Bitcoin Whales Fuel Price Rally: On-Chain Data Confirms Buying Spree

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Whales Fuel Price Rally: On-Chain Data Confirms Buying Spree

Bitcoin's recent price surge has captivated the crypto community, and new on-chain data reveals a compelling reason behind the rally: a significant buying spree by Bitcoin whales. This surge isn't just fueled by retail investors; large holders are accumulating, signaling a potential shift in market sentiment and potentially foreshadowing further price increases.

The Evidence: On-Chain Data Speaks Volumes

Several key on-chain metrics point towards substantial Bitcoin accumulation by whales. Analysts at Glassnode and other reputable blockchain data providers have observed a marked increase in the number of Bitcoin addresses holding 1,000 BTC or more (often considered the threshold for "whale" status). This increase correlates directly with the recent price appreciation, suggesting a direct causal link between whale buying and the market's upward trajectory.

What's Driving the Whale Accumulation?

While pinpointing the exact motivations of these large-scale investors is impossible, several factors likely contribute to their buying spree:

- Anticipation of Institutional Adoption: Increased institutional interest in Bitcoin, coupled with the growing acceptance of cryptocurrencies by mainstream financial institutions, could be a primary driver. Whales may be anticipating further price appreciation as institutional adoption accelerates.

- Halving Event Anticipation: The upcoming Bitcoin halving event, which reduces the rate of new Bitcoin creation, is also a significant factor. Historically, halving events have preceded periods of substantial price appreciation, making them attractive for long-term investors.

- Macroeconomic Uncertainty: Global macroeconomic uncertainty, including inflation concerns and geopolitical instability, is pushing investors towards Bitcoin as a hedge against inflation and a store of value. Whales, with their greater risk tolerance and resources, may be taking advantage of this trend.

- Regulatory Clarity (in some regions): Growing regulatory clarity in certain jurisdictions is also a positive factor. While regulatory uncertainty remains a challenge globally, positive developments in specific regions might encourage larger investors to accumulate Bitcoin.

Technical Analysis Supports the Narrative

Technical analysis further supports the narrative of a whale-driven rally. The recent price movements have coincided with a surge in trading volume and a strengthening of key support levels, indicating strong underlying buyer demand. Furthermore, several technical indicators suggest a bullish trend, aligning with the on-chain data pointing towards whale accumulation.

Risks and Cautions

While the current market sentiment is bullish, it's crucial to acknowledge potential risks:

- Market Volatility: Bitcoin remains a highly volatile asset, and price swings are common. The current rally could reverse, especially in the face of negative news or regulatory crackdowns.

- Whale Dumping: The same whales accumulating Bitcoin could also trigger a sharp price decline if they decide to sell their holdings en masse.

Conclusion: A Bullish Outlook, but Proceed with Caution

The on-chain data strongly suggests that Bitcoin whales are actively accumulating, driving the recent price rally. This bullish signal, coupled with other positive factors, paints a largely optimistic outlook for Bitcoin in the near term. However, investors should remain cautious and mindful of the inherent volatility of the cryptocurrency market. Diversification and a thorough understanding of the risks involved are crucial before making any investment decisions. Always conduct your own research (DYOR) before investing in cryptocurrencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Whales Fuel Price Rally: On-Chain Data Confirms Buying Spree. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Last Minute Injury Boost For Abraham Starting Xi Spot Against Venezia

Apr 28, 2025

Last Minute Injury Boost For Abraham Starting Xi Spot Against Venezia

Apr 28, 2025 -

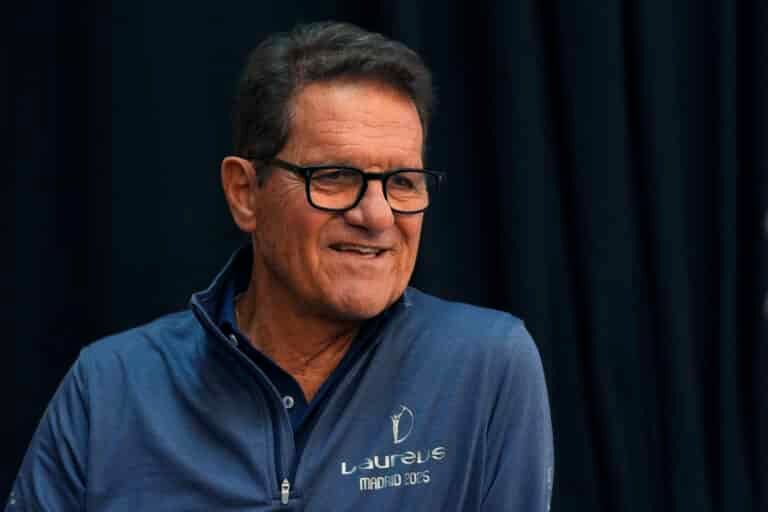

Capellos Verdict Inter Roma Clash Who Holds The Advantage

Apr 28, 2025

Capellos Verdict Inter Roma Clash Who Holds The Advantage

Apr 28, 2025 -

Bitcoins Future Ark Invest Forecasts 1 5 Million Price Point Contingent On Global Unity

Apr 28, 2025

Bitcoins Future Ark Invest Forecasts 1 5 Million Price Point Contingent On Global Unity

Apr 28, 2025 -

Enhanced Security Triage Strike Readys Ai Platform For Advanced Threat Detection

Apr 28, 2025

Enhanced Security Triage Strike Readys Ai Platform For Advanced Threat Detection

Apr 28, 2025 -

Modular Smartphone Innovation Nothing Phone 2 Breaks The Mold

Apr 28, 2025

Modular Smartphone Innovation Nothing Phone 2 Breaks The Mold

Apr 28, 2025

Latest Posts

-

Deceptive Trust Examining The Security Gaps Behind Web3 Verification

Apr 29, 2025

Deceptive Trust Examining The Security Gaps Behind Web3 Verification

Apr 29, 2025 -

Christie Brinkley The Exact Moment She Knew Her Marriage To Billy Joel Was Over

Apr 29, 2025

Christie Brinkley The Exact Moment She Knew Her Marriage To Billy Joel Was Over

Apr 29, 2025 -

Wordle Solutions A Complete List Of Past Answers

Apr 29, 2025

Wordle Solutions A Complete List Of Past Answers

Apr 29, 2025 -

Ge 2025 Election Campaign Day 6 Recap Rallies And Walkabouts

Apr 29, 2025

Ge 2025 Election Campaign Day 6 Recap Rallies And Walkabouts

Apr 29, 2025 -

Criminal Ip Showcases Advanced Threat Intelligence At Rsac 2025

Apr 29, 2025

Criminal Ip Showcases Advanced Threat Intelligence At Rsac 2025

Apr 29, 2025