Bitcoin's And Ethereum's Diminishing Supply: Impact And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin and Ethereum's Diminishing Supply: A Market Impact Analysis

Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies by market capitalization, are experiencing a phenomenon that's attracting significant attention from investors and analysts alike: diminishing supply. This isn't just a technical detail; it's a fundamental characteristic with potentially profound implications for the future price and adoption of these digital assets. This article delves into the mechanics behind this dwindling supply and analyzes its impact on the market.

Understanding the Scarcity Factor:

Both Bitcoin and Ethereum operate on a predetermined schedule for coin issuance. Bitcoin's protocol is designed to cap its total supply at 21 million coins. This hard cap, coupled with the consistent halving events (reducing the rate of new Bitcoin creation by half every four years), creates inherent scarcity. Ethereum, while not having a hard cap like Bitcoin, is transitioning to a proof-of-stake (PoS) consensus mechanism, drastically reducing the rate of ETH issuance. The shift from proof-of-work (PoW) to PoS significantly altered the inflationary nature of Ethereum, leading to a much lower supply increase compared to its previous PoW days.

The Impact of Diminishing Supply:

The shrinking supply of both cryptocurrencies is expected to have several key impacts:

-

Increased Value: Basic economic principles dictate that reduced supply, coupled with consistent or increasing demand, leads to higher prices. As the number of new Bitcoins and Ethereums entering circulation decreases, the existing supply becomes more valuable. This scarcity is a major driver of potential price appreciation.

-

Increased Investment Interest: The deflationary nature of Bitcoin and the reduced inflation of Ethereum attracts investors seeking to hedge against inflation in traditional markets. This increased institutional and retail interest further fuels demand, potentially exacerbating price increases.

-

Enhanced Store of Value Proposition: The decreasing supply strengthens the narrative that Bitcoin and Ethereum can serve as reliable stores of value, similar to gold. This is crucial for long-term adoption and acceptance as a mainstream asset class.

-

Network Effects and Adoption: While not directly related to supply, the growing scarcity can positively influence network effects. As the value of each coin increases, the incentive for participation in the network grows stronger, leading to wider adoption and ecosystem development.

Challenges and Considerations:

While the diminishing supply paints a bullish picture, it's important to consider certain factors:

-

Regulatory Uncertainty: Government regulations remain a significant challenge for the entire cryptocurrency market. Unfavorable regulations can negatively impact prices regardless of supply dynamics.

-

Market Volatility: Cryptocurrency markets are notoriously volatile. Even with a shrinking supply, significant price swings are expected, driven by market sentiment, technological advancements, and macroeconomic factors.

-

Technological Advancements: The emergence of competing cryptocurrencies with different supply mechanisms could challenge the dominance of Bitcoin and Ethereum.

Conclusion:

The diminishing supply of Bitcoin and Ethereum is a powerful driver shaping the future of the cryptocurrency market. While not a guarantee of constant price appreciation, the inherent scarcity creates a strong foundation for long-term value growth. However, it's crucial to acknowledge the existing challenges and volatility within the market. Investors should conduct thorough research and understand the risks involved before investing in any cryptocurrency. The future of Bitcoin and Ethereum is intertwined with both their diminishing supply and broader macroeconomic factors – understanding this interplay is key for navigating the evolving landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's And Ethereum's Diminishing Supply: Impact And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tej Pratap Denies Relationship After Facebook Account Hack

