Bitcoin Vs. MicroStrategy Stock: Investment Analysis And February 2025 Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin vs. MicroStrategy Stock: A February 2025 Investment Outlook

Introduction: The cryptocurrency market remains volatile, presenting both significant opportunities and considerable risks. For investors considering exposure to Bitcoin, a direct investment isn't the only path. MicroStrategy (MSTR), a business intelligence company, has made a significant bet on Bitcoin, holding a substantial amount of the cryptocurrency on its balance sheet. This comparison analyzes Bitcoin and MicroStrategy stock as investment vehicles, providing a nuanced perspective for February 2025 and beyond.

Bitcoin (BTC): The Decentralized Digital Gold

Bitcoin, the original cryptocurrency, has captivated investors with its decentralized nature and potential as a hedge against inflation. Its limited supply of 21 million coins is a key attraction, fueling arguments for its long-term value appreciation.

Investment Considerations for Bitcoin:

- Volatility: Bitcoin's price is notoriously volatile, experiencing significant swings in short periods. This high volatility presents both high reward and high risk.

- Regulation: The regulatory landscape for cryptocurrencies is constantly evolving, introducing uncertainty and potential legal hurdles. Government regulations across different jurisdictions can heavily influence Bitcoin's price and accessibility.

- Technological advancements: The Bitcoin network continues to evolve, with potential upgrades and scaling solutions impacting its efficiency and usability. These advancements could significantly influence its future value.

- Market Sentiment: Bitcoin's price is significantly influenced by market sentiment and media coverage. Positive news tends to drive prices up, while negative news can trigger sharp declines.

February 2025 Bitcoin Outlook: Predicting Bitcoin's price in February 2025 is inherently speculative. However, several factors could influence its price. Increased adoption by institutional investors, positive regulatory developments, and continued technological advancements could drive price increases. Conversely, negative regulatory actions, market crashes, or the emergence of competing cryptocurrencies could lead to price declines. A realistic scenario involves continued volatility, with the potential for both substantial gains and losses.

MicroStrategy (MSTR): A Bitcoin-Focused Investment Vehicle

MicroStrategy, a publicly traded company, has aggressively invested in Bitcoin, making it an indirect way to gain exposure to the cryptocurrency. This strategy has generated both significant gains and losses, making MSTR a uniquely volatile stock.

Investment Considerations for MicroStrategy Stock:

- Bitcoin Correlation: MSTR's stock price is heavily correlated with Bitcoin's price. Therefore, investing in MSTR exposes you to the volatility of Bitcoin, but with added company-specific risks.

- Company Fundamentals: While Bitcoin holdings are central to MSTR's investment thesis, investors should also consider the company's core business and financial health.

- Debt Levels: MicroStrategy's significant Bitcoin purchases have been financed through debt, introducing financial risk to the company.

- Management Expertise: The management team's expertise in both the business intelligence sector and the cryptocurrency market is crucial in assessing the company's long-term prospects.

February 2025 MicroStrategy Outlook: MicroStrategy's performance in February 2025 will be heavily influenced by Bitcoin's price. If Bitcoin's price appreciates significantly, MSTR's stock price will likely follow suit. Conversely, a decline in Bitcoin's price could severely impact MSTR's stock value, particularly given its debt levels. Investors should closely monitor both Bitcoin's market dynamics and MicroStrategy's financial performance.

Bitcoin vs. MicroStrategy: Which is Right for You?

The choice between investing directly in Bitcoin and investing in MicroStrategy stock depends heavily on your risk tolerance and investment strategy. Direct Bitcoin investment offers potentially higher returns but comes with significantly higher volatility and risk. MicroStrategy provides a more diversified approach with exposure to both Bitcoin and the company's core business, but this diversification does not eliminate the significant risk associated with Bitcoin's price fluctuations.

Conclusion: Both Bitcoin and MicroStrategy stock present opportunities and significant risks. By carefully considering the factors outlined above, and conducting thorough due diligence, investors can make informed decisions aligned with their risk profiles and investment goals. The February 2025 outlook for both remains highly uncertain, highlighting the need for a long-term perspective and a well-defined risk management strategy. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Vs. MicroStrategy Stock: Investment Analysis And February 2025 Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

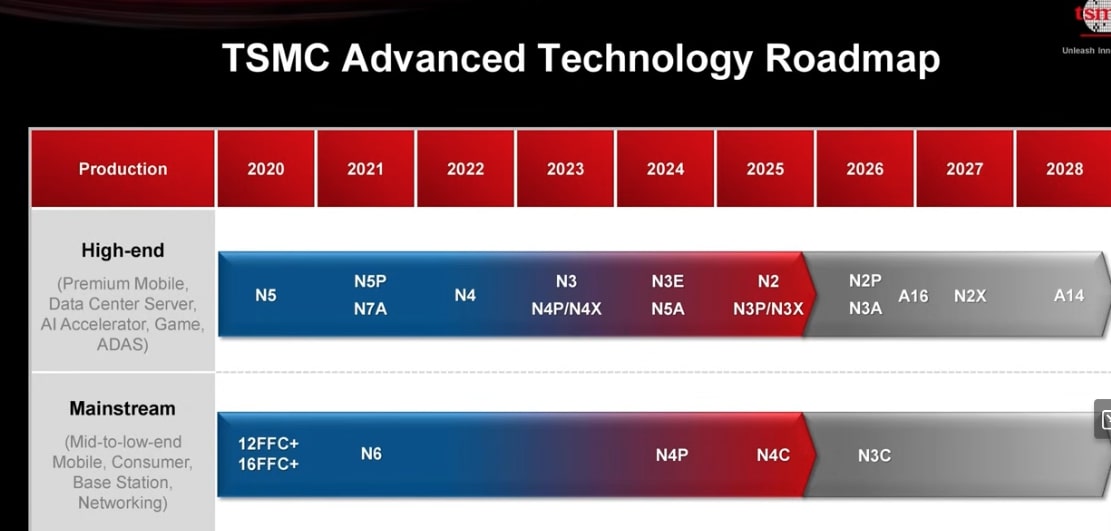

Tsmcs 2025 Technology Symposium Exploring The 1 4nm Node And Future Plans

May 19, 2025

Tsmcs 2025 Technology Symposium Exploring The 1 4nm Node And Future Plans

May 19, 2025 -

Inter Vs Lazio Castellanos Faces Stiff Test Five Key Battles

May 19, 2025

Inter Vs Lazio Castellanos Faces Stiff Test Five Key Battles

May 19, 2025 -

Will Luguentz Dort Play Game 7 Thunder Injury News Ahead Of Nuggets Clash

May 19, 2025

Will Luguentz Dort Play Game 7 Thunder Injury News Ahead Of Nuggets Clash

May 19, 2025 -

Sfida A Fuorigrotta Tre Legni Non Bastano Per Il Cagliari Obiettivi Di Fine Stagione

May 19, 2025

Sfida A Fuorigrotta Tre Legni Non Bastano Per Il Cagliari Obiettivi Di Fine Stagione

May 19, 2025 -

Donald Trumps Dementia Fears Parallels To His Fathers Fate

May 19, 2025

Donald Trumps Dementia Fears Parallels To His Fathers Fate

May 19, 2025