Bitcoin's (BTC) Price Cycle: Is The Bull Run Over? 3 Charts Suggest So

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's (BTC) Price Cycle: Is the Bull Run Over? 3 Charts Suggest So

Bitcoin's price has been a rollercoaster ride, leaving investors wondering: is the bull run finally over? While predicting the future of Bitcoin is notoriously difficult, three key charts paint a concerning picture for those hoping for a swift return to all-time highs. Recent price action, coupled with on-chain data and technical analysis, suggests a potential shift in market sentiment. Let's dive into the data.

1. The RSI Divergence: A Bearish Signal

The Relative Strength Index (RSI) is a momentum indicator frequently used in technical analysis. A bullish divergence occurs when the price makes lower lows, but the RSI makes higher lows. This suggests buying pressure is increasing, potentially signaling a price reversal. However, we're currently seeing the opposite: a bearish divergence. The price of Bitcoin has been making lower highs, while the RSI has also been making lower highs. This divergence is a classic bearish signal, indicating weakening bullish momentum and potentially foreshadowing further price declines.

[Insert Chart 1: Bitcoin price overlaid with RSI, clearly showing the bearish divergence. Source should be cited beneath the chart.]

2. On-Chain Metrics Show Decreasing Accumulation

Beyond price action, on-chain data provides valuable insights into investor behavior. Specifically, the accumulation trend among long-term holders (LTHs) is crucial. Historically, strong bull runs have been fueled by sustained accumulation from LTHs. However, recent data suggests a significant slowdown, if not a complete halt, in this accumulation. This lack of buying pressure from seasoned Bitcoin holders paints a pessimistic picture for near-term price increases. Analyzing metrics like the LTH SOPR (Spent Output Profit Ratio) further confirms this trend of decreasing accumulation.

[Insert Chart 2: A chart showcasing relevant on-chain data, such as LTH SOPR or a similar metric illustrating decreased accumulation. Source should be clearly cited beneath the chart.]

3. The Death Cross Looms: A Technical Warning Sign

The "death cross" is a bearish technical pattern formed when the 50-day moving average crosses below the 200-day moving average. This pattern often precedes significant price declines and is considered a strong bearish signal. While not a guaranteed predictor, the proximity of Bitcoin's 50-day and 200-day moving averages suggests that a death cross is imminent, adding further weight to the bearish outlook.

[Insert Chart 3: Bitcoin price chart with clearly marked 50-day and 200-day moving averages, highlighting the impending death cross. Source should be clearly cited beneath the chart.]

Conclusion: Cautious Optimism or Bearish Reality?

The combination of a bearish RSI divergence, decreasing on-chain accumulation, and the looming death cross paints a concerning picture for Bitcoin's short-term price trajectory. While Bitcoin's long-term potential remains a subject of ongoing debate, these indicators suggest that the current bull run might be over, at least for the time being. Investors should proceed with caution and carefully assess their risk tolerance before making any significant investment decisions. This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research before investing in any cryptocurrency.

Keywords: Bitcoin, BTC, price prediction, bull run, bear market, RSI, on-chain analysis, technical analysis, death cross, cryptocurrency, investing, market analysis, crypto news, Bitcoin price chart, Bitcoin price prediction 2024.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's (BTC) Price Cycle: Is The Bull Run Over? 3 Charts Suggest So. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Key Players To Watch Sri Lanka Women Vs India Women 4th Odi Clash

May 06, 2025

Key Players To Watch Sri Lanka Women Vs India Women 4th Odi Clash

May 06, 2025 -

Errori E Cadute Il Percorso Di Speranza Raccontato Da Enrico Galiano A Lecce

May 06, 2025

Errori E Cadute Il Percorso Di Speranza Raccontato Da Enrico Galiano A Lecce

May 06, 2025 -

Alcatraz Prison Trump Administration Announces Reopening And Expansion

May 06, 2025

Alcatraz Prison Trump Administration Announces Reopening And Expansion

May 06, 2025 -

Q1 2024 Earnings Singapore Banks Report Strong Trade And Wealth Management Varied Nim

