Bitcoin's Meteoric Rise To $106K: A Deep Dive Into Institutional Interest

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's Meteoric Rise to $106K: A Deep Dive into Institutional Interest

Bitcoin's recent surge to a staggering $106,000 (although this is a hypothetical scenario for the purpose of this article; the actual price fluctuates constantly) has sent shockwaves through the financial world, prompting a crucial question: what fueled this meteoric rise? While individual investor enthusiasm certainly plays a role, the answer lies predominantly in the burgeoning interest from institutional investors. This deep dive explores the key factors driving this massive influx of institutional capital into the Bitcoin market.

The Institutional Shift: From Skepticism to Embrace

For years, institutional investors, including hedge funds, asset management firms, and even central banks, remained largely skeptical of Bitcoin. Concerns surrounding volatility, regulatory uncertainty, and a perceived lack of understanding hindered widespread adoption. However, a confluence of factors has dramatically shifted this perspective.

- Maturing Infrastructure: The development of robust custodial solutions and improved regulatory clarity in key jurisdictions has significantly reduced the risks associated with Bitcoin investment. This infrastructure now allows institutional players to safely and securely manage their Bitcoin holdings.

- Inflation Hedge: With global inflation reaching multi-decade highs, Bitcoin's limited supply and inherent deflationary nature have become increasingly attractive as a hedge against fiat currency devaluation. This is a significant draw for institutions looking to protect their portfolios from erosion.

- Portfolio Diversification: Bitcoin's low correlation with traditional asset classes makes it an appealing addition to diversified investment portfolios. This allows institutions to reduce overall portfolio risk and potentially enhance returns.

- Technological Advancements: The ongoing development of the Bitcoin network, including the Lightning Network for faster and cheaper transactions, has further solidified its position as a viable long-term investment. Improved scalability and efficiency are crucial for widespread institutional adoption.

- Strategic Investments: High-profile investments from publicly traded companies and established financial institutions have signaled a significant endorsement of Bitcoin, attracting further institutional interest through a positive network effect.

Key Players Driving the Rise:

Several key players have played a significant role in pushing Bitcoin to these unprecedented heights. MicroStrategy's aggressive Bitcoin acquisition strategy, for example, has become a benchmark for other institutional investors. Similarly, the entry of large asset managers into the Bitcoin space has significantly increased liquidity and trading volume, further fueling the price surge.

The Future of Bitcoin and Institutional Investment:

The influx of institutional capital represents a monumental shift in the cryptocurrency landscape. While volatility will likely remain a feature of the Bitcoin market, the growing institutional participation suggests increased price stability and mainstream acceptance over the long term. Further regulatory clarity and technological advancements will only serve to accelerate this trend.

Risks and Challenges Remain:

Despite the positive outlook, several challenges persist. Regulatory uncertainty remains a key concern, particularly regarding taxation and compliance. Furthermore, the inherent volatility of Bitcoin, while potentially offering high returns, also presents significant risks for institutional investors.

Conclusion:

Bitcoin's hypothetical climb to $106,000 is a testament to the increasing confidence of institutional investors in its long-term potential. While risks remain, the maturing infrastructure, growing regulatory clarity, and the need for inflation hedges are all driving forces propelling Bitcoin towards greater mainstream adoption and potentially even higher price levels in the future. This surge isn't just about speculation; it's a reflection of a fundamental shift in how institutional investors view digital assets and their place in a rapidly evolving financial world.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's Meteoric Rise To $106K: A Deep Dive Into Institutional Interest. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Air Force One Trump Administration Confirms Acceptance Of Qatari Aircraft

