Bitcoin Vs. MicroStrategy (MSTR): An Investment Comparison For 2025 And Beyond.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin vs. MicroStrategy (MSTR): An Investment Comparison for 2025 and Beyond

The cryptocurrency market continues to evolve, presenting both exciting opportunities and significant risks. For investors considering exposure to Bitcoin, a direct investment isn't the only option. Companies like MicroStrategy (MSTR) have made significant bets on Bitcoin, offering an alternative entry point for those seeking indirect exposure. But which path is better – investing directly in Bitcoin or through a company like MicroStrategy? This comparison explores the potential of both options for 2025 and beyond.

Understanding the Choices: Bitcoin (BTC) and MicroStrategy (MSTR)

Bitcoin (BTC): The original cryptocurrency, Bitcoin, is a decentralized digital asset operating on a blockchain network. Its value is driven by supply and demand, influenced by factors such as adoption rates, regulatory changes, and technological advancements. Investing directly in Bitcoin offers maximum potential upside but also carries significant volatility and risk.

MicroStrategy (MSTR): A publicly traded business intelligence company, MicroStrategy has become synonymous with large-scale Bitcoin adoption. Their significant Bitcoin holdings directly impact their financial performance, making MSTR stock a proxy for Bitcoin's price movement. However, MSTR's performance is also influenced by its core business activities and overall market conditions, adding another layer of complexity.

Bitcoin Investment: High Risk, High Reward

-

Pros:

- Potential for high returns: Bitcoin's historical price appreciation showcases its potential for significant gains.

- Decentralization: Bitcoin's decentralized nature provides a hedge against traditional financial systems.

- Direct Ownership: You directly own the asset, offering complete control.

-

Cons:

- Extreme Volatility: Bitcoin's price is highly volatile, leading to substantial potential losses.

- Regulatory Uncertainty: Varying regulatory landscapes across the globe create uncertainty.

- Security Risks: Securing your Bitcoin requires careful consideration of storage and security protocols.

MicroStrategy Investment: Diversified Exposure, Reduced Volatility (Potentially)

-

Pros:

- Indirect Bitcoin Exposure: MSTR provides a less volatile entry point to the Bitcoin market compared to direct ownership.

- Traditional Stock Market Liquidity: Buying and selling MSTR stock is generally easier than buying and selling Bitcoin.

- Diversification (partially): While heavily reliant on Bitcoin, MSTR's core business adds a layer of diversification.

-

Cons:

- Lower Potential Returns: Returns are likely to be less dramatic than with direct Bitcoin investments.

- Dependence on MicroStrategy's Performance: MSTR's overall business performance influences its stock price, impacting your investment beyond Bitcoin's price.

- Management Risk: The success of your investment relies partly on MicroStrategy's management decisions.

Bitcoin vs. MicroStrategy: The 2025 and Beyond Outlook

Predicting the future of either Bitcoin or MSTR is challenging. However, several factors will likely influence their performance in the coming years:

- Widespread Adoption: Increasing mainstream adoption of Bitcoin will likely drive its price upwards.

- Regulatory Developments: Clearer and more consistent regulations could boost Bitcoin's legitimacy and stability.

- Technological Advancements: Improvements to Bitcoin's scalability and efficiency could attract more users and investment.

- MicroStrategy's Business Performance: The success of MSTR's core business will play a vital role in its overall stock price.

- Macroeconomic Factors: Global economic conditions will inevitably influence both Bitcoin and MSTR's performance.

Conclusion:

The choice between investing directly in Bitcoin or through MicroStrategy (MSTR) depends heavily on your risk tolerance, investment goals, and overall financial strategy. Direct Bitcoin investment offers higher potential rewards but with considerably higher risk. MSTR provides a less volatile, albeit potentially less rewarding, alternative. Thorough research and a clear understanding of the risks associated with both options are crucial before making any investment decisions. Remember to consult with a financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Vs. MicroStrategy (MSTR): An Investment Comparison For 2025 And Beyond.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Smaller Cheaper And Smarter Amazons Echo Show Challenges Googles Dominance

