Bitcoin Whale Activity Sparks Price Rally: Deep Dive Into On-Chain Metrics

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Whale Activity Sparks Price Rally: Deep Dive into On-Chain Metrics

Bitcoin's price recently experienced a significant surge, leaving many wondering about the driving force behind this bullish movement. While several factors likely contributed, a closer examination of on-chain metrics reveals a compelling narrative: the re-emergence of Bitcoin whales and their strategic activity. This deep dive explores the key on-chain indicators that suggest whale accumulation is a major catalyst behind the recent Bitcoin price rally.

The Significance of Whale Accumulation

Bitcoin whales, defined as entities holding substantial amounts of Bitcoin (typically 1,000 BTC or more), wield significant influence over the market. Their buying and selling activity can create significant price swings. When whales accumulate Bitcoin, it often signals bullish sentiment, suggesting they anticipate future price appreciation. Conversely, significant selling pressure from whales can trigger price corrections.

Key On-Chain Metrics Pointing to Whale Activity:

Several on-chain metrics provide strong evidence of increased whale activity:

-

Exchange Outflows: A notable increase in Bitcoin moving off exchanges has been observed. This suggests whales are taking their Bitcoin out of exchanges, reducing the supply available for selling and potentially indicating a long-term holding strategy. This reduced supply can lead to upward pressure on price.

-

Large Transaction Volumes: The number of transactions involving a large number of Bitcoin (e.g., 100 BTC or more) has increased recently. This points to significant whale activity, with large players actively accumulating or repositioning their holdings.

-

Increased Accumulation by Large Holders: Analysis of Bitcoin addresses holding significant amounts reveals a net increase in their holdings. This confirms that major players are actively accumulating BTC despite the recent price volatility.

-

Decreased Exchange Reserves: Major cryptocurrency exchanges have seen a noticeable decrease in their Bitcoin reserves. This further reinforces the theory that whales are moving their Bitcoin off exchanges, indicating less likelihood of immediate selling pressure.

Interpreting the Data: A Bullish Narrative?

The confluence of these on-chain indicators paints a compelling picture of increased whale accumulation. This strategic activity suggests a belief among these major players that Bitcoin's price is poised for further growth. However, it's crucial to remember that on-chain data is just one piece of the puzzle. Macroeconomic factors, regulatory developments, and overall market sentiment also play crucial roles in shaping Bitcoin's price.

What This Means for Investors:

While whale activity offers valuable insight, it's not a foolproof predictor of future price movements. Investors should always conduct thorough due diligence before making any investment decisions. However, the current on-chain data, coupled with other positive indicators, suggests a cautiously optimistic outlook for Bitcoin in the near term.

Conclusion:

The recent Bitcoin price rally is likely influenced by a number of factors. However, the evidence strongly suggests that increased whale activity, as reflected in key on-chain metrics, plays a significant role. This accumulation, characterized by exchange outflows, large transaction volumes, and increased holdings by major players, contributes to a bullish narrative. While not a guarantee of future price increases, understanding these on-chain signals provides valuable context for navigating the volatile world of Bitcoin investment. Keeping a close eye on these metrics remains crucial for investors seeking to understand and react to shifts in the market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Whale Activity Sparks Price Rally: Deep Dive Into On-Chain Metrics. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

All About Singapore Elections A Guide For Kids

Apr 27, 2025

All About Singapore Elections A Guide For Kids

Apr 27, 2025 -

Champions League El Barca Visita Al Chelsea Con La Victoria En Mente

Apr 27, 2025

Champions League El Barca Visita Al Chelsea Con La Victoria En Mente

Apr 27, 2025 -

Beyond Basic Ai Strike Readys Innovative Approach To Security Triage

Apr 27, 2025

Beyond Basic Ai Strike Readys Innovative Approach To Security Triage

Apr 27, 2025 -

Solana Price Prediction Is Sols Rally Topping Out

Apr 27, 2025

Solana Price Prediction Is Sols Rally Topping Out

Apr 27, 2025 -

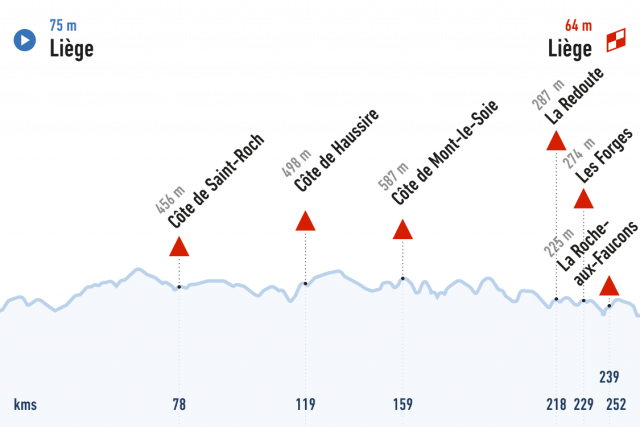

27 Avril 2025 Suivez La Liege Bastogne Liege En Direct

Apr 27, 2025

27 Avril 2025 Suivez La Liege Bastogne Liege En Direct

Apr 27, 2025