BoC's Inflation Fight: CIBC Economist Avery Shenfeld's Analysis Of Canada's Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BoC's Inflation Fight: CIBC Economist Avery Shenfeld's Analysis of Canada's Economy

Canada's battle against inflation continues, and the Bank of Canada's (BoC) every move is scrutinized intensely. Avery Shenfeld, Chief Economist at CIBC, a leading Canadian financial institution, offers a crucial perspective on the current economic landscape and the BoC's ongoing strategy. His insights provide valuable context for understanding the challenges and potential paths ahead for the Canadian economy.

Interest Rates and the Housing Market: A Delicate Balance

Shenfeld's recent analysis highlights the delicate balancing act the BoC faces. While interest rate hikes are a key tool in combating inflation, they also carry significant consequences for the housing market, a cornerstone of the Canadian economy. Higher interest rates cool down demand, potentially leading to a correction in house prices, but also risking a sharp downturn that could negatively impact consumer spending and overall economic growth. Shenfeld's commentary often focuses on this crucial trade-off, emphasizing the need for a nuanced approach that avoids a hard landing.

Inflationary Pressures: Beyond the Headline Numbers

The BoC's mandate is to control inflation. However, Shenfeld's analysis often delves beyond the headline inflation numbers, examining underlying factors driving price increases. He frequently highlights the impact of global supply chain disruptions, energy price volatility, and wage pressures. Understanding these underlying drivers is crucial for formulating effective monetary policy, according to Shenfeld. His research likely explores the persistence of inflation and the effectiveness of past rate hikes in curbing it.

The Outlook for Canadian Economic Growth

Shenfeld's forecasts regarding Canadian economic growth are keenly followed by investors and policymakers alike. His analysis takes into account a range of factors, including global economic conditions, commodity prices, and consumer confidence. He likely provides insights into the potential for a recession, the resilience of the Canadian economy, and the prospects for future job creation. His predictions are often nuanced, acknowledging the inherent uncertainties in economic forecasting while providing a well-reasoned assessment of the situation.

Shenfeld's Influence and the Role of CIBC Economics

CIBC World Markets, through its economics team led by Shenfeld, plays a significant role in shaping the economic narrative in Canada. Their analyses are frequently cited by media outlets and contribute to the public discourse surrounding monetary policy and economic outlook. Shenfeld’s reputation rests on his ability to provide insightful, data-driven commentary that is both accessible to a broad audience and sophisticated enough for seasoned economists.

Key Takeaways from Shenfeld's Analysis:

- Careful Rate Hike Management: The BoC needs to carefully manage interest rate increases to avoid triggering a sharp economic slowdown.

- Underlying Inflation Drivers: Understanding the root causes of inflation is crucial for effective policy.

- Global Economic Uncertainty: Global factors significantly impact the Canadian economy.

- Housing Market Sensitivity: Interest rate changes have a profound impact on the Canadian housing market.

- Economic Growth Projections: CIBC's economic forecasts offer valuable insights into Canada's future economic trajectory.

By regularly following Shenfeld's analysis and the broader work of CIBC Economics, individuals and businesses can better understand the complexities of the Canadian economy and prepare for the challenges and opportunities that lie ahead. His insights are invaluable for navigating the ever-evolving economic landscape. Staying informed on his perspectives is crucial for anyone invested in Canada's economic future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BoC's Inflation Fight: CIBC Economist Avery Shenfeld's Analysis Of Canada's Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bitcoin Btc Soars To Record High Market Analysis And Future Predictions

May 24, 2025

Bitcoin Btc Soars To Record High Market Analysis And Future Predictions

May 24, 2025 -

Sga Rewards Team With Lavish 10k Gift Baskets After Mvp Win

May 24, 2025

Sga Rewards Team With Lavish 10k Gift Baskets After Mvp Win

May 24, 2025 -

Martin Place Homeless Kitchens Vivid Festival Closure Impacts Vulnerable

May 24, 2025

Martin Place Homeless Kitchens Vivid Festival Closure Impacts Vulnerable

May 24, 2025 -

Can Shai Gilgeous Alexander Become The Next Canadian Nba Mvp Tonight We Find Out

May 24, 2025

Can Shai Gilgeous Alexander Become The Next Canadian Nba Mvp Tonight We Find Out

May 24, 2025 -

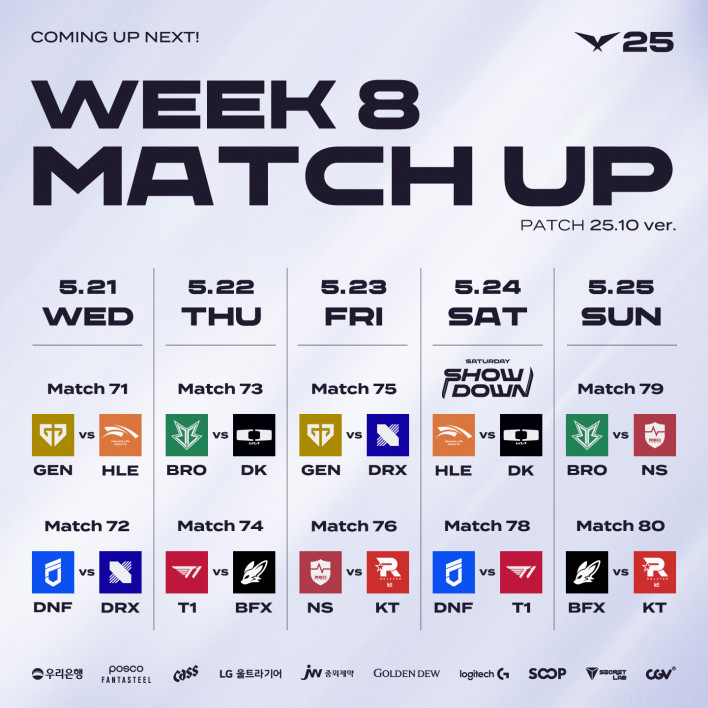

Lck Summer 2024 Hle Faces Gen G And Dplus Kia A Crucial Patch 25 10 Test

May 24, 2025

Lck Summer 2024 Hle Faces Gen G And Dplus Kia A Crucial Patch 25 10 Test

May 24, 2025