Bitcoin Vs. MicroStrategy: Investing In BTC Or MSTR In February 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin vs. MicroStrategy: Investing in BTC or MSTR in February 2025?

The cryptocurrency market remains volatile, making investment decisions challenging. For those considering exposure to Bitcoin, a direct investment in BTC itself competes with investing in MicroStrategy (MSTR), a publicly traded company with a significant Bitcoin holding. But which is the better bet in February 2025? This analysis weighs the pros and cons of each approach.

Bitcoin (BTC): Direct Exposure to the King of Crypto

Bitcoin, the pioneering cryptocurrency, needs no introduction. Its decentralized nature, limited supply (21 million coins), and growing adoption continue to attract investors. However, investing directly in BTC comes with significant risks:

- Volatility: Bitcoin's price is notoriously volatile, experiencing dramatic swings in short periods. This inherent risk can lead to substantial losses if the market turns bearish.

- Security Risks: Storing Bitcoin requires secure wallets and robust security practices. Loss of private keys can result in the irreversible loss of funds.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving globally, creating uncertainty and potential for future restrictions.

MicroStrategy (MSTR): A Corporate Bitcoin Play

MicroStrategy, a business intelligence company, has made a bold strategic move by accumulating a substantial Bitcoin reserve. Investing in MSTR offers a different approach to Bitcoin exposure:

- Indirect Exposure: You gain exposure to Bitcoin's price movements without directly holding the cryptocurrency. This mitigates some security and storage concerns.

- Diversification (partially): While heavily weighted towards Bitcoin, MSTR also engages in other business activities, providing a degree of diversification compared to a pure Bitcoin investment.

- Liquidity: MSTR shares are traded on major stock exchanges, offering greater liquidity compared to the Bitcoin market. This can be advantageous for quick buy/sell transactions.

- Management Expertise: Your investment benefits from MicroStrategy's management team's expertise in navigating the cryptocurrency market.

February 2025 Considerations:

Predicting market movements is inherently risky, but several factors will influence the Bitcoin vs. MSTR decision in February 2025:

- Bitcoin's Price Trajectory: Will Bitcoin's price continue its upward trend, or will it experience a correction? A significant price drop would heavily impact both BTC and MSTR investments.

- Regulatory Developments: Any major regulatory changes impacting cryptocurrencies could drastically affect both investment options.

- MicroStrategy's Financial Performance: MSTR's overall financial health and success in its core business will play a role in its stock price, independently of Bitcoin's performance.

- Market Sentiment: The broader market sentiment towards cryptocurrencies and technology stocks will also affect both investments.

Which to Choose?

The "better" investment depends entirely on your risk tolerance and investment strategy.

- High-Risk, High-Reward: Direct Bitcoin investment offers the potential for significantly higher returns but carries substantially higher risk.

- Moderate Risk, Moderate Reward: Investing in MSTR provides a less volatile but potentially lower-return path to Bitcoin exposure.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions. The cryptocurrency market is highly speculative, and losses are possible.

Keywords: Bitcoin, BTC, MicroStrategy, MSTR, Cryptocurrency Investment, Bitcoin Investment, Stock Market, February 2025, Crypto Market, Investment Strategy, Risk Tolerance, Financial Advice, Cryptocurrency Regulation, Bitcoin Price Prediction, Investing in Bitcoin, Alternative Bitcoin Investments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Vs. MicroStrategy: Investing In BTC Or MSTR In February 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alcaraz Cruises Past Draper To Secure Italian Open Semifinal Berth

