BoC Inflation Fight: CIBC's Avery Shenfeld On Canada's Economic Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BoC Inflation Fight: CIBC's Avery Shenfeld on Canada's Economic Future

Canada's economy is navigating a complex landscape, grappling with persistent inflation and the Bank of Canada's (BoC) aggressive interest rate hikes. To understand the implications for Canadian households and businesses, we turned to Avery Shenfeld, Chief Economist at CIBC, a leading voice in Canadian economic forecasting. His insights offer a crucial perspective on the ongoing inflation fight and what the future holds for the Canadian economy.

The BoC's Tightrope Walk: Balancing Inflation and Recession

The Bank of Canada has been aggressively raising interest rates to combat inflation, aiming to cool down an overheating economy. Shenfeld highlights the delicate balancing act the BoC faces. "They're trying to engineer a soft landing," he explains, "slowing the economy enough to bring inflation down without triggering a full-blown recession." This strategy, however, is fraught with challenges. The lag effect of interest rate changes means the full impact of current hikes might not be felt for several months, making precise economic steering incredibly difficult.

Housing Market Slowdown: A Key Indicator

One key area reflecting the BoC's impact is the housing market. Shenfeld notes a significant slowdown in sales and price growth, a direct consequence of higher borrowing costs. "The housing market is highly sensitive to interest rates," he points out. "We're seeing a correction, but it's crucial to differentiate between a healthy adjustment and a sharp downturn." The extent of the housing market slowdown will be a vital indicator of the overall economic health in the coming months.

Inflation's Stubborn Persistence: A Complex Issue

While inflation has shown signs of easing, it remains stubbornly above the BoC's target of 2%. Shenfeld attributes this persistence to several factors, including global supply chain disruptions, strong consumer demand, and the lingering effects of the pandemic. He emphasizes the complexity of the situation: "Inflation isn't just about interest rates; it's a multifaceted problem requiring a comprehensive approach."

Looking Ahead: Shenfeld's Predictions and Cautions

Shenfeld predicts a period of slower economic growth, with the possibility of a mild recession. However, he cautions against overly pessimistic predictions. "A recession isn't inevitable," he states, "but the risk is certainly elevated." He believes the BoC will likely pause its rate hike cycle soon, carefully monitoring the economic data before deciding on further actions.

Key takeaways from Shenfeld's analysis:

- Interest Rate Hikes: The BoC's aggressive approach is aimed at curbing inflation, but the full impact is yet to be seen.

- Housing Market Cooling: A significant slowdown is underway, but the extent of the correction remains uncertain.

- Inflation's Persistence: Several factors contribute to inflation's resilience, making the BoC's task challenging.

- Recession Risk: While a recession isn't guaranteed, the risk is higher than previously anticipated.

- BoC's Next Move: A pause in rate hikes is likely, with the BoC closely monitoring economic indicators.

The Canadian economy is at a crucial juncture. Shenfeld's analysis provides valuable insights into the challenges and uncertainties ahead. While the future remains uncertain, his perspective offers a clear and well-informed view of the path forward, highlighting both the risks and potential opportunities for Canada's economic future. Staying informed about economic forecasts from experts like Shenfeld is critical for individuals and businesses navigating the current environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BoC Inflation Fight: CIBC's Avery Shenfeld On Canada's Economic Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Yield Focused Investing Cibcs Top Energy Infrastructure And Power Stock Picks

May 24, 2025

Yield Focused Investing Cibcs Top Energy Infrastructure And Power Stock Picks

May 24, 2025 -

Londons Festivals Flashpoint For Political Tensions

May 24, 2025

Londons Festivals Flashpoint For Political Tensions

May 24, 2025 -

First Alert Unsettled Weather To Linger Into Memorial Day

May 24, 2025

First Alert Unsettled Weather To Linger Into Memorial Day

May 24, 2025 -

28 Years In The Making The There Are No Rescues Tv Spot Is Here

May 24, 2025

28 Years In The Making The There Are No Rescues Tv Spot Is Here

May 24, 2025 -

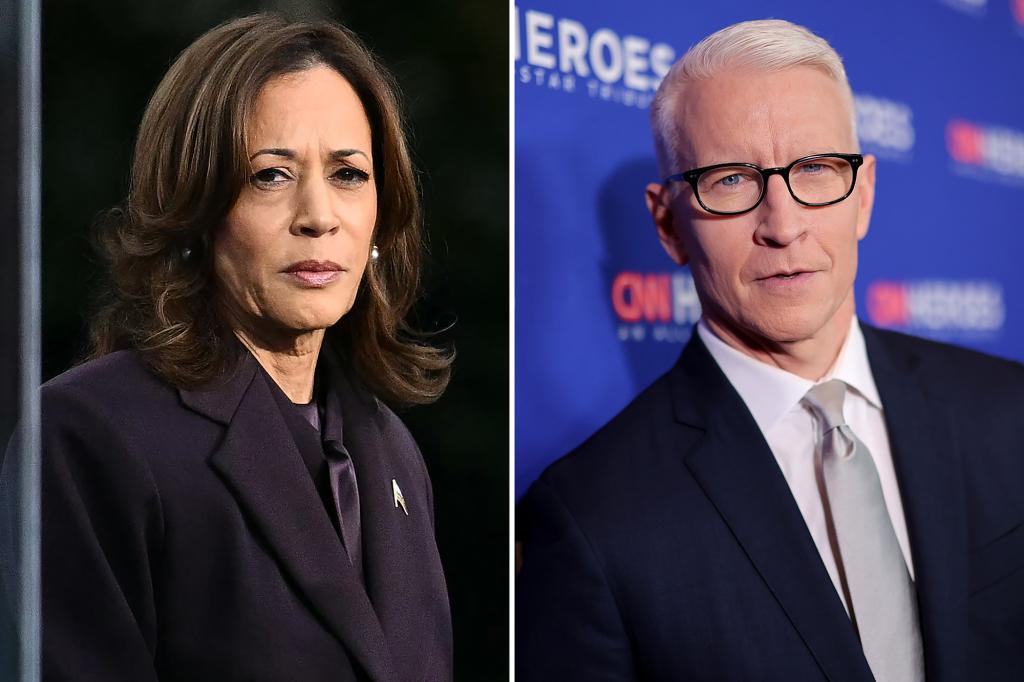

Kamala Harriss Heated Exchange Motherf Er Remark After Tense Cooper Interview

May 24, 2025

Kamala Harriss Heated Exchange Motherf Er Remark After Tense Cooper Interview

May 24, 2025