Bond Market Calm Expected: Bessent's Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bond Market Calm Expected: Bessent's Outlook Offers a Cautious Optimism

The bond market, a barometer of global economic health, is expected to remain relatively calm in the coming months, according to renowned financial expert, [Insert Bessent's Full Name and Title/Affiliation Here]. This cautiously optimistic outlook follows a period of significant volatility, offering a degree of reassurance to investors and analysts alike. Bessent's analysis, detailed in a recent report [mention report name and publication if available], suggests several factors contributing to this anticipated stability.

Factors Contributing to Bond Market Stability:

Bessent's prediction is not based on blind optimism, but rather on a careful assessment of current macroeconomic conditions. Key factors contributing to this anticipated calm include:

-

Moderating Inflation: While inflation remains a concern, recent data suggests a moderation in price increases. This easing of inflationary pressures reduces the likelihood of aggressive interest rate hikes by central banks, a key driver of bond market volatility. Bessent highlights the importance of monitoring inflation figures closely, stating that any unexpected surges could disrupt the predicted calm.

-

Central Bank Policy: Central banks around the globe are increasingly adopting a data-dependent approach to monetary policy. This means that future interest rate decisions will be heavily influenced by incoming economic data, rather than pre-determined schedules. This approach, Bessent argues, contributes to a more predictable and stable environment for bond markets.

-

Geopolitical Stability (Relative): Although geopolitical risks remain, the current level of global instability is comparatively lower than it has been in recent years. While unforeseen events can always disrupt markets, the absence of major escalating conflicts currently contributes to a more stable outlook for bond investments. Bessent emphasizes the need to remain vigilant, however, as geopolitical shifts can rapidly impact global financial markets.

Potential Risks and Challenges:

Despite the relatively positive outlook, Bessent acknowledges several potential challenges that could impact the bond market's stability:

-

Recessionary Fears: The ongoing debate surrounding a potential recession continues to cast a shadow over the global economy. While Bessent doesn't predict an imminent recession, the possibility remains a significant risk factor that could trigger increased volatility in the bond market.

-

Unexpected Economic Data: Unforeseen economic data releases, such as unexpectedly high inflation figures or a sharp decline in GDP growth, could easily disrupt the current calm. Bessent stresses the importance of closely monitoring economic indicators and adapting investment strategies accordingly.

-

Unforeseen Global Events: The global landscape is inherently unpredictable. Unexpected geopolitical events, natural disasters, or other unforeseen circumstances could quickly destabilize the bond market, regardless of the current relatively positive outlook.

Investor Strategies and Conclusion:

Bessent advises investors to maintain a diversified portfolio, emphasizing the importance of a long-term investment strategy. While the outlook is cautiously optimistic, the inherent volatility of the bond market requires a degree of caution and preparedness. Careful monitoring of economic indicators and geopolitical developments remains crucial for navigating the complexities of the current market environment. In conclusion, while Bessent predicts a period of relative calm, investors should remain vigilant and adaptable to the ever-changing landscape of global finance. The bond market, like all markets, remains susceptible to unexpected shocks. Prudent risk management and a well-informed investment strategy are key to navigating the potential challenges ahead.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bond Market Calm Expected: Bessent's Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

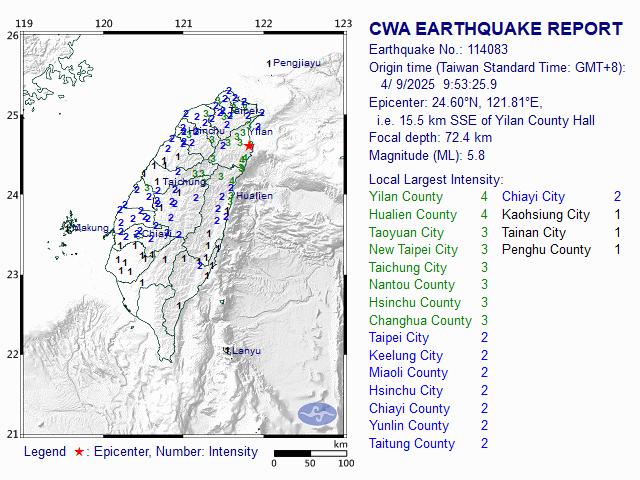

Minor Earthquake Strikes Northern Taiwan Causing No Reported Damage

Apr 10, 2025

Minor Earthquake Strikes Northern Taiwan Causing No Reported Damage

Apr 10, 2025 -

Death Of Lee Ek Tieng A Legacy Of Public Service In Singapore

Apr 10, 2025

Death Of Lee Ek Tieng A Legacy Of Public Service In Singapore

Apr 10, 2025 -

Pekhart Jedyny Napastnik Chelsea Analiza Sytuacji

Apr 10, 2025

Pekhart Jedyny Napastnik Chelsea Analiza Sytuacji

Apr 10, 2025 -

Singapore Car Coe Prices 3 4 Cat A Premium Hike Pushes Costs Higher

Apr 10, 2025

Singapore Car Coe Prices 3 4 Cat A Premium Hike Pushes Costs Higher

Apr 10, 2025 -

Afc Cup Svay Rieng Faces Challenge Despite Forward Lineup Issues

Apr 10, 2025

Afc Cup Svay Rieng Faces Challenge Despite Forward Lineup Issues

Apr 10, 2025