Bitcoin Vs. MSTR: Which Investment Strategy Reigns Supreme In February 2025?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin vs. MSTR: Which Investment Strategy Reigns Supreme in February 2025?

The cryptocurrency market remains a volatile landscape, and investors are constantly seeking the best strategy to navigate its unpredictable currents. Two prominent contenders often find themselves in the spotlight: Bitcoin (BTC), the original cryptocurrency, and MicroStrategy (MSTR), a business intelligence company that has made a significant bet on Bitcoin as a treasury asset. But as we stand in February 2025, which approach offers the superior investment strategy? Let's delve into a comparative analysis.

Bitcoin (BTC): The Decentralized Giant

Bitcoin's position as the leading cryptocurrency is undeniable. Its decentralized nature, limited supply of 21 million coins, and growing adoption as a store of value continue to attract investors despite its notorious price swings. In February 2025, the narrative around Bitcoin is likely to be shaped by several factors:

- Regulatory Clarity: Increased regulatory clarity in key markets could significantly impact Bitcoin's price. Positive developments leading to clearer guidelines for cryptocurrency trading and usage would likely boost investor confidence.

- Technological Advancements: The evolution of the Bitcoin network, including potential scaling solutions like the Lightning Network, could improve transaction speeds and reduce fees, enhancing its usability.

- Macroeconomic Conditions: Global economic trends, inflation rates, and geopolitical events will continue to exert significant influence on Bitcoin's price. A strong dollar, for instance, could negatively affect its value.

- Institutional Adoption: Continued institutional adoption of Bitcoin as a treasury asset, similar to MicroStrategy's strategy, could drive price appreciation.

MicroStrategy (MSTR): The Corporate Bitcoin Bet

MicroStrategy's substantial investment in Bitcoin has made it a fascinating case study. Its strategy involves holding Bitcoin as a long-term asset, hedging against inflation, and potentially profiting from Bitcoin's price appreciation. However, this strategy comes with inherent risks:

- Volatility Exposure: MSTR's stock price is directly correlated with the price of Bitcoin. Significant price drops in Bitcoin can severely impact MSTR's market capitalization.

- Regulatory Uncertainty: Changes in regulatory landscapes for cryptocurrencies can profoundly affect MSTR's valuation.

- Diversification Concerns: MSTR's heavy reliance on Bitcoin lacks diversification, increasing its overall risk profile.

- Opportunity Cost: Investing heavily in Bitcoin means forgoing potential opportunities in other asset classes.

Head-to-Head Comparison: Bitcoin vs. MSTR in February 2025

Choosing between Bitcoin and MSTR in February 2025 requires a careful assessment of risk tolerance and investment goals.

- Risk Tolerance: Direct Bitcoin investment carries higher volatility, while MSTR offers a more diluted exposure but is still highly susceptible to Bitcoin's price fluctuations.

- Investment Goals: Long-term investors seeking exposure to Bitcoin might find direct investment more appealing. Those seeking a more balanced approach, albeit with potentially lower returns, might prefer MSTR.

- Diversification: Investing solely in Bitcoin or MSTR lacks diversification. A balanced portfolio including other asset classes is crucial for mitigating risk.

Conclusion:

There's no definitive "winner" in the Bitcoin vs. MSTR debate. The best investment strategy depends entirely on individual investor profiles and risk tolerance. In February 2025, both options remain viable but necessitate thorough research and understanding of the inherent risks involved. It is crucial to consult with a qualified financial advisor before making any investment decisions. The cryptocurrency market remains highly speculative, and past performance is not indicative of future results. Always remember to invest responsibly and only with capital you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Vs. MSTR: Which Investment Strategy Reigns Supreme In February 2025?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

