Bitcoin's Second Wind: Is This The Start Of A New Bull Run?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin's Second Wind: Is This the Start of a New Bull Run?

Bitcoin, the world's leading cryptocurrency, has shown surprising resilience in recent weeks, sparking renewed excitement and debate among investors: is this the beginning of a new bull run? After a prolonged period of consolidation and uncertainty, characterized by regulatory scrutiny and macroeconomic headwinds, Bitcoin’s price has demonstrated a notable upswing, leaving many wondering if the crypto winter is finally over.

This recent surge isn't just about price action; it’s fueled by a confluence of factors, some expected and others less predictable. Let's delve into the key elements driving this renewed optimism and explore the potential for a sustained bull market.

The Catalysts for Bitcoin's Resurgence:

Several key factors have contributed to Bitcoin's recent price increase and renewed investor interest:

-

Reduced Inflationary Pressures: Easing inflation in major economies has reduced the appeal of safe-haven assets like gold, potentially shifting some investment towards riskier assets like Bitcoin. The decreased fear of aggressive interest rate hikes also plays a significant role.

-

Gradual Regulatory Clarity: While regulatory uncertainty remains a significant concern globally, some jurisdictions are showing signs of a more measured and nuanced approach to crypto regulation. This cautious optimism is boosting investor confidence. The ongoing debate around regulatory frameworks is crucial to long-term Bitcoin adoption.

-

Growing Institutional Adoption: Despite the market volatility, institutional investors continue to show a growing interest in Bitcoin and other cryptocurrencies, albeit cautiously. Their strategic allocation of funds suggests a belief in Bitcoin's long-term potential as a store of value and a diversification tool.

-

Technological Advancements: Ongoing developments in the Bitcoin ecosystem, such as the Lightning Network's improvement in scalability and transaction speed, are enhancing its usability and appeal to a wider audience. These advancements are vital for Bitcoin's continued growth and mainstream adoption.

-

Halving Cycle Anticipation: The upcoming Bitcoin halving event, expected in 2024, is already influencing market sentiment. Historically, halving events have preceded significant price increases due to reduced supply. This anticipated scarcity is a major factor driving current speculation.

Is This a Sustainable Bull Run? The Challenges Remain:

While the recent price action is encouraging, it's crucial to acknowledge the persistent challenges facing Bitcoin:

-

Geopolitical Uncertainty: Global instability and ongoing conflicts can significantly impact investor sentiment and cryptocurrency markets. This unpredictable external environment poses a continuous threat.

-

Regulatory Scrutiny: The regulatory landscape for crypto remains volatile and unpredictable, with varying approaches across different countries. Unfavorable regulations could negatively impact Bitcoin's price and adoption.

-

Market Volatility: The inherent volatility of cryptocurrency markets is a significant risk. Sharp price corrections are still possible, even during a bull run.

Conclusion: Navigating the Uncertain Future of Bitcoin

The recent upswing in Bitcoin's price offers a glimmer of hope for a new bull run. However, it's crucial to approach this development with caution and realism. While the factors discussed above contribute to a positive outlook, the inherent risks and uncertainties within the cryptocurrency market remain significant. Investors should adopt a well-informed and diversified approach, considering both the potential rewards and the substantial risks involved in investing in Bitcoin. The ongoing evolution of the crypto landscape necessitates continuous monitoring and careful analysis of market trends. Only time will tell if this resurgence marks the beginning of a sustained bull market or merely a temporary reprieve.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin's Second Wind: Is This The Start Of A New Bull Run?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Australian Outback Dramatic Confrontation Between Wallaby And Crocodile

