Bitcoin's (BTC) Price: Chart-Based Evidence Suggesting A Cycle Completion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's (BTC) Price: Chart-Based Evidence Suggesting a Cycle Completion

Bitcoin (BTC) has experienced a rollercoaster ride since its inception, captivating investors and sparking debates about its future. While predicting the volatile cryptocurrency market remains a challenge, a compelling case can be made using chart analysis that suggests the current Bitcoin cycle may be nearing completion. This analysis focuses on key on-chain metrics and historical price patterns to support this claim. Let’s dive into the evidence.

Historical Cycles and the Current Pattern:

Bitcoin's price history exhibits distinct cyclical patterns. Examining previous bull and bear markets reveals a recurring trend: periods of intense growth followed by significant corrections. These cycles, often lasting several years, are characterized by distinct phases, including accumulation, rapid price appreciation, a peak, and a subsequent bear market correction.

Analyzing historical BTC/USD charts shows a striking resemblance between the current cycle and previous ones. Key indicators such as the Relative Strength Index (RSI) and moving averages suggest a potential convergence with historical patterns observed at the end of previous cycles. The current price action, coupled with decreasing trading volume in some exchanges, could point toward a period of consolidation or even the beginning of a bear market.

On-Chain Data Corroboration:

While price charts provide a visual representation of market sentiment, on-chain data provides crucial underlying insights. Analyzing metrics like the Miner Revenue to Transaction Value ratio (MVRV), the Bitcoin Spent Output Profit Ratio (SOPR), and the Net Unrealized Profit/Loss (NUPL) reveals potentially significant conclusions.

- MVRV: A high MVRV ratio historically signifies a potential market top, indicating that miners are generating substantial profits, potentially leading to selling pressure. Recent data shows a declining MVRV, suggesting reduced miner profitability and potentially less selling pressure.

- SOPR: This metric measures the average profit or loss realized by investors when they sell their Bitcoin. A consistently high SOPR often precedes a market correction. Recent data suggests a decrease in SOPR, aligning with the potential cycle completion.

- NUPL: This indicator measures the aggregate unrealized profit or loss across all Bitcoin holders. A high NUPL typically indicates a market overbought condition, prone to correction. Current NUPL readings show signs of decreasing, suggesting less bullish sentiment overall.

Potential Scenarios and Implications:

It's crucial to emphasize that chart analysis is not an exact science, and various factors can influence Bitcoin's price. However, the confluence of historical price patterns and on-chain data strongly suggests a potential cycle completion. This doesn't necessarily mean a catastrophic crash, but rather a period of consolidation or a bear market.

Several scenarios are possible:

- Consolidation: The price may stabilize within a defined range before initiating a new upward trend.

- Bear Market: A significant price correction could follow, leading to a prolonged period of lower prices.

- Sideways Trend: A prolonged period of sideways movement with minimal price fluctuations could be expected.

Conclusion: Navigating Uncertainty:

While the evidence suggests a potential cycle completion for Bitcoin, the cryptocurrency market remains inherently volatile and unpredictable. Investors should proceed with caution, conduct thorough research, and manage risk effectively. Diversification of investment portfolios remains a crucial strategy, and only investing what you can afford to lose is paramount. This analysis serves as a potential indication, not definitive prediction. Always consult with a financial advisor before making investment decisions related to Bitcoin or any cryptocurrency. The information provided here is for educational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's (BTC) Price: Chart-Based Evidence Suggesting A Cycle Completion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Full Statewide Deployment Tesla Robotaxi Approved In Texas

May 05, 2025

Full Statewide Deployment Tesla Robotaxi Approved In Texas

May 05, 2025 -

Cruzeiro X Flamengo Disputa E Divergencias Internas No Flamengo Antes Do Confronto

May 05, 2025

Cruzeiro X Flamengo Disputa E Divergencias Internas No Flamengo Antes Do Confronto

May 05, 2025 -

Popovichs Impact How The Spurs Coach Shaped Wnba Star Becky Hammons Career

May 05, 2025

Popovichs Impact How The Spurs Coach Shaped Wnba Star Becky Hammons Career

May 05, 2025 -

Alcatrazs Future Trumps Plan To House More Prisoners In Expanded Facility

May 05, 2025

Alcatrazs Future Trumps Plan To House More Prisoners In Expanded Facility

May 05, 2025 -

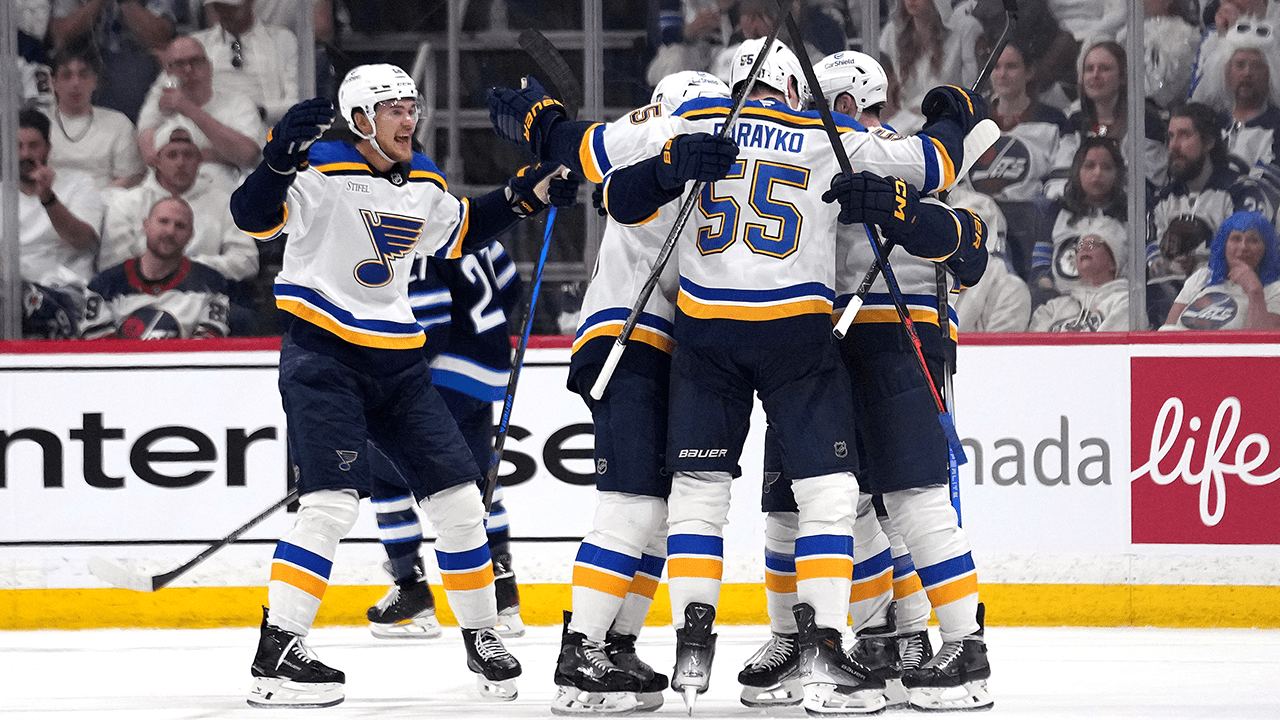

Top Shelf Success Analyzing Faksas Market Position

May 05, 2025

Top Shelf Success Analyzing Faksas Market Position

May 05, 2025