Bitcoin's Best Weekly Close: Investors Flee Traditional Safe Havens

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's Best Weekly Close: Investors Flee Traditional Safe Havens

Bitcoin (BTC) surged to its best weekly close in months, leaving traditional safe haven assets like gold and government bonds in the dust. This dramatic shift signals a growing appetite for riskier investments and a potential erosion of faith in established financial systems. The cryptocurrency's impressive performance comes amidst a backdrop of global economic uncertainty and rising inflation, prompting investors to seek alternative stores of value.

The cryptocurrency market has seen a significant upswing recently, with Bitcoin leading the charge. This rally isn't just about speculation; it reflects a deeper trend: investors are actively diversifying their portfolios, seeking assets less correlated with traditional markets. The flight from traditional safe havens suggests a growing unease with the current economic climate and a search for resilience against inflation and geopolitical instability.

Why the Sudden Shift Towards Bitcoin?

Several factors contribute to Bitcoin's recent success and the simultaneous exodus from traditional safe havens:

-

Inflation Concerns: Persistently high inflation rates globally are eroding the purchasing power of fiat currencies, prompting investors to seek assets that can potentially hedge against inflation. Bitcoin, with its fixed supply of 21 million coins, is often viewed as a deflationary asset.

-

Geopolitical Instability: Ongoing geopolitical tensions and uncertainties are fueling investor anxiety, pushing them towards assets perceived as less vulnerable to political risks. Bitcoin's decentralized nature makes it attractive in such volatile environments.

-

Increased Institutional Adoption: The growing adoption of Bitcoin by institutional investors, including large corporations and hedge funds, adds to its credibility and further drives its price upwards. This institutional interest signals a shift in perception, positioning Bitcoin as a serious investment asset rather than just a speculative bubble.

-

Technological Advancements: Ongoing developments within the Bitcoin ecosystem, such as the Lightning Network improving transaction speeds and reducing fees, are making it a more user-friendly and efficient asset.

Gold and Government Bonds: Losing Their Luster?

Traditionally, gold and government bonds have served as safe havens during times of economic uncertainty. However, their recent underperformance relative to Bitcoin suggests a potential paradigm shift in investor behavior. The low yields on government bonds in many countries, coupled with concerns about the long-term value of gold in a rapidly evolving technological and economic landscape, are likely contributing factors.

This doesn't necessarily signal the end of gold or government bonds as investment vehicles, but it undeniably marks a significant change in investor sentiment. The growing acceptance of Bitcoin as a viable alternative suggests that diversification strategies are evolving to include digital assets.

The Future of Bitcoin: Cautious Optimism

While the recent surge in Bitcoin's price is undeniably impressive, it's crucial to approach the future with cautious optimism. The cryptocurrency market remains volatile, and significant price fluctuations are to be expected. However, the current trends suggest that Bitcoin's position as a significant asset class is solidifying, driving investors away from traditional safe havens and towards this innovative digital currency. The long-term implications of this shift remain to be seen, but it's clear that Bitcoin's role in the global financial landscape is undergoing a significant transformation. Investors should conduct thorough research and consult with financial advisors before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's Best Weekly Close: Investors Flee Traditional Safe Havens. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

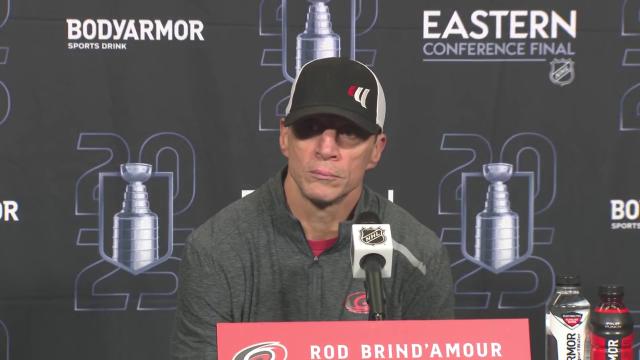

The Florida Panthers Undefeated Run Brind Amour Offers Insight

May 21, 2025

The Florida Panthers Undefeated Run Brind Amour Offers Insight

May 21, 2025 -

Wordle Game 1431 Nyts May 20 Puzzle Answer And Strategies

May 21, 2025

Wordle Game 1431 Nyts May 20 Puzzle Answer And Strategies

May 21, 2025 -

Oilers Vs Stars Nhl West Final Rematch Edmontons Confidence High

May 21, 2025

Oilers Vs Stars Nhl West Final Rematch Edmontons Confidence High

May 21, 2025 -

Klarna Reaches 100 Million Customers But Faces Mounting Financial Challenges

May 21, 2025

Klarna Reaches 100 Million Customers But Faces Mounting Financial Challenges

May 21, 2025 -

Nhl Analysis Brind Amour On The Florida Panthers Undefeated Streak

May 21, 2025

Nhl Analysis Brind Amour On The Florida Panthers Undefeated Streak

May 21, 2025