Bitcoin's Best Week: Investors Flee Safe Havens For Crypto

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's Best Week: Investors Flee Safe Havens for Crypto

Bitcoin experienced its best week in months, surging over 13% to reclaim the $30,000 mark. This dramatic upswing has analysts buzzing, attributing the rally to a confluence of factors, most notably a flight from traditional "safe haven" assets and renewed investor confidence in the cryptocurrency market. The question on everyone's mind: is this a sustainable trend, or just a temporary bounce?

The Great Escape from Safe Havens:

For months, investors have flocked to perceived safe havens like gold and the US dollar amidst global economic uncertainty. Rising inflation, banking sector instability, and geopolitical tensions fueled this trend. However, the recent Bitcoin rally suggests a shift in sentiment. Investors, potentially disillusioned by the stagnant returns of traditional safe havens, are increasingly looking towards alternative assets, with Bitcoin leading the charge. This "flight to risk" highlights the growing perception of Bitcoin as a hedge against inflation and economic instability, a narrative that has been gaining traction within the crypto community.

What Fueled Bitcoin's Ascent?

Several factors contributed to Bitcoin's impressive performance this week:

-

Reduced Regulatory Uncertainty (in some regions): While regulatory clarity remains a key challenge for the crypto industry globally, some positive developments in specific jurisdictions have helped bolster investor confidence. This includes clearer regulatory frameworks in certain countries, leading to a perception of reduced risk for Bitcoin investment.

-

Positive Macroeconomic Indicators (cautious optimism): While economic headwinds persist, some recent macroeconomic data points have offered a glimmer of hope, suggesting a potential easing of inflationary pressures. This subtle shift in the economic outlook has encouraged investors to move away from defensive positions and re-allocate capital to riskier assets, such as Bitcoin.

-

BlackRock's Bitcoin ETF Application: The filing of a spot Bitcoin ETF application by the investment giant BlackRock sent shockwaves through the market. This move, considered a watershed moment by many in the crypto space, signifies the growing institutional interest in Bitcoin and its potential for mainstream adoption. The potential for easier access to Bitcoin via regulated exchange-traded funds (ETFs) is a powerful catalyst for further price increases.

-

Technical Indicators: Several technical indicators, such as increasing trading volume and a break above key resistance levels, also contributed to the bullish sentiment surrounding Bitcoin. These signals, often followed closely by technical analysts, provided further confirmation of the ongoing upward trend.

Is This a Sustainable Rally?

While the recent Bitcoin rally is undeniably impressive, it's crucial to remain cautious. The cryptocurrency market is notoriously volatile, and predicting its future trajectory is challenging. Several factors could potentially reverse the current trend, including renewed regulatory crackdowns, unexpected macroeconomic events, or simply a correction after a sharp price increase.

The Future of Bitcoin:

Despite the inherent volatility, the long-term outlook for Bitcoin remains a subject of intense debate. Proponents point to its decentralized nature, scarcity, and growing adoption as factors that support its long-term value proposition. However, skeptics remain concerned about its regulatory uncertainties, environmental impact, and its susceptibility to market manipulation.

Ultimately, the future of Bitcoin, and the cryptocurrency market as a whole, depends on a complex interplay of technological advancements, regulatory developments, and evolving investor sentiment. This week's surge underscores Bitcoin's potential, but investors should approach this volatile market with both excitement and caution. Further analysis and a long-term perspective are vital for navigating the crypto landscape effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's Best Week: Investors Flee Safe Havens For Crypto. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tottenham Defeat Manchester United 1 0 In 2025 Europa League Final

