Bitcoin Vs. MicroStrategy: Analyzing Investment Performance In February 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin vs. MicroStrategy: A February 2025 Investment Performance Showdown

February 2025 saw significant shifts in the cryptocurrency market, prompting a renewed focus on Bitcoin's performance against established players like MicroStrategy, a publicly traded business intelligence company with a substantial Bitcoin holding. This analysis compares the investment performance of Bitcoin and MicroStrategy's Bitcoin holdings during this volatile month, examining factors influencing their respective trajectories.

Bitcoin's February 2025 Rollercoaster:

Bitcoin, the world's largest cryptocurrency by market capitalization, experienced a turbulent February 2025. Early in the month, positive news regarding [insert specific relevant news, e.g., regulatory clarity in a major market, a significant institutional investment] pushed the price to a [insert hypothetical price, e.g., $45,000]. However, this bullish sentiment was short-lived. A subsequent [insert specific negative news impacting Bitcoin price, e.g., a major security breach on a prominent exchange, renewed regulatory concerns] triggered a sharp correction, sending the price plummeting to [insert hypothetical price, e.g., $38,000] by month's end. This volatility underscored Bitcoin's inherent risk, highlighting the importance of a diversified investment strategy for long-term holders.

MicroStrategy's Bitcoin Strategy: A Mixed Bag?

MicroStrategy, under the leadership of Michael Saylor, has aggressively embraced Bitcoin as a corporate treasury asset. Their substantial holdings, accumulated over several years, make them a key player in the Bitcoin market. In February 2025, MicroStrategy's Bitcoin holdings mirrored the cryptocurrency's price fluctuations, resulting in a [insert hypothetical percentage change, e.g., 15%] decrease in the value of their Bitcoin investment. However, it's crucial to consider the broader context. While the short-term performance may seem negative, MicroStrategy’s long-term strategy is anchored to Bitcoin's potential for future growth, a bet that hinges on the long-term adoption of cryptocurrency.

Analyzing the Performance Discrepancy:

The performance gap between Bitcoin itself and MicroStrategy's investment in Bitcoin during February 2025 wasn't significant. This is because MicroStrategy's investment is primarily tied directly to the price movements of Bitcoin. Any discrepancy would likely stem from factors such as:

- Transaction Costs: Buying and selling Bitcoin incurs fees, which can slightly impact overall returns, particularly during periods of high volatility.

- Accounting Practices: MicroStrategy's accounting methods for its Bitcoin holdings might slightly influence the reported performance compared to simply tracking Bitcoin's price alone.

- Market Sentiment: The overall market sentiment surrounding both Bitcoin and MicroStrategy could have influenced their respective performance.

Conclusion: Long-Term Outlook Remains Key

February 2025 served as a reminder of the inherent volatility in the cryptocurrency market. While both Bitcoin and MicroStrategy experienced a downturn, evaluating their performance solely based on a single month’s data provides an incomplete picture. The long-term outlook for Bitcoin and MicroStrategy's Bitcoin strategy remains a topic of ongoing debate among investors. A comprehensive analysis requires considering long-term price trends, regulatory developments, and the overall adoption rate of Bitcoin. Both Bitcoin and MicroStrategy represent high-risk, high-reward investment opportunities, and investors should proceed with caution and conduct thorough due diligence before committing capital.

Keywords: Bitcoin, MicroStrategy, Cryptocurrency, Investment Performance, February 2025, Bitcoin Price, Volatility, Michael Saylor, Cryptocurrency Investment, Market Analysis, Bitcoin Strategy, Risk Management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Vs. MicroStrategy: Analyzing Investment Performance In February 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brasil Copom Define Selic Ipca E Industria Enfrentam Desafios Olhar Nos Dados Da China

May 25, 2025

Brasil Copom Define Selic Ipca E Industria Enfrentam Desafios Olhar Nos Dados Da China

May 25, 2025 -

28 Years On Reassessing Danny Boyles Impact On The Zombie Genre

May 25, 2025

28 Years On Reassessing Danny Boyles Impact On The Zombie Genre

May 25, 2025 -

Veteran Actor And Model Mukul Dev Passes Away At 54

May 25, 2025

Veteran Actor And Model Mukul Dev Passes Away At 54

May 25, 2025 -

Birmingham Pride 2025 Travel Advice Road Closures Buses And Metro Changes

May 25, 2025

Birmingham Pride 2025 Travel Advice Road Closures Buses And Metro Changes

May 25, 2025 -

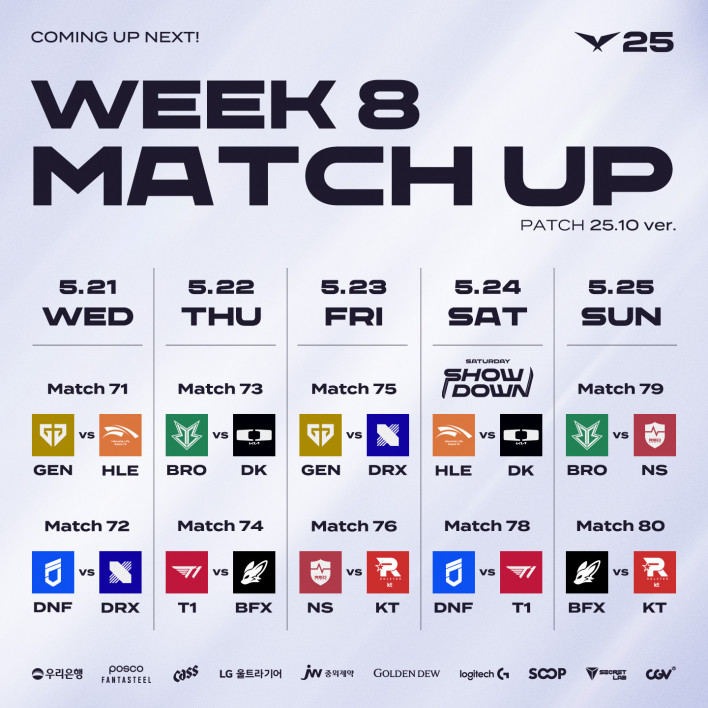

Lck Shakeup Patch 25 10 Impacts Hles Chances Against Gen G And Dplus Kia

May 25, 2025

Lck Shakeup Patch 25 10 Impacts Hles Chances Against Gen G And Dplus Kia

May 25, 2025

Latest Posts

-

The Untold Story Anita Ranis Grief And The End Of Her Marriage

May 25, 2025

The Untold Story Anita Ranis Grief And The End Of Her Marriage

May 25, 2025 -

Popular Labubu Plush Toy Uk Sales Halted Due To Customer Disputes

May 25, 2025

Popular Labubu Plush Toy Uk Sales Halted Due To Customer Disputes

May 25, 2025 -

Immerse Yourself In Star Wars Samsungs New Disney Art Collection On Qled Neo Qled And The Frame Tvs

May 25, 2025

Immerse Yourself In Star Wars Samsungs New Disney Art Collection On Qled Neo Qled And The Frame Tvs

May 25, 2025 -

Claremonts Will Hayes To Debut For Collingwood Against North Melbourne

May 25, 2025

Claremonts Will Hayes To Debut For Collingwood Against North Melbourne

May 25, 2025 -

Ta Btouch Team Update Walyalup Lineup Remains Consistent

May 25, 2025

Ta Btouch Team Update Walyalup Lineup Remains Consistent

May 25, 2025