May 23, 2025

Smaller Cheaper And Smarter Amazons Echo Show Challenges Googles Dominance

May 23, 2025 -

Vivid Sydneys Fire Kitchen 5 Must Try Dishes You Wont Want To Miss

May 23, 2025

Vivid Sydneys Fire Kitchen 5 Must Try Dishes You Wont Want To Miss

May 23, 2025 -

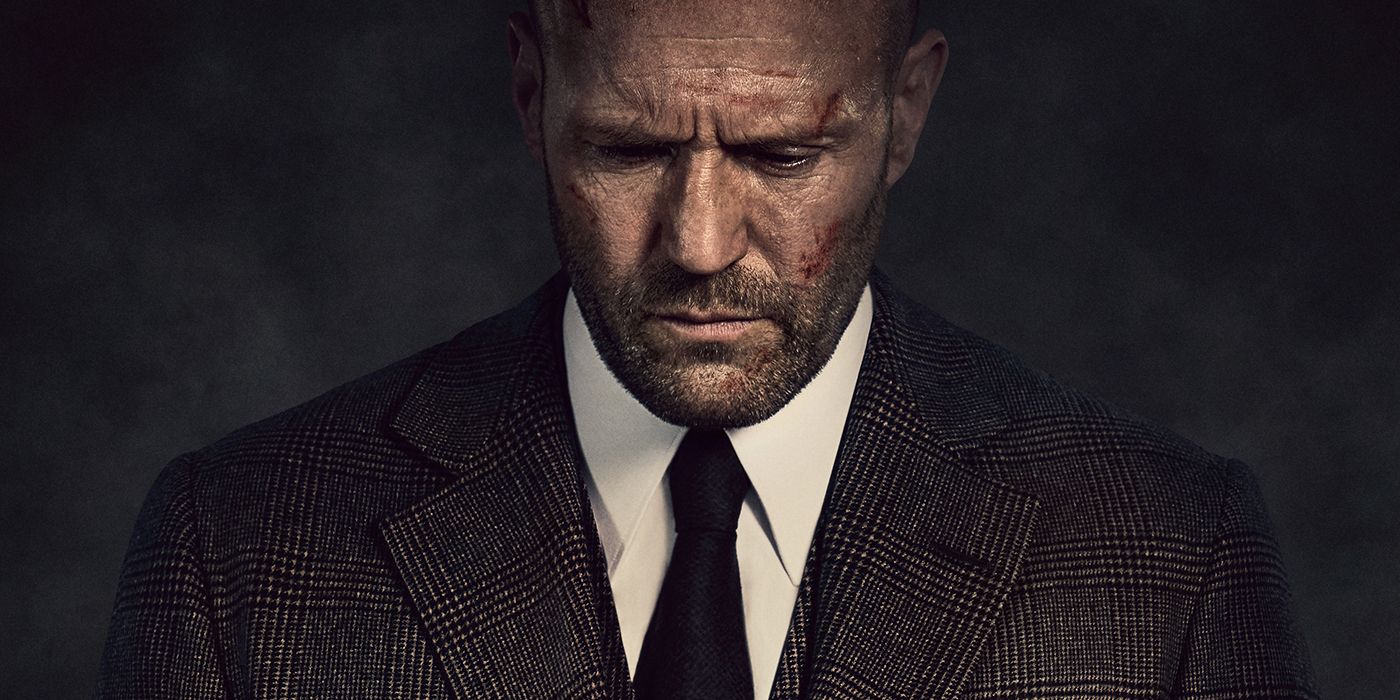

Critical Darling And Streaming Hit Jason Stathams Film Scores 90 On Rotten Tomatoes

May 23, 2025

Critical Darling And Streaming Hit Jason Stathams Film Scores 90 On Rotten Tomatoes

