Bitcoin's Meteoric Rise: $106,000 Milestone And The Institutional Factor

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's Meteoric Rise: $106,000 Milestone and the Institutional Factor

Bitcoin's price recently surged past the $106,000 mark, sending shockwaves through the cryptocurrency market and sparking intense debate about the future of digital assets. This unprecedented rise isn't just a matter of speculation; it's increasingly fueled by a significant shift in the institutional landscape. While individual investors have always played a crucial role, the growing involvement of large corporations, hedge funds, and institutional investors is proving to be a major catalyst for Bitcoin's meteoric ascent.

The $106,000 Milestone: A Turning Point?

The crossing of the $106,000 threshold represents a significant psychological barrier broken. This milestone reinforces Bitcoin's status as a viable store of value and a potential hedge against inflation, attracting further institutional interest and driving up demand. While volatility remains inherent to the cryptocurrency market, the sustained price increase suggests a growing confidence in Bitcoin's long-term potential.

Several factors contributed to this recent surge. Increased regulatory clarity in certain jurisdictions, coupled with growing acceptance by mainstream financial institutions, has significantly boosted investor confidence. Moreover, the ongoing global economic uncertainty and inflationary pressures have pushed investors towards alternative assets, with Bitcoin emerging as a prominent choice.

The Institutional Influence: A Game Changer

The involvement of institutional investors is arguably the most significant driver of Bitcoin's recent price surge. Large corporations are increasingly adding Bitcoin to their balance sheets as a diversification strategy, recognizing its potential for long-term growth. Hedge funds are allocating a portion of their portfolios to Bitcoin, viewing it as a promising asset class with significant upside potential.

Here's how institutional involvement is impacting Bitcoin:

- Increased liquidity: Large institutional trades increase market liquidity, reducing volatility and making Bitcoin more accessible to a wider range of investors.

- Price stability (relatively): While still volatile, institutional participation helps to stabilize prices by mitigating the impact of individual investor actions.

- Enhanced legitimacy: The adoption of Bitcoin by established financial institutions lends credibility and legitimacy to the cryptocurrency, attracting further investment.

- Technological advancements: Institutional involvement drives innovation and development within the Bitcoin ecosystem, fostering improvements in scalability and security.

Looking Ahead: Challenges and Opportunities

Despite the impressive growth, challenges remain. Regulatory uncertainty in some regions continues to pose a risk, and the environmental concerns surrounding Bitcoin mining are still a subject of ongoing debate. However, the increasing adoption of sustainable mining practices and technological advancements aimed at improving energy efficiency are addressing these concerns.

The future of Bitcoin remains uncertain, but the current trajectory suggests a continued upward trend, driven largely by institutional participation. The $106,000 milestone is not just a numerical achievement; it marks a pivotal moment in Bitcoin's journey towards mainstream adoption and a potential shift in the global financial landscape. As institutional interest continues to grow, we can expect further price fluctuations, but the overall trend seems to point towards a future where Bitcoin plays an increasingly significant role in the world of finance. The key question is not if Bitcoin will continue to rise, but how high it will ultimately reach. This ongoing saga will continue to fascinate investors and observers alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's Meteoric Rise: $106,000 Milestone And The Institutional Factor. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

22 Hour Session Ends Trumps Policy Bill Heads To House Floor

May 22, 2025

22 Hour Session Ends Trumps Policy Bill Heads To House Floor

May 22, 2025 -

Todays Stock Market Deep Losses For Dow S And P 500 Nasdaq Bitcoin Hits All Time High

May 22, 2025

Todays Stock Market Deep Losses For Dow S And P 500 Nasdaq Bitcoin Hits All Time High

May 22, 2025 -

S 1 3 Billion Aviation Deal Sia Engineering To Service Singapore Airlines And Scoot

May 22, 2025

S 1 3 Billion Aviation Deal Sia Engineering To Service Singapore Airlines And Scoot

May 22, 2025 -

Stanley Cup Playoffs 2025 Conference Finals Breakdown Panthers Vs Hurricanes Stars Vs Oilers

May 22, 2025

Stanley Cup Playoffs 2025 Conference Finals Breakdown Panthers Vs Hurricanes Stars Vs Oilers

May 22, 2025 -

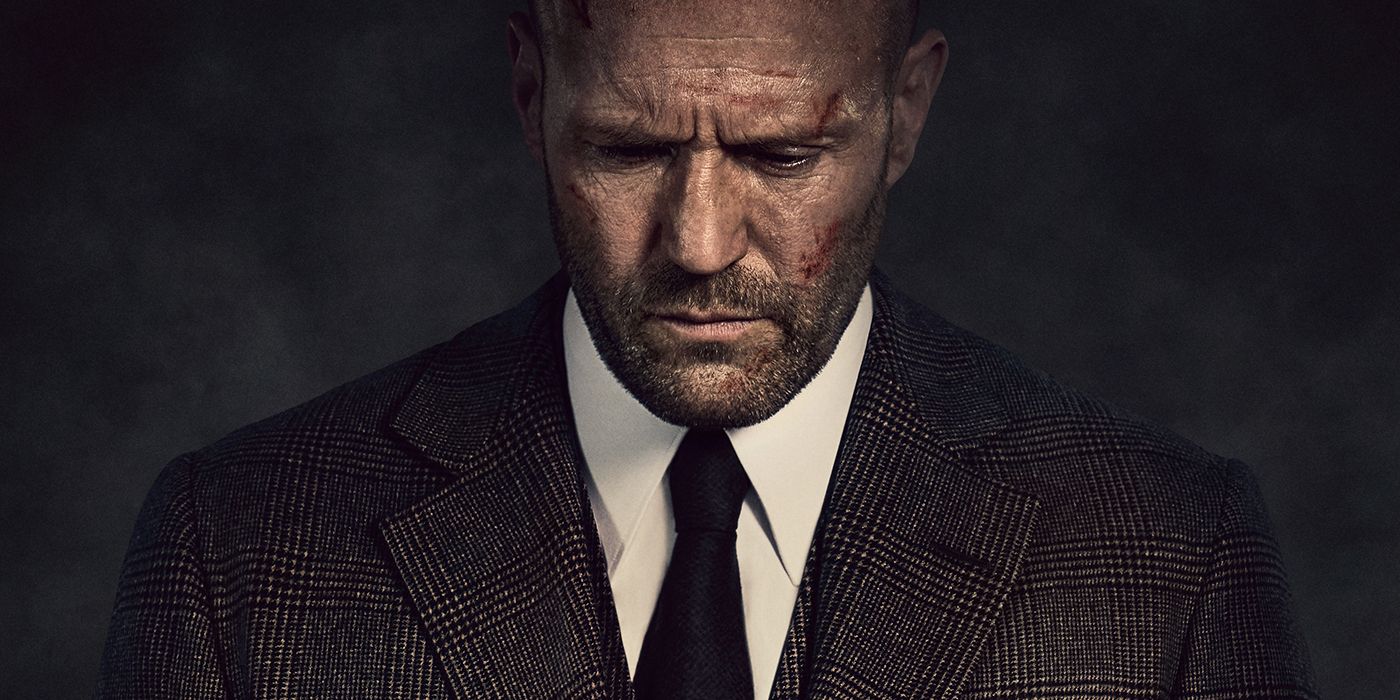

Jason Statham Movie Scores 90 On Rotten Tomatoes Breaks Streaming Charts

May 22, 2025

Jason Statham Movie Scores 90 On Rotten Tomatoes Breaks Streaming Charts

May 22, 2025