May 16, 2025

Australian Outback Dramatic Confrontation Between Wallaby And Crocodile

May 16, 2025 -

Nhl Playoffs 2025 Oilers 1 0 Ot Victory And Updated Tournament Bracket

May 16, 2025

Nhl Playoffs 2025 Oilers 1 0 Ot Victory And Updated Tournament Bracket

May 16, 2025 -

Metas Antitrust Trial Fresh Tensions With The Media Emerge

May 16, 2025

Metas Antitrust Trial Fresh Tensions With The Media Emerge

May 16, 2025 -

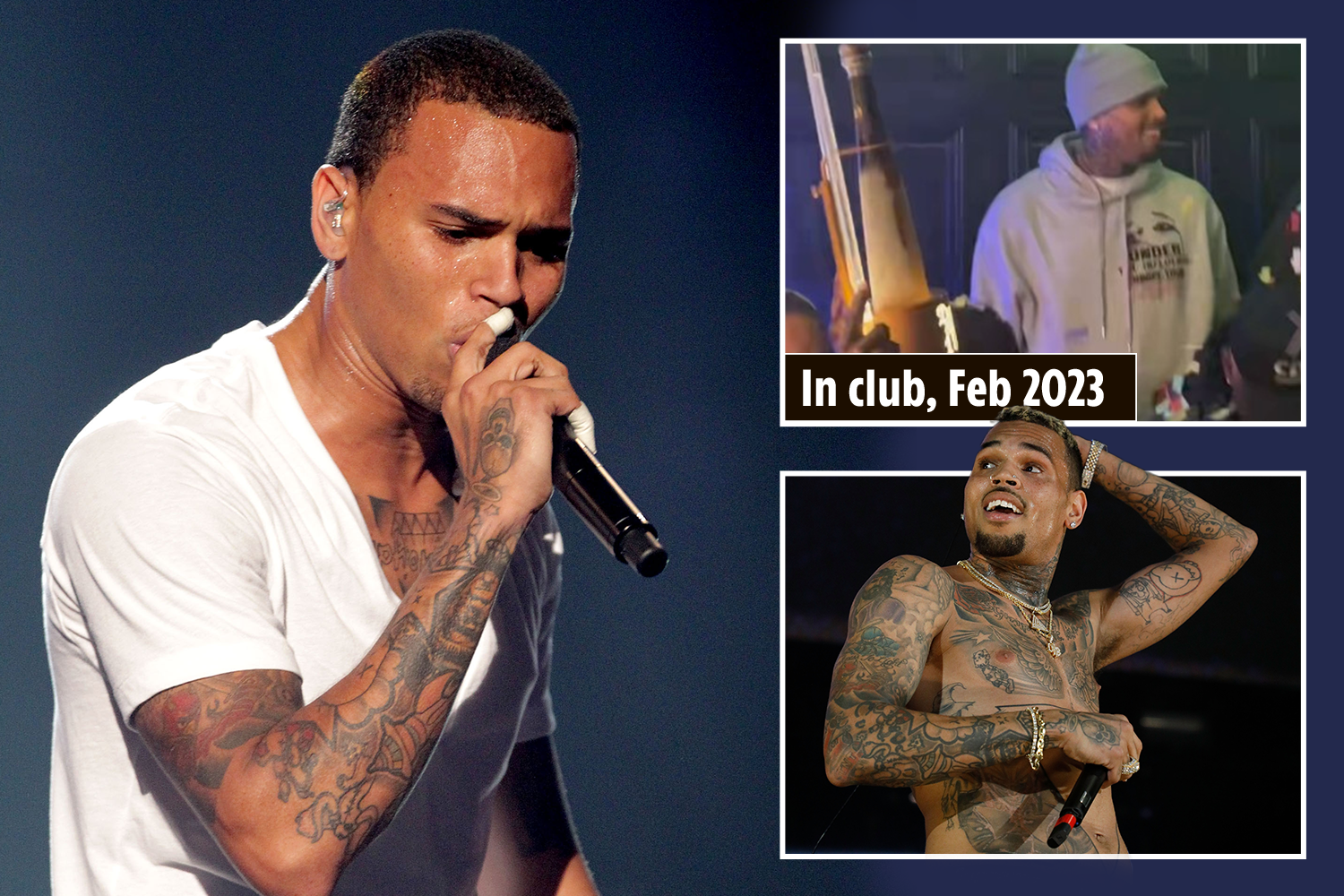

Police Arrest Chris Brown At 5 Star Uk Hotel After Nightclub Incident

May 16, 2025

Police Arrest Chris Brown At 5 Star Uk Hotel After Nightclub Incident

May 16, 2025 -

Unravel Wordle May 13 2025 Hints And The Answer

May 16, 2025

Unravel Wordle May 13 2025 Hints And The Answer

May 16, 2025