May 26, 2025

Tej Pratap Denies Relationship After Facebook Account Hack

May 26, 2025 -

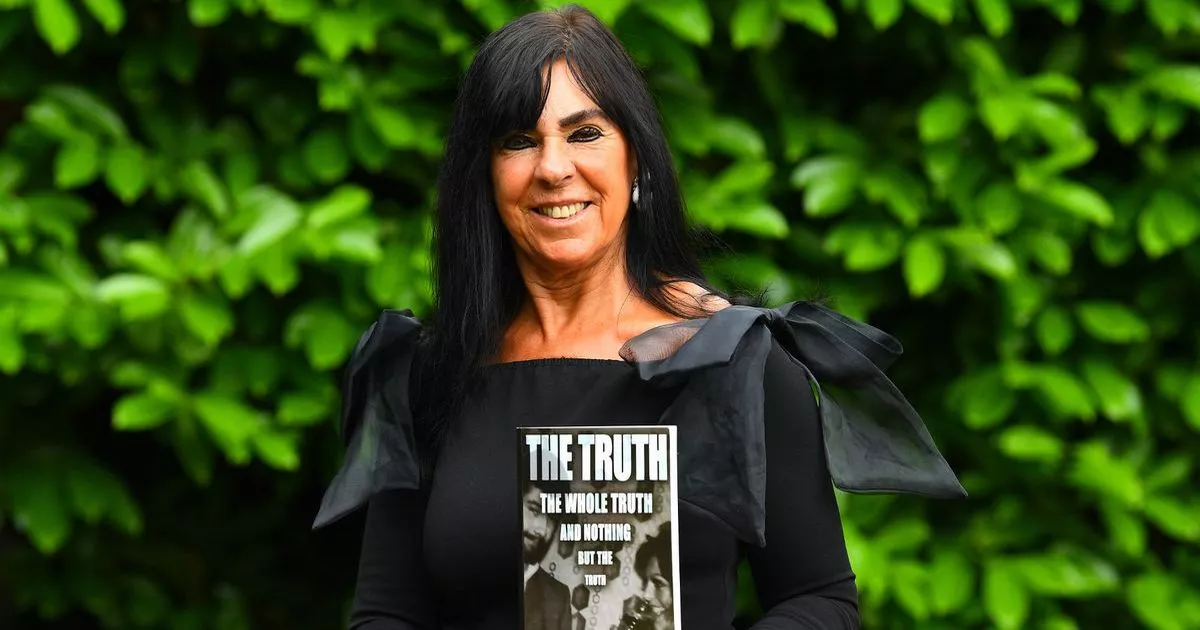

Married To Britains Most Notorious Prisoner A Wifes Untold Story

May 26, 2025

Married To Britains Most Notorious Prisoner A Wifes Untold Story

May 26, 2025 -

Dont Miss The Weeks Top 7 Tech Stories Google Dyson And Beyond

May 26, 2025

Dont Miss The Weeks Top 7 Tech Stories Google Dyson And Beyond

May 26, 2025 -

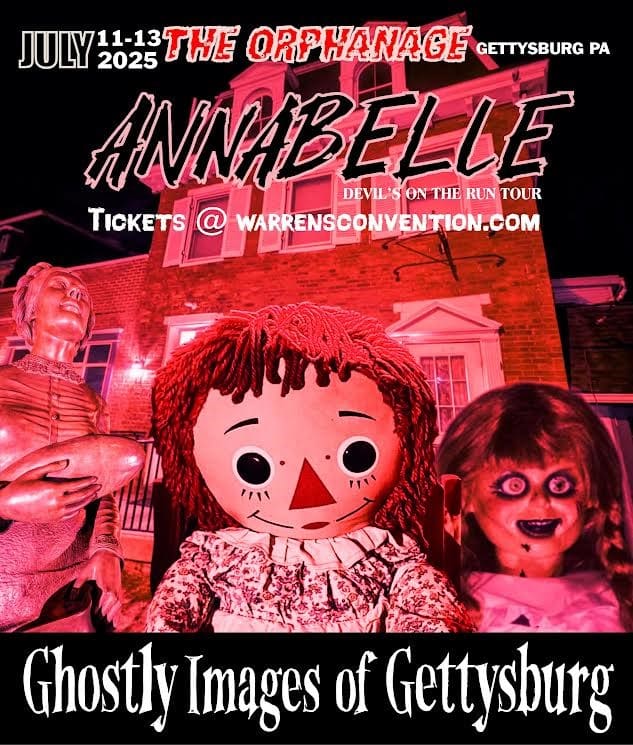

Annabelle Gettysburg Tour July 11th Date Announced

May 26, 2025

Annabelle Gettysburg Tour July 11th Date Announced

May 26, 2025 -

Monaco Grand Prix 2024 Norris Vs Leclerc Tactical Battles And The Two Stop Strategy

May 26, 2025

Monaco Grand Prix 2024 Norris Vs Leclerc Tactical Battles And The Two Stop Strategy

May 26, 2025