Bitcoin's $100K Breakout: Biggest Short Squeeze Since 2021

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's $100K Breakout: Biggest Short Squeeze Since 2021?

Bitcoin's price recently surged past the coveted $100,000 mark, sparking intense debate about the future of the cryptocurrency and igniting memories of the massive short squeeze witnessed in 2021. While the exact causes are multifaceted, analysts point towards a confluence of factors contributing to this dramatic price action. Could this be the beginning of another bull run, or is it a temporary spike driven by speculative trading? Let's delve into the details.

The $100,000 Milestone: A Psychological Barrier Shattered

The psychological significance of the $100,000 price point for Bitcoin cannot be overstated. This level had acted as a significant resistance point for months, representing a key hurdle for bullish sentiment. Breaking through it signals a potential shift in market dynamics, emboldening investors and potentially triggering further price increases.

Short Squeeze: The Fuel Behind the Fire?

Many analysts believe a significant short squeeze is fueling this Bitcoin price surge. A short squeeze occurs when investors who bet against an asset (shorting) are forced to buy it back to limit their losses as the price rises unexpectedly. This buying pressure exacerbates the price increase, creating a self-reinforcing cycle. The scale of this potential short squeeze is being compared to the dramatic events of 2021, when Bitcoin's price experienced a meteoric rise.

Factors Contributing to the Breakout:

- Increased Institutional Adoption: Growing institutional investment in Bitcoin continues to provide a solid foundation for price appreciation. Large-scale investors are increasingly recognizing Bitcoin's potential as a store of value and a hedge against inflation.

- Regulatory Clarity (in some jurisdictions): While regulatory uncertainty remains a concern globally, positive developments in certain jurisdictions are contributing to a more favorable investment climate. This increased clarity reduces risk for some investors.

- Macroeconomic Factors: Global macroeconomic instability, including high inflation and uncertainty in traditional markets, is driving investors towards alternative assets like Bitcoin, further boosting demand.

- Technological Advancements: Ongoing developments in Bitcoin's underlying technology, such as the Lightning Network, are enhancing its scalability and usability, making it more attractive to a wider range of users.

H2: Potential Risks and Cautions

While the current price action is undeniably exciting, it's crucial to remain cautious. The cryptocurrency market is inherently volatile, and sharp price corrections are not uncommon. Investors should be mindful of the following risks:

- Market Volatility: Bitcoin's price can fluctuate significantly in short periods, leading to substantial gains or losses.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains complex and evolving, posing potential risks to investors.

- Security Risks: Holding and trading cryptocurrencies carries inherent security risks, including the possibility of hacking and theft.

H2: What Lies Ahead for Bitcoin?

Predicting the future price of Bitcoin is inherently speculative. However, the recent breakout above $100,000 suggests a potential shift in market sentiment. The interplay of institutional adoption, macroeconomic factors, and technical advancements will continue to shape Bitcoin's trajectory. While a repeat of the 2021 bull run is possible, investors should approach the market with caution and conduct thorough due diligence before making any investment decisions. The $100,000 milestone is a significant achievement, but sustained growth will depend on a confluence of factors beyond this single price point. The coming months will be crucial in determining whether this breakout marks the beginning of a new bull market or simply a temporary surge driven by a short squeeze.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's $100K Breakout: Biggest Short Squeeze Since 2021. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Scotts Swings Essendons Response To Sydneys Threat Live Afl Match

