Bitcoin's Historic High: What's Fueling The Cryptocurrency's Ascent?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's Historic High: What's Fueling the Cryptocurrency's Ascent?

Bitcoin, the world's most dominant cryptocurrency, recently hit a historic high, sparking renewed interest and debate about its future. This surge isn't just random fluctuation; several key factors are contributing to Bitcoin's remarkable ascent. Understanding these drivers is crucial for anyone navigating the complex world of digital assets.

The Institutional Adoption Wave: One of the most significant shifts is the increasing adoption of Bitcoin by institutional investors. Large corporations and hedge funds, previously hesitant, are now allocating a portion of their portfolios to Bitcoin, viewing it as a hedge against inflation and a potential long-term store of value. This influx of institutional money provides significant buying pressure, pushing prices higher. Grayscale Bitcoin Trust, for instance, has seen massive inflows, reflecting this institutional interest.

Inflationary Concerns and Safe-Haven Status: Global inflationary pressures are playing a significant role. With traditional currencies losing purchasing power, investors are seeking alternative assets to preserve their wealth. Bitcoin, with its fixed supply of 21 million coins, is seen by many as a potential hedge against inflation, driving demand. This perception of Bitcoin as a "digital gold" or a safe-haven asset is further solidifying its position in investors' portfolios.

Growing Regulatory Clarity (in some regions): While regulatory uncertainty remains a significant challenge in many jurisdictions, some countries are showing increasing clarity and even embracing cryptocurrencies. This growing regulatory clarity, particularly in certain regions, is fostering a more stable and attractive environment for investment. The evolving regulatory landscape is a key factor influencing investor confidence.

Technological Advancements and Network Upgrades: Bitcoin's underlying technology continues to evolve. Upgrades and improvements to the network's scalability and efficiency are attracting more developers and bolstering the long-term viability of the cryptocurrency. These advancements contribute to a more robust and resilient ecosystem, further increasing investor confidence.

Increased Mainstream Awareness and Media Coverage: The growing mainstream media coverage of Bitcoin and cryptocurrencies, while sometimes overly sensationalized, is undeniably increasing public awareness. This increased visibility, coupled with stories of successful Bitcoin investments, is drawing in new investors and fueling demand.

However, Challenges Remain: Despite the impressive surge, it's crucial to acknowledge the inherent risks associated with Bitcoin. Its volatility remains a significant concern, with sharp price swings common. Furthermore, regulatory uncertainty in many parts of the world persists and could potentially impact the market.

What Does the Future Hold?

Predicting the future price of Bitcoin is notoriously difficult. While the current bullish trend is fueled by several powerful factors, investors should remain cautious and diversify their portfolios. The factors outlined above suggest a continued upward trajectory for Bitcoin in the medium term, but unforeseen events could drastically alter the market. Careful due diligence and a comprehensive understanding of the risks involved are crucial for anyone considering investing in Bitcoin or other cryptocurrencies.

Keywords: Bitcoin, cryptocurrency, Bitcoin price, Bitcoin investment, institutional investors, inflation, digital gold, regulatory clarity, cryptocurrency regulation, Bitcoin volatility, cryptocurrency future, crypto market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's Historic High: What's Fueling The Cryptocurrency's Ascent?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Obi Toppins Failed Dunk The Internets New Favorite Highlight

May 22, 2025

Obi Toppins Failed Dunk The Internets New Favorite Highlight

May 22, 2025 -

Timberwolves Playoff Victory Betting Lines And Odds Analysis After 2004 Drought

May 22, 2025

Timberwolves Playoff Victory Betting Lines And Odds Analysis After 2004 Drought

May 22, 2025 -

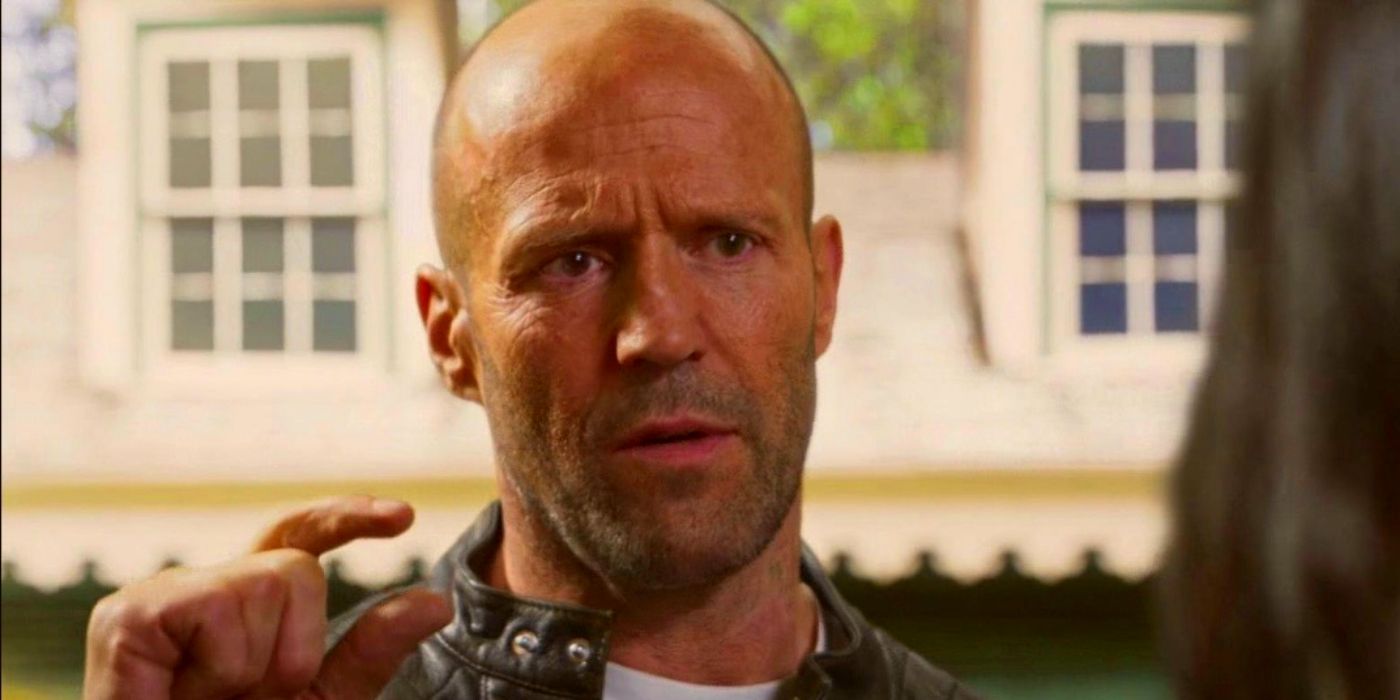

Jason Statham And Megan Foxs Expend4bles A Streaming Success Despite Rotten Tomatoes Score

May 22, 2025

Jason Statham And Megan Foxs Expend4bles A Streaming Success Despite Rotten Tomatoes Score

May 22, 2025 -

Unexpected Bitcoin Surge Leaves The World Speechless

May 22, 2025

Unexpected Bitcoin Surge Leaves The World Speechless

May 22, 2025 -

Why Nikola Jokics All Around Game Deserves The 2024 Nba Mvp Trophy

May 22, 2025

Why Nikola Jokics All Around Game Deserves The 2024 Nba Mvp Trophy

May 22, 2025