BlackRock's Bitcoin ETF: $530 Million Influx, Ethereum Funds Remain Unchanged

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BlackRock's Bitcoin ETF Attracts $530 Million Influx: Ethereum Funds Stay Static

BlackRock's highly anticipated Bitcoin exchange-traded fund (ETF) has experienced a phenomenal surge in its first week, attracting a staggering $530 million in assets under management (AUM). This explosive growth underscores the significant investor interest in regulated Bitcoin exposure and marks a pivotal moment for the cryptocurrency market's integration into traditional finance. However, in a stark contrast, Ethereum-focused funds have seen little to no change in their AUM, highlighting the specific market excitement surrounding Bitcoin's entry into the ETF arena.

The launch of the iShares Bitcoin Trust (iShares BIT) has been lauded as a major step towards broader cryptocurrency adoption. The ETF's success is attributed to several factors, including BlackRock's reputation as a global investment behemoth, the regulatory approval from the SEC (Securities and Exchange Commission), and the growing institutional demand for Bitcoin as a potential hedge against inflation and diversification tool.

<h3>A Record-Breaking Start for Bitcoin ETFs</h3>

The $530 million influx surpasses initial expectations and sets a new benchmark for Bitcoin ETF launches. This significant inflow signifies a major shift in the landscape, demonstrating institutional investors' growing confidence in the digital asset. This rapid growth underscores the potential for further adoption and suggests that BlackRock's ETF could become a dominant force in the Bitcoin investment market.

- Institutional Confidence: The sheer volume of investment highlights a growing belief among institutional players in Bitcoin's long-term potential. BlackRock's involvement lends significant credibility to the asset class.

- Regulatory Clarity: SEC approval of the ETF signifies a move towards greater regulatory clarity within the cryptocurrency space, reassuring investors and encouraging further participation.

- Accessibility: The ETF provides a more accessible and regulated entry point for institutional and retail investors interested in gaining exposure to Bitcoin.

<h3>Ethereum ETFs Remain Unchanged: A Tale of Two Cryptocurrencies</h3>

While BlackRock's Bitcoin ETF enjoys meteoric success, the lack of movement in Ethereum-focused investment funds paints a contrasting picture. This disparity likely stems from several factors:

- Differing Use Cases: Bitcoin's primary function as a store of value and its established market dominance differentiate it from Ethereum, which is primarily used for smart contracts and decentralized applications (dApps).

- Market Sentiment: Investor sentiment currently favors Bitcoin, potentially due to the regulatory clarity surrounding the ETF and its established position in the cryptocurrency ecosystem.

- Future Potential: While Ethereum holds significant long-term potential, its market dynamics are different, and its growth trajectory may not be as directly influenced by ETF launches as Bitcoin's.

<h3>Looking Ahead: Implications for the Crypto Market</h3>

The success of BlackRock's Bitcoin ETF is likely to have significant ripple effects on the broader cryptocurrency market. We can expect to see:

- Increased Institutional Investment: More institutional investors may follow BlackRock's lead, driving further adoption of Bitcoin and potentially other cryptocurrencies.

- Price Volatility: While the ETF provides regulated exposure, price volatility within the Bitcoin market is likely to persist.

- Regulatory Scrutiny: The ETF's success may increase regulatory scrutiny of other cryptocurrencies and their potential for ETF listings.

The launch of BlackRock's Bitcoin ETF represents a monumental shift in the relationship between traditional finance and the cryptocurrency market. While the future remains uncertain, the initial success of the ETF suggests a bright outlook for Bitcoin's integration into mainstream finance, while the differing trajectories of Bitcoin and Ethereum ETFs highlight the nuanced nature of the cryptocurrency market. The coming months will be crucial in observing the long-term impact of this groundbreaking development.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BlackRock's Bitcoin ETF: $530 Million Influx, Ethereum Funds Remain Unchanged. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

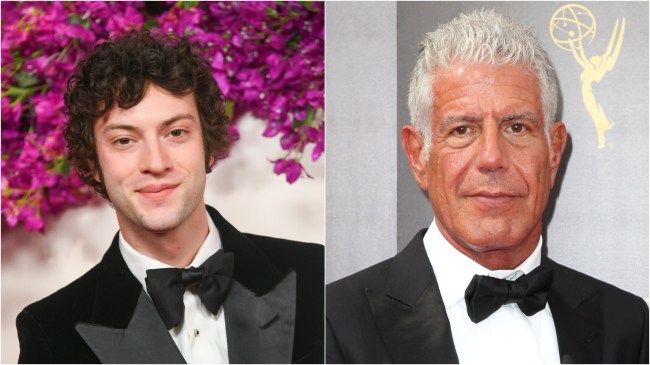

Anthony Bourdains Legacy A24s Tony Employs Method Acting Techniques

May 08, 2025

Anthony Bourdains Legacy A24s Tony Employs Method Acting Techniques

May 08, 2025 -

No More Symfonisk Speakers Sonos And Ikea Partnership Ends

May 08, 2025

No More Symfonisk Speakers Sonos And Ikea Partnership Ends

May 08, 2025 -

Broken Brains A Literary Exploration Of Mental Illness

May 08, 2025

Broken Brains A Literary Exploration Of Mental Illness

May 08, 2025 -

Billions In Crypto Three Week Inflow Streak Continues To Dominate Markets

May 08, 2025

Billions In Crypto Three Week Inflow Streak Continues To Dominate Markets

May 08, 2025 -

Is Jaylin Williams Earning More Playing Time With The Okc Thunder

May 08, 2025

Is Jaylin Williams Earning More Playing Time With The Okc Thunder

May 08, 2025

Latest Posts

-

Ticketmaster Australia Renews Long Term Partnership With Crown Resorts

May 08, 2025

Ticketmaster Australia Renews Long Term Partnership With Crown Resorts

May 08, 2025 -

360 000 Cadillac Celestiq Ev Performance And Luxury Tested

May 08, 2025

360 000 Cadillac Celestiq Ev Performance And Luxury Tested

May 08, 2025 -

Stellar Xlm Plummets Key Support At Risk Whats Next

May 08, 2025

Stellar Xlm Plummets Key Support At Risk Whats Next

May 08, 2025 -

Cerebras Wse 3 Vs Nvidia B200 A Detailed Comparison

May 08, 2025

Cerebras Wse 3 Vs Nvidia B200 A Detailed Comparison

May 08, 2025 -

Rockets Playoff Exit What Went Wrong And What Needs To Change

May 08, 2025

Rockets Playoff Exit What Went Wrong And What Needs To Change

May 08, 2025