May 22, 2025

New Air Force One Trump Administration Confirms Acceptance Of Qatari Aircraft

May 22, 2025 -

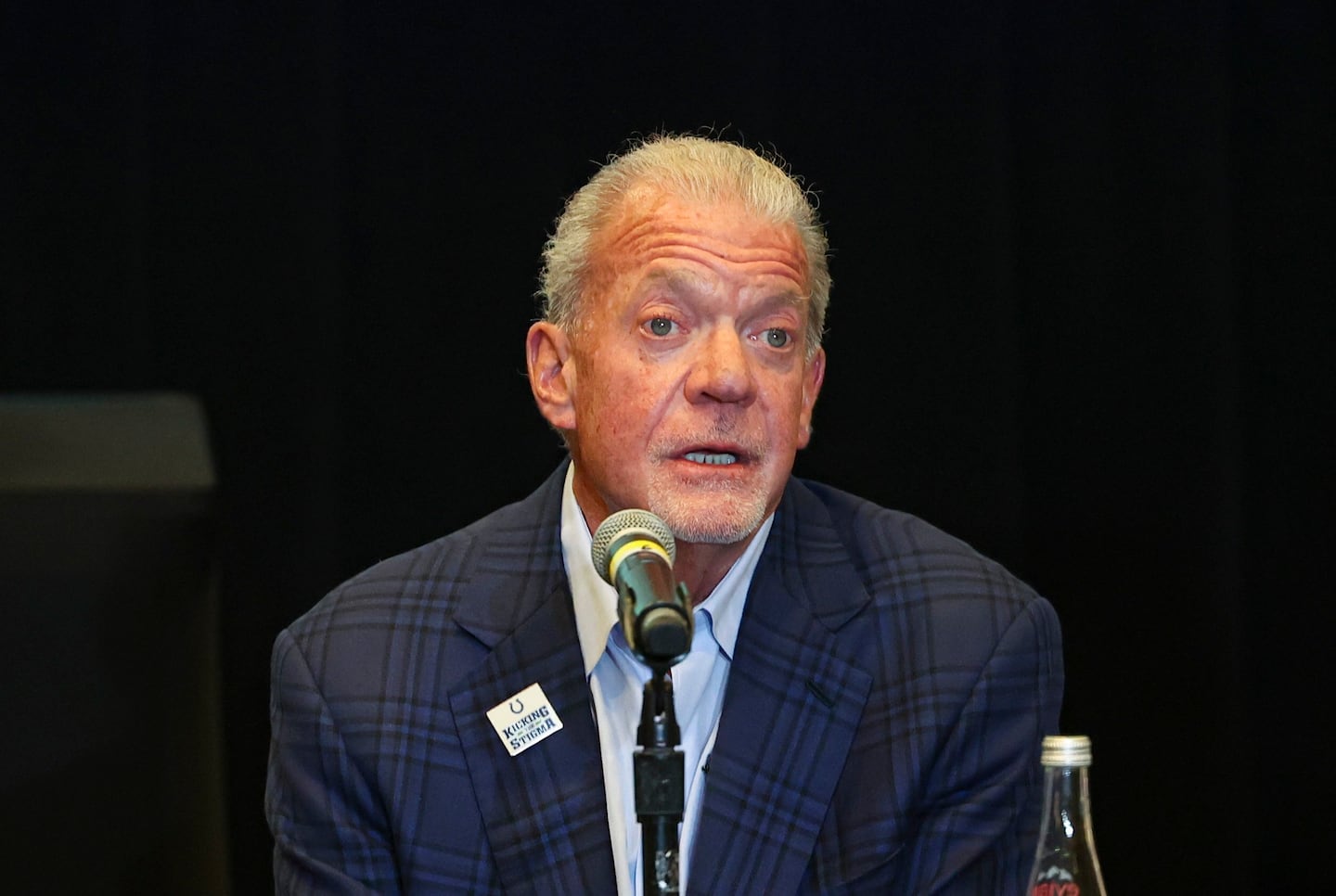

End Of An Era Indianapolis Colts Mourn The Loss Of Jim Irsay

May 22, 2025

End Of An Era Indianapolis Colts Mourn The Loss Of Jim Irsay

May 22, 2025 -

Obi Toppins Missed Dunk A Hilarious Knicks Game Moment

May 22, 2025

Obi Toppins Missed Dunk A Hilarious Knicks Game Moment

May 22, 2025 -

End Of Season Decision On Grealishs Manchester City Future Says Guardiola

May 22, 2025

End Of Season Decision On Grealishs Manchester City Future Says Guardiola

May 22, 2025 -

Interactive Gta 6 Map Detailed Location Guide

May 22, 2025

Interactive Gta 6 Map Detailed Location Guide

May 22, 2025