BlackRock's Bitcoin ETF Sees Record Inflows: $590 Million Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BlackRock's Bitcoin ETF Sees Record Inflows: $590 Million Surge Signals Growing Institutional Confidence

BlackRock's highly anticipated Bitcoin ETF has experienced a record-breaking influx of capital, attracting a staggering $590 million in just its first few weeks. This monumental surge signals a significant shift in the perception of Bitcoin among institutional investors, bolstering the cryptocurrency's legitimacy and potentially paving the way for broader market adoption. The iShares Bitcoin Trust (ticker symbol likely to be announced soon), managed by the world's largest asset manager, has quickly become a focal point in the evolving landscape of digital asset investment.

This unprecedented inflow dwarfs the initial investments seen in other Bitcoin ETFs, highlighting the immense appetite for regulated Bitcoin exposure from large-scale investors. The move represents a significant vote of confidence in Bitcoin, despite ongoing regulatory uncertainty surrounding cryptocurrencies globally.

What's Driving the Record Inflows?

Several factors contribute to this remarkable success:

-

BlackRock's Reputation: BlackRock's involvement lends an air of legitimacy and trust to the Bitcoin ETF, attracting investors who might otherwise be hesitant to navigate the often volatile and unregulated cryptocurrency market. The firm's reputation for prudent investment strategies reassures many institutional investors.

-

Regulatory Clarity (Potential): While full regulatory clarity remains elusive, the SEC's increasing engagement with Bitcoin ETF applications suggests a potential shift towards greater acceptance of cryptocurrencies within traditional financial markets. BlackRock's deep connections within regulatory bodies may have played a significant role in facilitating this progress.

-

Institutional Demand for Bitcoin Exposure: Many institutional investors have been seeking regulated avenues for Bitcoin exposure. This ETF provides a familiar and convenient vehicle, eliminating the complexities and risks associated with directly holding Bitcoin.

-

Diversification and Portfolio Hedging: Bitcoin's potential as a portfolio diversifier and hedge against inflation is increasingly recognized by institutional investors, who see it as a valuable addition to their investment strategies.

Implications for the Bitcoin Market:

The massive inflow into BlackRock's Bitcoin ETF has significant implications for the wider cryptocurrency market:

-

Price Volatility: While the ETF itself may dampen some price volatility by providing a more stable regulated market, the overall inflow of institutional capital could still lead to price fluctuations.

-

Increased Market Maturity: The influx of institutional money suggests a maturing of the Bitcoin market, moving it closer to mainstream acceptance.

-

Regulatory Scrutiny: The ETF's success is likely to intensify regulatory scrutiny of the cryptocurrency market, potentially accelerating the development of clearer regulatory frameworks.

The Future of Bitcoin ETFs:

BlackRock's success is likely to encourage other asset managers to launch their own Bitcoin ETFs. This could lead to increased competition, potentially resulting in lower fees and more accessible investment opportunities for a wider range of investors. The future of Bitcoin ETFs seems bright, with the potential to reshape the landscape of digital asset investment. This monumental inflow sets a powerful precedent, suggesting that the institutional adoption of Bitcoin is far from over. The ongoing developments in this space warrant close observation from both investors and regulators alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BlackRock's Bitcoin ETF Sees Record Inflows: $590 Million Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

