Mac De Marcos Big Announcement

Apr 12, 2025

Canadian Tour And New Album Mac De Marcos Big Announcement

Apr 12, 2025