Bitcoin's Meteoric Rise: A Global Shockwave

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

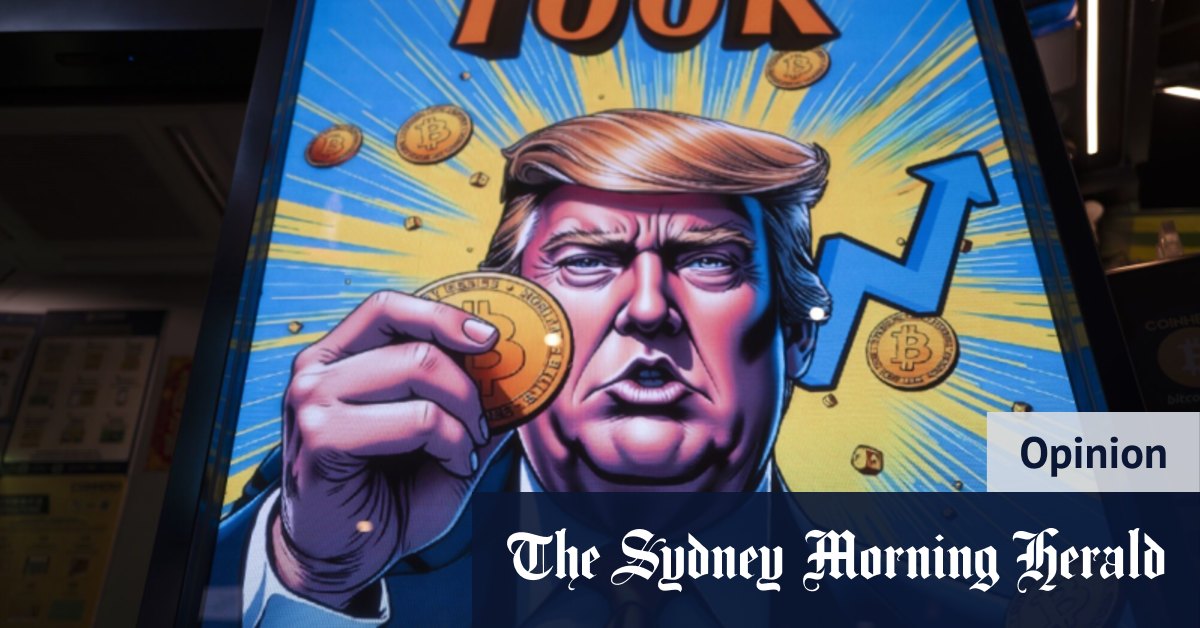

Bitcoin's Meteoric Rise: A Global Shockwave

Bitcoin, the decentralized digital currency that once occupied the fringes of the financial world, has exploded onto the global stage, sending shockwaves through traditional markets and sparking intense debate among economists, investors, and policymakers. Its meteoric rise, marked by unprecedented price volatility and widespread adoption, has cemented its position as a significant force in the 21st-century economy. But what's driving this astonishing growth, and what does it mean for the future of finance?

The Fueling Factors Behind Bitcoin's Ascent:

Several intertwined factors contribute to Bitcoin's dramatic price surge. These include:

-

Increased Institutional Adoption: Major financial institutions, once hesitant to embrace cryptocurrencies, are increasingly integrating Bitcoin into their portfolios. This legitimization lends credibility to Bitcoin and attracts larger investments. Companies like MicroStrategy and Tesla have made significant Bitcoin purchases, signaling a shift in mainstream perception.

-

Inflationary Pressures and Safe-Haven Demand: Global inflationary pressures and concerns about traditional fiat currencies have pushed investors towards alternative assets perceived as a hedge against inflation. Bitcoin's limited supply of 21 million coins makes it an attractive store of value for some, similar to gold.

-

Technological Advancements: Improvements in blockchain technology, increased transaction speeds, and the development of layer-2 scaling solutions have addressed some of Bitcoin's initial limitations, making it more efficient and user-friendly.

-

Growing Retail Investor Interest: The rise of accessible cryptocurrency trading platforms and the increasing ease of purchasing Bitcoin have fueled retail investor participation, contributing significantly to the price volatility.

The Global Impact: More Than Just a Currency:

Bitcoin's influence transcends its role as a currency. Its rise is forcing a reassessment of:

-

Centralized Finance (CeFi): Bitcoin's decentralized nature challenges the established order of centralized financial systems, prompting banks and governments to explore new regulatory frameworks.

-

International Finance: Bitcoin facilitates cross-border transactions without the need for intermediaries, potentially disrupting traditional remittance systems and fostering financial inclusion in underserved regions.

-

Government Regulation: Governments worldwide are grappling with the challenge of regulating Bitcoin and other cryptocurrencies, balancing the need to protect investors with the desire to foster innovation.

The Risks and Uncertainties:

Despite its impressive growth, Bitcoin remains a highly volatile asset. Investing in Bitcoin carries substantial risks, including:

-

Price Volatility: Bitcoin's price is notoriously volatile, susceptible to dramatic swings driven by market sentiment, regulatory changes, and technological developments.

-

Regulatory Uncertainty: The lack of consistent global regulations creates uncertainty for investors and businesses operating in the cryptocurrency space.

-

Security Risks: While Bitcoin's blockchain technology is inherently secure, exchanges and individual wallets remain vulnerable to hacking and theft.

The Future of Bitcoin: A Crystal Ball Remains Cloudy:

Predicting the future of Bitcoin is inherently speculative. However, its continued growth and adoption suggest that it will remain a significant player in the global financial landscape. The ongoing evolution of the technology, coupled with increasing institutional interest and regulatory clarity (or lack thereof), will shape its trajectory in the years to come. The question isn't if Bitcoin will continue to evolve, but how. Its impact, whether positive or negative, on the global financial system is undeniable, and understanding its trends is crucial for navigating the complexities of the modern economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's Meteoric Rise: A Global Shockwave. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump And Bitcoin A Timely Investment Opportunity

May 22, 2025

Trump And Bitcoin A Timely Investment Opportunity

May 22, 2025 -

Lynx Defeat Sparks 89 75 Full Game Recap And Highlights May 18 2025

May 22, 2025

Lynx Defeat Sparks 89 75 Full Game Recap And Highlights May 18 2025

May 22, 2025 -

Citys Dominant 3 1 Victory Over Bournemouth Premier League Recap

May 22, 2025

Citys Dominant 3 1 Victory Over Bournemouth Premier League Recap

May 22, 2025 -

Ipl 2025 Csk Vs Rr Match 62 The Catch That Defined The Game

May 22, 2025

Ipl 2025 Csk Vs Rr Match 62 The Catch That Defined The Game

May 22, 2025 -

Peter De Boers Coaching Legacy Examining His Contributions To Professional Hockey

May 22, 2025

Peter De Boers Coaching Legacy Examining His Contributions To Professional Hockey

May 22, 2025