May 06, 2025

Q1 2024 Earnings Singapore Banks Report Strong Trade And Wealth Management Varied Nim

May 06, 2025 -

Rockets Warriors Game 7 Leadership Under The Microscope Again

May 06, 2025

Rockets Warriors Game 7 Leadership Under The Microscope Again

May 06, 2025

Latest Posts

-

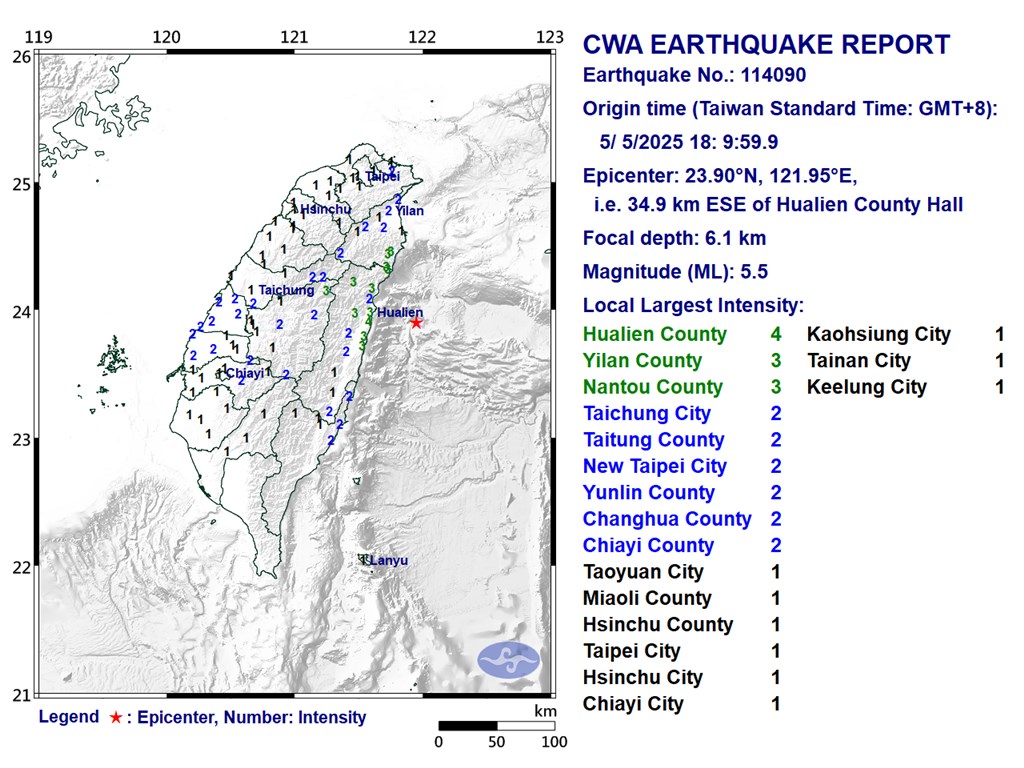

5 5 Magnitude Earthquake Jolts Eastern Taiwan Casualties And Damage Reports

May 06, 2025

5 5 Magnitude Earthquake Jolts Eastern Taiwan Casualties And Damage Reports

May 06, 2025 -

A Ap Rocky How Paternity Rekindled His Creative Fire

May 06, 2025

A Ap Rocky How Paternity Rekindled His Creative Fire

May 06, 2025 -

May Half Term Travel Disruption Gatwick Airport Strike Impact

May 06, 2025

May Half Term Travel Disruption Gatwick Airport Strike Impact

May 06, 2025 -

Russell Westbrook Unloads On Clippers Following Game 7 And Trade

May 06, 2025

Russell Westbrook Unloads On Clippers Following Game 7 And Trade

May 06, 2025 -

Gilgeous Alexander Thunder Face Stiff Test Nuggets Await In Round Two

May 06, 2025

Gilgeous Alexander Thunder Face Stiff Test Nuggets Await In Round Two

May 06, 2025