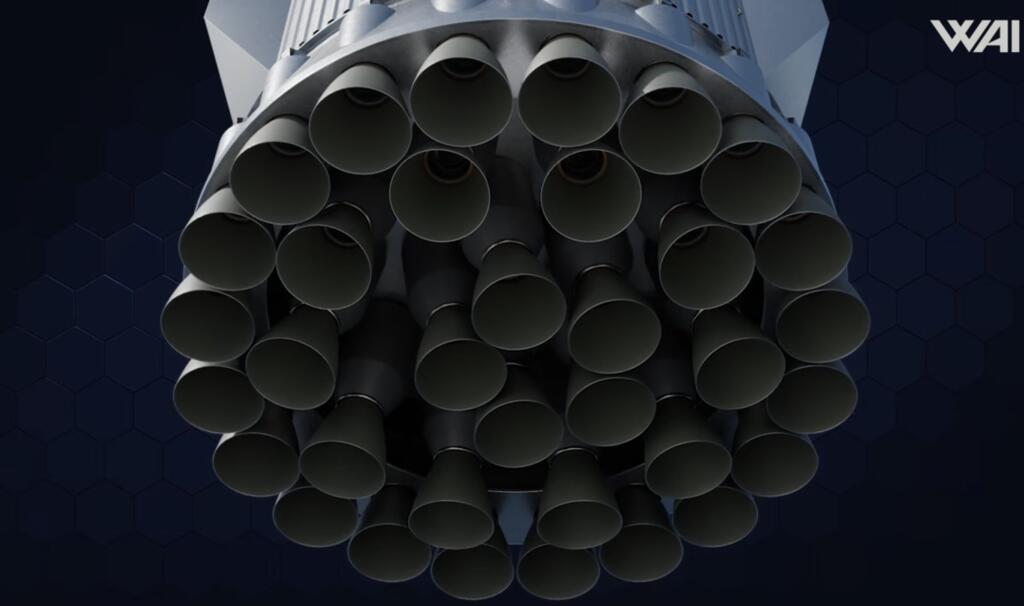

Space X Unveils Starship Booster With Unprecedented 35 Raptor 3 Engines

May 01, 2025

Space X Unveils Starship Booster With Unprecedented 35 Raptor 3 Engines

May 01, 2025 -

The Next Generation Of Taste Recording And Playback Capabilities

May 01, 2025

The Next Generation Of Taste Recording And Playback Capabilities

May 01, 2025 -

Animoca Ceo Highlights Uks Strengths For Web3 Growth And Development

May 01, 2025

Animoca Ceo Highlights Uks Strengths For Web3 Growth And Development

May 01, 2025 -

Iberian Peninsula Power Outage Full Restoration And Ongoing Investigation

May 01, 2025

Iberian Peninsula Power Outage Full Restoration And Ongoing Investigation

May 01, 2025 -

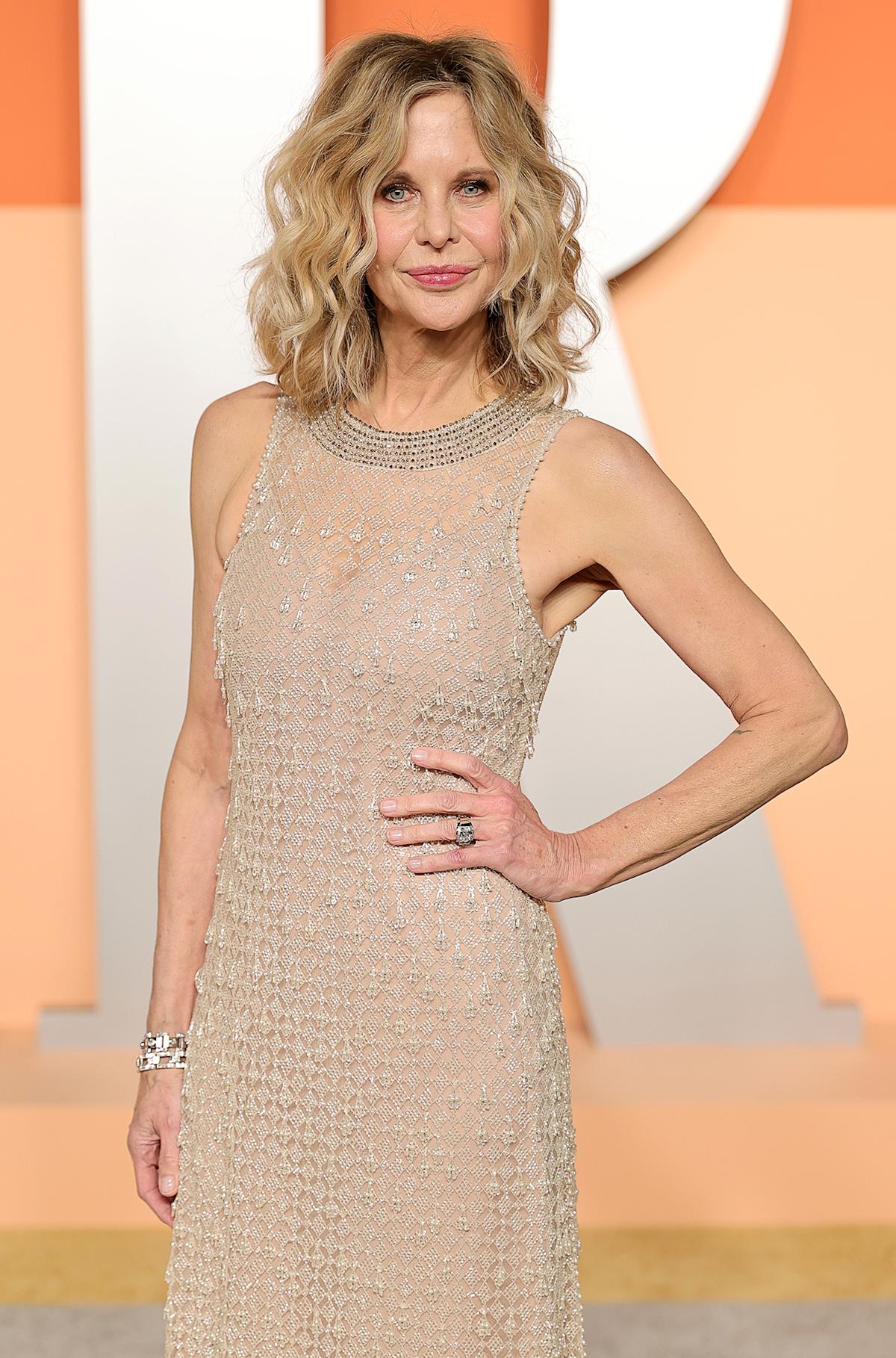

Montecito Estate Meg Ryan Lists Renovated Home For 19 5 Million

May 01, 2025

Montecito Estate Meg Ryan Lists Renovated Home For 19 5 Million

May 01, 2025