May 22, 2025

Tottenham Defeat Manchester United 1 0 In 2025 Europa League Final

May 22, 2025 -

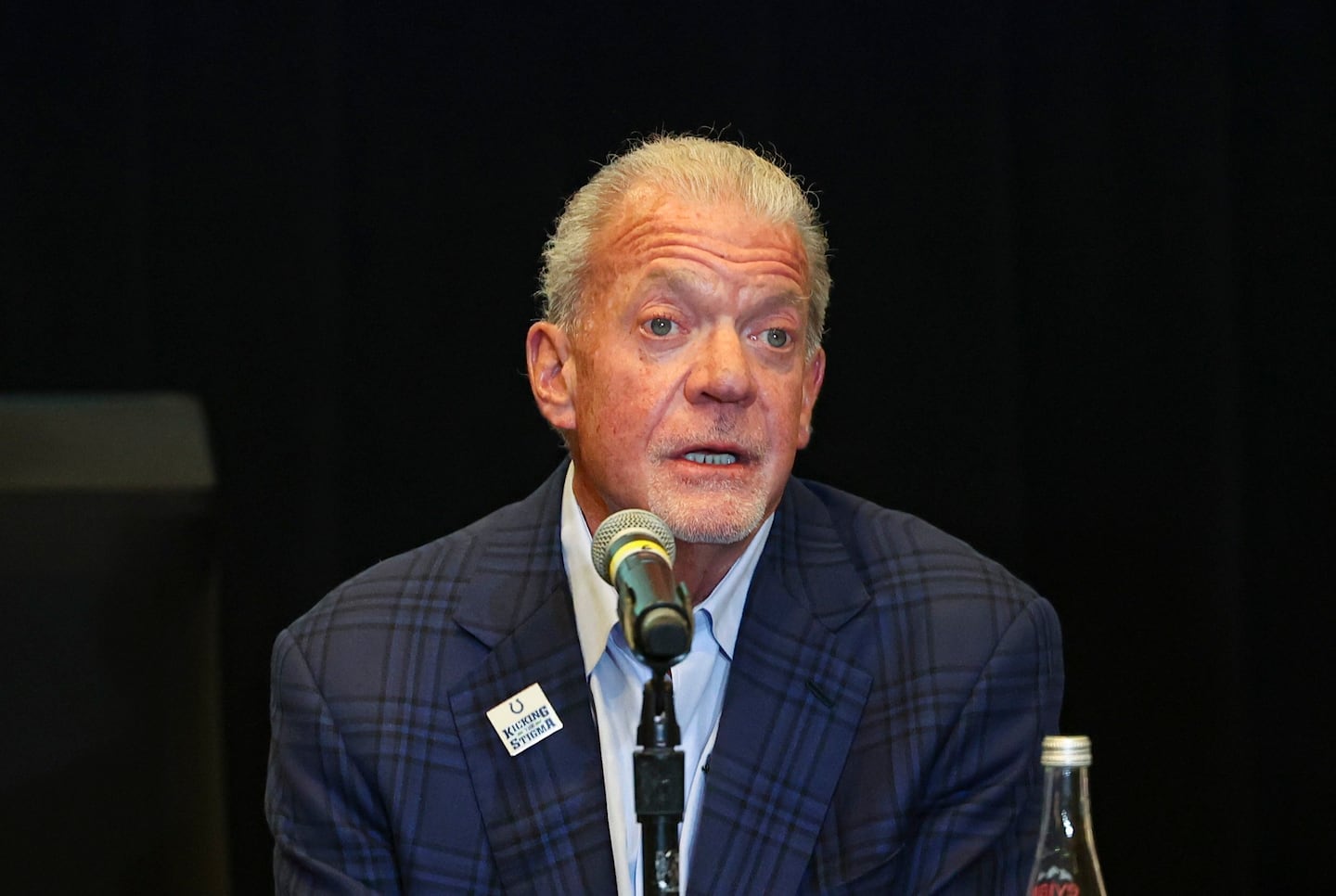

Jim Irsay 65 Impactful Reign As Indianapolis Colts Owner Ends

May 22, 2025

Jim Irsay 65 Impactful Reign As Indianapolis Colts Owner Ends

May 22, 2025 -

Brasil Copom Define Selic Ipca Pressiona E Dados Da China Impactam A Industria

May 22, 2025

Brasil Copom Define Selic Ipca Pressiona E Dados Da China Impactam A Industria

May 22, 2025 -

Predicting The Winner Thunder Vs Timberwolves Playoff Series Schedule And Analysis

May 22, 2025

Predicting The Winner Thunder Vs Timberwolves Playoff Series Schedule And Analysis

May 22, 2025 -

Surprise Inventory Build U S Crude Oil And Fuel Stocks Increase

May 22, 2025

Surprise Inventory Build U S Crude Oil And Fuel Stocks Increase

May 22, 2025