Bond Market Outlook: Yellen's Prediction And Its Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bond Market Outlook: Yellen's Prediction and its Implications

The bond market, a cornerstone of global finance, is currently facing a period of considerable uncertainty. Recent comments from Treasury Secretary Janet Yellen have added fuel to the fire, sparking debate about the future trajectory of interest rates and the overall health of the economy. Understanding Yellen's prediction and its implications is crucial for investors and policymakers alike.

Yellen's Cautious Stance on Inflation and Interest Rates

Secretary Yellen recently expressed a cautious outlook on inflation, suggesting that while progress has been made, the fight to bring inflation down to the Federal Reserve's 2% target is far from over. She hinted at the possibility of further interest rate hikes by the Federal Reserve, depending on upcoming economic data. This statement, while not a definitive prediction, sent ripples through the bond market. Her emphasis on persistent inflationary pressures, despite recent positive economic indicators, signals a continued focus on monetary policy tightening.

Implications for Bond Yields and Prices

Yellen's comments have significant implications for bond yields and prices. If the Federal Reserve continues its path of raising interest rates, as suggested by Yellen's remarks, we can expect:

- Higher Bond Yields: Increased interest rates generally lead to higher yields on newly issued bonds. This is because investors demand a greater return for lending their money at higher risk.

- Lower Bond Prices: Existing bonds with lower coupon rates become less attractive compared to newer, higher-yielding bonds. This results in a decrease in the price of existing bonds.

- Increased Volatility: Uncertainty surrounding future interest rate decisions contributes to increased volatility in the bond market, making it a more challenging environment for investors.

Navigating the Uncertain Bond Market Landscape

The current bond market landscape presents both challenges and opportunities. Investors need to carefully consider their risk tolerance and investment horizon when making decisions. Some strategies investors might employ include:

- Diversification: Spreading investments across different asset classes, including stocks, real estate, and alternative investments, can help mitigate risk.

- Duration Management: Investors with longer time horizons might be better positioned to weather short-term volatility. Careful consideration of bond duration is essential.

- Active Management: Working with a financial advisor to actively manage a bond portfolio can help navigate the complexities of the current market environment.

Beyond Interest Rates: Other Factors Affecting the Bond Market

While interest rate predictions are central to the current bond market outlook, it's crucial to remember other factors at play:

- Global Economic Growth: Slowdowns in global economic growth can impact demand for U.S. Treasuries, influencing bond prices.

- Geopolitical Risks: Geopolitical events, such as international conflicts or political instability, can cause significant market fluctuations.

- Fiscal Policy: Government spending and tax policies also play a significant role in shaping the bond market environment.

Conclusion: A Period of Vigilance

Yellen's prediction, while not a definitive forecast, underscores the ongoing uncertainty in the bond market. Investors and policymakers should maintain a vigilant approach, closely monitoring economic data and adapting their strategies accordingly. The coming months will be crucial in determining the trajectory of interest rates and the overall health of the bond market. Careful planning and diversification are key to navigating this period of economic transition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bond Market Outlook: Yellen's Prediction And Its Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

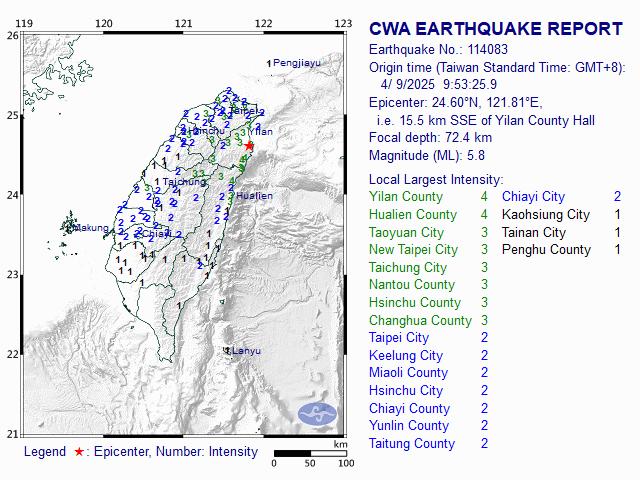

Northern Taiwan Rattled By Earthquake Authorities Report No Significant Impact

Apr 10, 2025

Northern Taiwan Rattled By Earthquake Authorities Report No Significant Impact

Apr 10, 2025 -

Taca De Portugal Guia Completo Para Assistir A Tirsense X Benfica

Apr 10, 2025

Taca De Portugal Guia Completo Para Assistir A Tirsense X Benfica

Apr 10, 2025 -

Hoaks Erupsi Gunung Gede Bnpb Berikan Klarifikasi Resmi

Apr 10, 2025

Hoaks Erupsi Gunung Gede Bnpb Berikan Klarifikasi Resmi

Apr 10, 2025 -

Auroville Foundation And Cdac Ink Mo U For Mutual Collaboration

Apr 10, 2025

Auroville Foundation And Cdac Ink Mo U For Mutual Collaboration

Apr 10, 2025 -

Rolex Monte Carlo Masters 2025 Betting Odds And Mens Singles Previews April 9th

Apr 10, 2025

Rolex Monte Carlo Masters 2025 Betting Odds And Mens Singles Previews April 9th

Apr 10, 2025