May 11, 2025

Scotts Swings Essendons Response To Sydneys Threat Live Afl Match

May 11, 2025 -

Decoding The Godzilla X Kong Sequels Title Two Potential Interpretations

May 11, 2025

Decoding The Godzilla X Kong Sequels Title Two Potential Interpretations

May 11, 2025 -

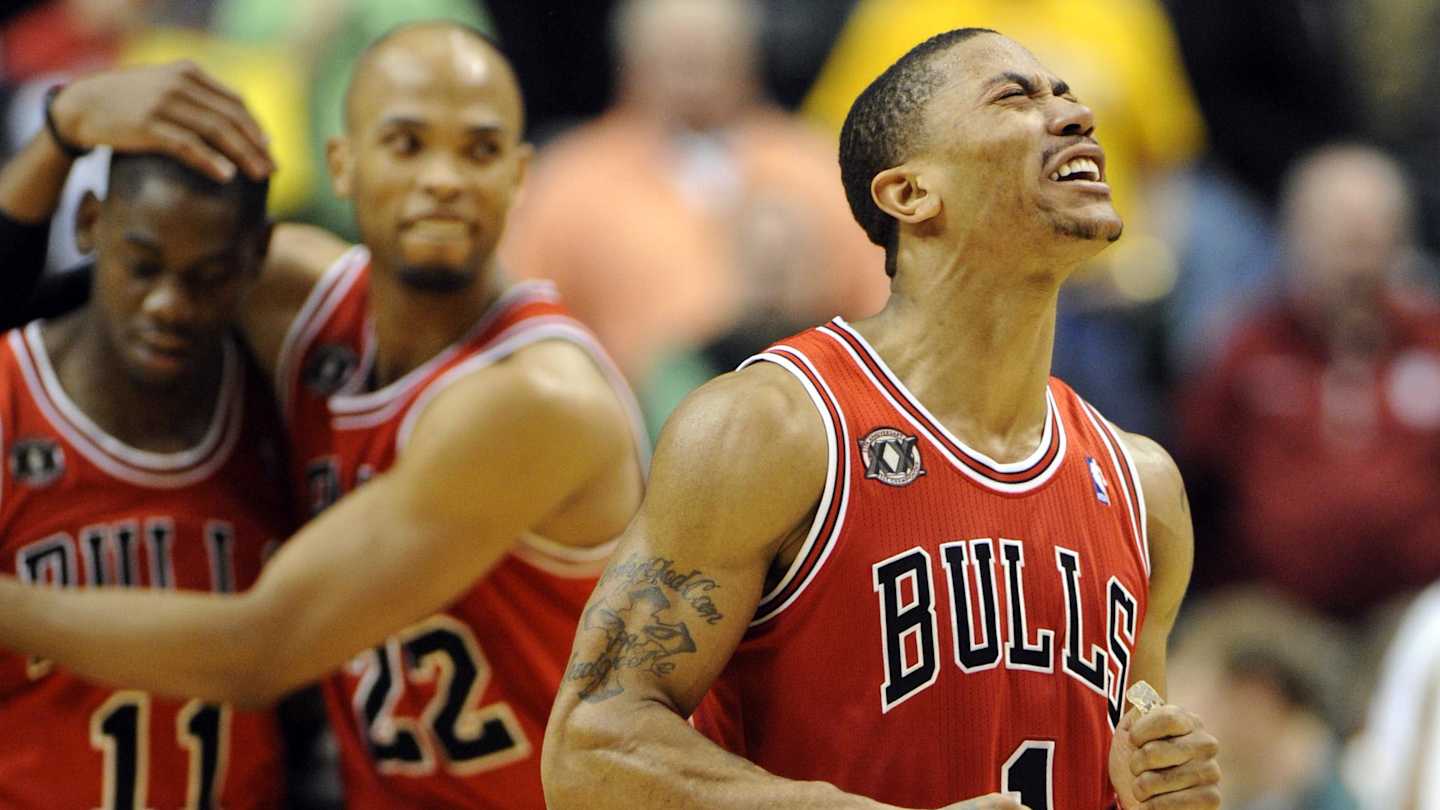

Youngest To Oldest A Comprehensive History Of Nba Mvp Winners

May 11, 2025

Youngest To Oldest A Comprehensive History Of Nba Mvp Winners

May 11, 2025 -

Spiral Of Madness Danny Dyer Opens Up About Grief After Harold Pinters Passing

May 11, 2025

Spiral Of Madness Danny Dyer Opens Up About Grief After Harold Pinters Passing

May 11, 2025 -

German Authorities Shut Down E Xch Crypto Exchange Seize E34 M Amid Bybit Hack Investigation

May 11, 2025

German Authorities Shut Down E Xch Crypto Exchange Seize E34 M Amid Bybit Hack Investigation

May 11, 2025

Latest Posts

-

Guido En Accion Reporte Del Partido Contra Necaxa

May 12, 2025

Guido En Accion Reporte Del Partido Contra Necaxa

May 12, 2025 -

India And Pakistan Claim Victory Following Ceasefire Agreement

May 12, 2025

India And Pakistan Claim Victory Following Ceasefire Agreement

May 12, 2025 -

Trump And Xi Agree To 90 Day Trade War Delay

May 12, 2025

Trump And Xi Agree To 90 Day Trade War Delay

May 12, 2025 -

Nvidia Stock Forecast Sell Rating Sparks Concerns For Investors

May 12, 2025

Nvidia Stock Forecast Sell Rating Sparks Concerns For Investors

May 12, 2025 -

Nba Draft Combine Cooper Flagg And Top Prospects To Watch In 5 On 5 Play

May 12, 2025

Nba Draft Combine Cooper Flagg And Top Prospects To Watch In 5 On 5 Play

May 12, 2025