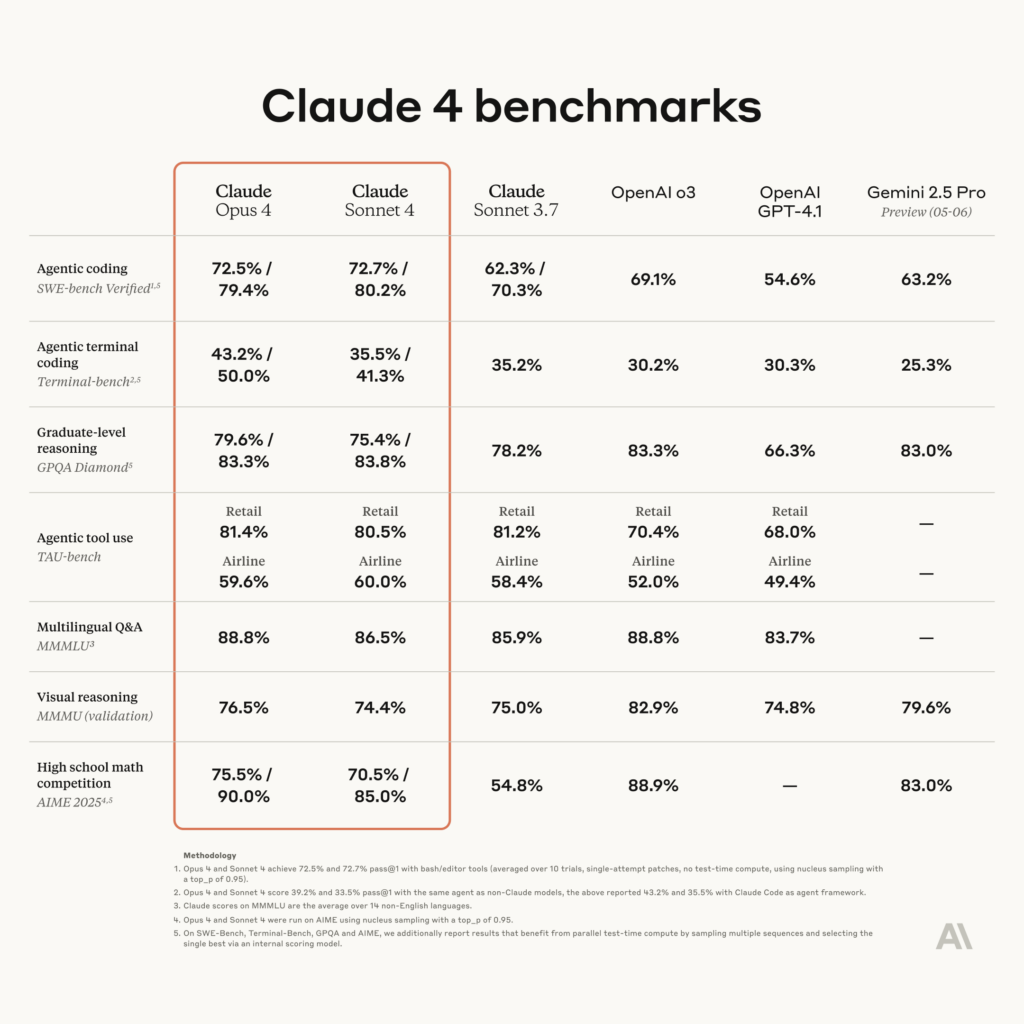

Anthropics Claude 4 Sonnet Opus And Next Level Agentic Coding Capabilities

May 25, 2025

Anthropics Claude 4 Sonnet Opus And Next Level Agentic Coding Capabilities

May 25, 2025 -

New Cybersecurity Training Programs Launched In Saudi Arabia By Ine And Abadnet

May 25, 2025

New Cybersecurity Training Programs Launched In Saudi Arabia By Ine And Abadnet

May 25, 2025 -

Planning Your Trip The Ultimate Love Saves The Day Bristol Guide

May 25, 2025

Planning Your Trip The Ultimate Love Saves The Day Bristol Guide

May 25, 2025 -

Solve Todays Nyt Wordle Hints And Answer For Game 1435

May 25, 2025

Solve Todays Nyt Wordle Hints And Answer For Game 1435

May 25, 2025 -

Can Warren Buffetts Fear And Greed Index Predict Crypto Market Movements

May 25, 2025

Can Warren Buffetts Fear And Greed Index Predict Crypto Market Movements

May 25, 2025

Latest Posts

-

Hamiltons Monaco Gp Hopes Rest On Penalty Lottery

May 25, 2025

Hamiltons Monaco Gp Hopes Rest On Penalty Lottery

May 25, 2025 -

Leclerc Vs Norris Watch The Decisive Monaco Qualifying Lap

May 25, 2025

Leclerc Vs Norris Watch The Decisive Monaco Qualifying Lap

May 25, 2025 -

Printable Indy 500 Starting Grid For Your Office Pool

May 25, 2025

Printable Indy 500 Starting Grid For Your Office Pool

May 25, 2025 -

Annabelle Doll Vanishes New Orleans Residents On High Alert

May 25, 2025

Annabelle Doll Vanishes New Orleans Residents On High Alert

May 25, 2025 -

France Analyse Du Nouveau Variant Covid 19 Taux De Transmission Et Donnees Vaccinales

May 25, 2025

France Analyse Du Nouveau Variant Covid 19 Taux De Transmission Et Donnees Vaccinales

May 25, 2025