May 16, 2025

Alcaraz Cruises Past Draper To Secure Italian Open Semifinal Berth

May 16, 2025 -

Pridham Expresses Regret For Goodes Past Trauma

May 16, 2025

Pridham Expresses Regret For Goodes Past Trauma

May 16, 2025 -

2025 Afl Season Collingwoods Full Fixture Unveiled

May 16, 2025

2025 Afl Season Collingwoods Full Fixture Unveiled

May 16, 2025 -

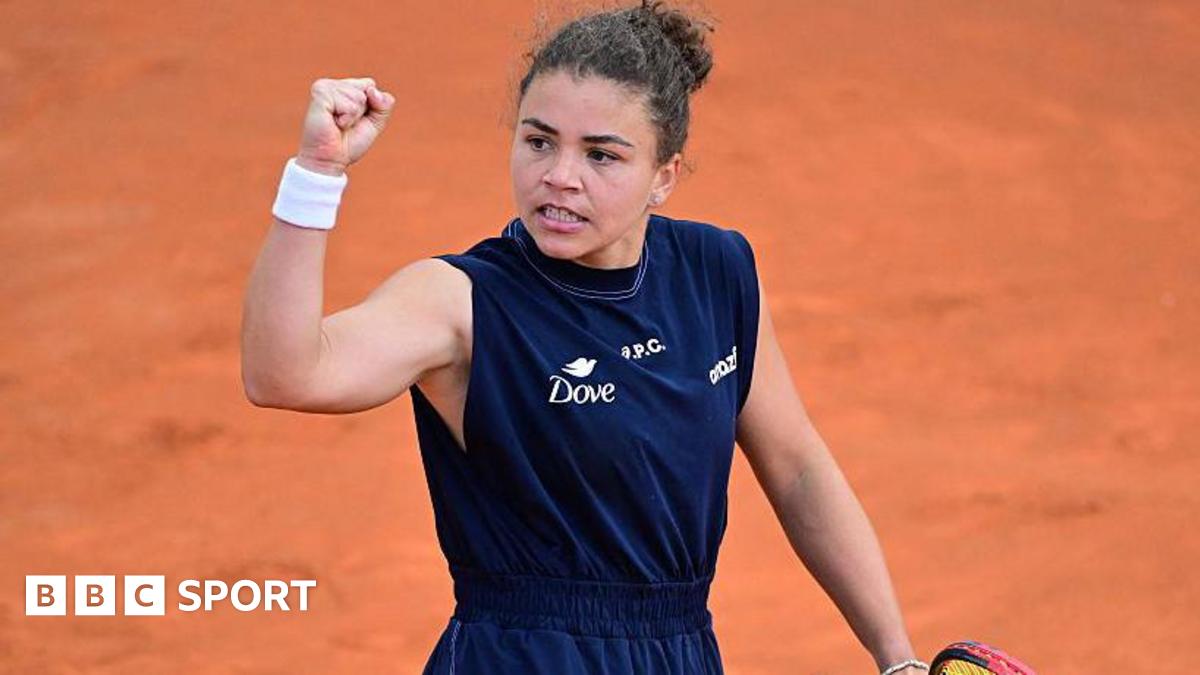

Home Hero Paolini Wins At Italian Open After Comeback Victory

May 16, 2025

Home Hero Paolini Wins At Italian Open After Comeback Victory

May 16, 2025 -

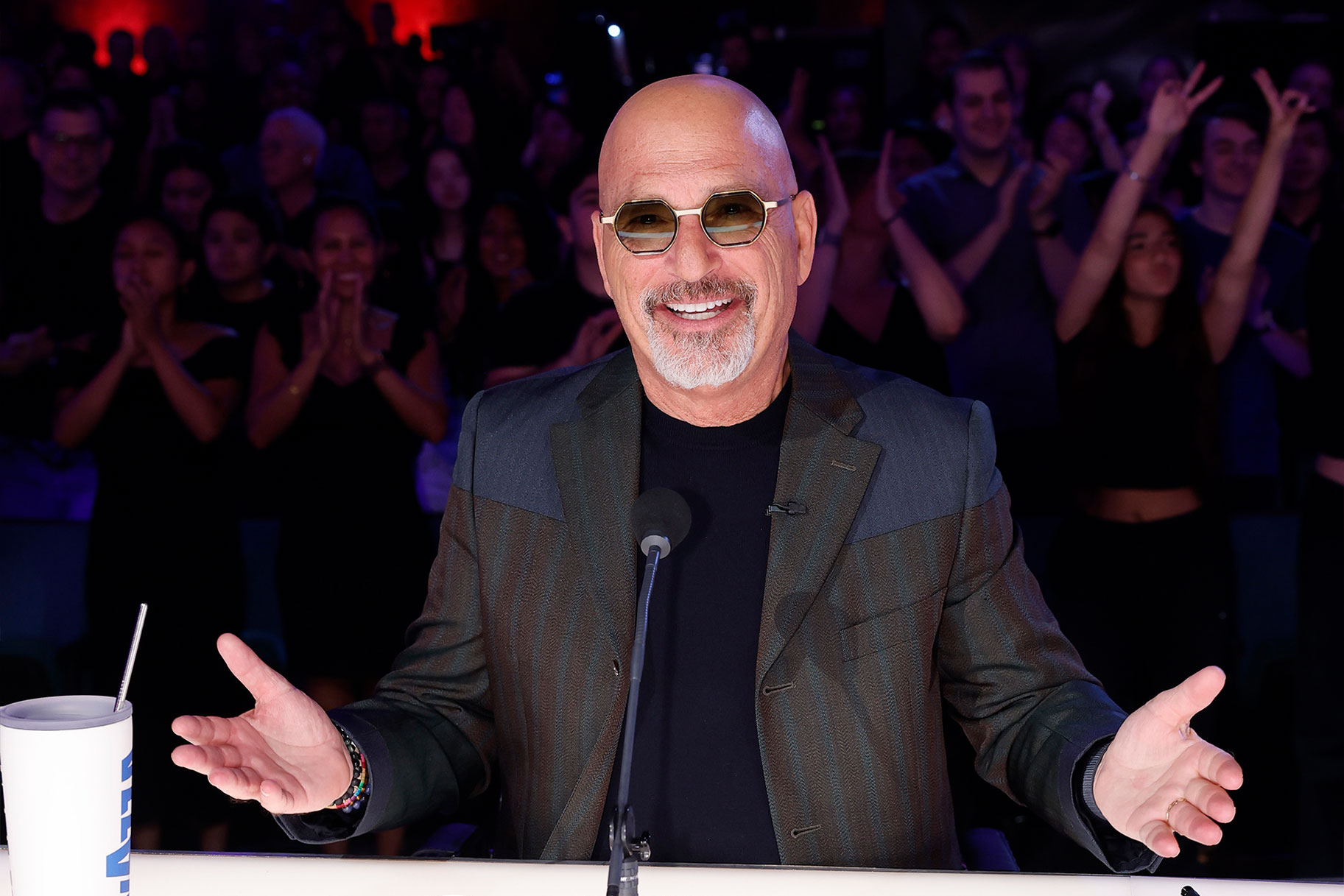

Is Howie Mandels Granddaughter His Mini Me The Video Says It All

May 16, 2025

Is Howie Mandels Granddaughter His Mini Me The Video Says It All

May 16, 2025