May 23, 2025 -

Vinicius Jr Ronaldinho Congratulate Shai Gilgeous Alexander On Mvp Award

May 23, 2025

Vinicius Jr Ronaldinho Congratulate Shai Gilgeous Alexander On Mvp Award

May 23, 2025 -

Hay Festival Stress Free Travel With Shuttle Buses From Worcester And Hereford

May 23, 2025

Hay Festival Stress Free Travel With Shuttle Buses From Worcester And Hereford

May 23, 2025

Latest Posts

-

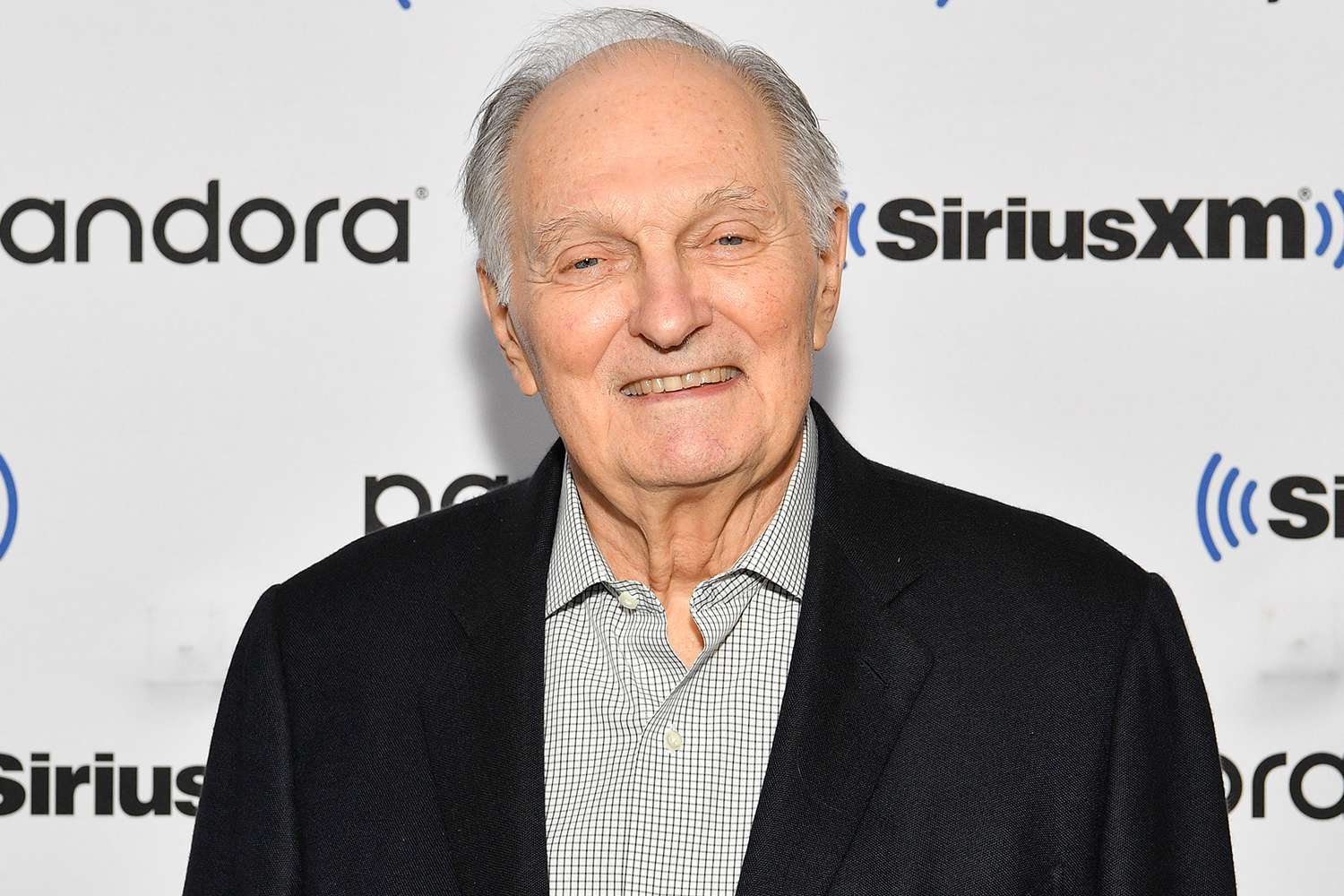

Alan Aldas Parkinsons Journey Challenges And Laughter At 89 Exclusive

May 23, 2025

Alan Aldas Parkinsons Journey Challenges And Laughter At 89 Exclusive

May 23, 2025 -

Revisiting A Classic Movie Show Name S New Tv Spot Underscores The Brutal Truth After 28 Years

May 23, 2025

Revisiting A Classic Movie Show Name S New Tv Spot Underscores The Brutal Truth After 28 Years

May 23, 2025 -

Nyt Wordle Today Solution And Hints For 1433 May 22

May 23, 2025

Nyt Wordle Today Solution And Hints For 1433 May 22

May 23, 2025 -

Bet Netflix A Critical Analysis Of The Manga Adaptation And Its Shortcomings

May 23, 2025

Bet Netflix A Critical Analysis Of The Manga Adaptation And Its Shortcomings

May 23, 2025 -

Bonus Podcast A Conversation On Reframing Black Historys Representation

May 23, 2025

Bonus Podcast A Conversation On Reframing Black Historys Representation

May 23, 2025