BRI Dividen 2024: Prediksi Minimal 85% Laba & Sejarah Pembagiannya

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BRI Dividen 2024: Prediksi Minimal 85% Laba & Sejarah Pembagiannya

Bank Rakyat Indonesia (BRI), a titan in the Indonesian banking sector, is once again in the spotlight as investors eagerly anticipate the dividend payout for 2024. With strong financial performance predicted, expectations are high, fueling speculation about a potentially generous dividend distribution. This article delves into the predictions surrounding BRI's 2024 dividend, examining the historical trends and factors influencing this crucial decision for shareholders.

Prediksi Dividen BRI 2024: Menargetkan 85% Laba Bersih

Analysts are forecasting a minimum dividend payout of 85% of BRI's net profit for the 2024 fiscal year. This optimistic prediction is underpinned by the bank's consistently strong financial performance and its robust growth trajectory. Several factors contribute to this positive outlook, including:

- Pertumbuhan Kredit yang Kuat: BRI's continued expansion in lending activities across various sectors, particularly in micro, small, and medium enterprises (MSMEs), is a key driver of profitability.

- Efisiensi Operasional: The bank's ongoing efforts to streamline operations and enhance efficiency have contributed to improved profit margins.

- Peningkatan Digitalisasi: BRI's significant investment in digital banking infrastructure has broadened its reach and improved customer service, leading to increased transaction volumes and revenue streams.

- Kinerja Keuangan yang Solid: BRI has consistently demonstrated strong financial fundamentals, making it a favored investment among both domestic and international investors.

While an 85% payout is a strong prediction, the final decision rests with the BRI board of directors and will depend on several factors including regulatory approvals and the overall economic climate. However, the positive indicators suggest a substantial return for shareholders is highly likely.

Sejarah Pembagian Dividen BRI: Sebuah Tren Positif

Understanding the historical trend of BRI's dividend payouts offers valuable insights into the bank's commitment to shareholder returns. Over the years, BRI has maintained a consistent policy of distributing a significant portion of its profits as dividends, demonstrating its dedication to rewarding its investors. Analyzing past dividend payouts reveals a pattern of increasing payouts reflecting the bank's growth and financial strength. While specific percentages vary from year to year, the overall trend showcases a commitment to significant shareholder returns. This historical data reassures investors and strengthens the confidence surrounding the 2024 prediction.

Faktor-Faktor yang Mempengaruhi Pembagian Dividen

Several factors play a crucial role in determining the final dividend payout percentage. These include:

- Keuntungan Bersih (Net Profit): The primary determinant is the bank's net profit for the fiscal year. A higher net profit generally leads to a higher dividend payout.

- Kebijakan Bank Indonesia (BI): Regulations and guidelines from Bank Indonesia, Indonesia's central bank, can influence the amount of dividends a bank can distribute.

- Kebutuhan Modal Kerja: The bank's need for capital for future investments and expansion projects can also impact the dividend payout.

- Kondisi Ekonomi Makro: The overall health of the Indonesian economy and global financial markets can affect BRI's profitability and, consequently, its dividend distribution.

Kesimpulan:

The anticipation surrounding BRI's 2024 dividend is palpable. The prediction of a minimum 85% payout, supported by strong financial performance and historical trends, paints a positive picture for shareholders. However, it's crucial to remember that the final decision remains subject to various factors. Keeping abreast of official announcements from BRI and monitoring relevant economic indicators will be essential for investors seeking to maximize their returns. Stay tuned for further updates as the year progresses. This article will be updated as more information becomes available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BRI Dividen 2024: Prediksi Minimal 85% Laba & Sejarah Pembagiannya. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Official Uae Public Sector Eid Al Fitr Holiday Long Weekend Confirmed

Mar 18, 2025

Official Uae Public Sector Eid Al Fitr Holiday Long Weekend Confirmed

Mar 18, 2025 -

Two Young Boys Killed By Falling Tree Familys Unbearable Grief

Mar 18, 2025

Two Young Boys Killed By Falling Tree Familys Unbearable Grief

Mar 18, 2025 -

100 Year Old Hudson Valley Bridge A Revitalization Project Begins

Mar 18, 2025

100 Year Old Hudson Valley Bridge A Revitalization Project Begins

Mar 18, 2025 -

Listen Now Flying Lotus Shares New Track Oxygene For Ash Horror Film

Mar 18, 2025

Listen Now Flying Lotus Shares New Track Oxygene For Ash Horror Film

Mar 18, 2025 -

Chelseas Response To Mason Mount Allegations Silence Amidst Criticism

Mar 18, 2025

Chelseas Response To Mason Mount Allegations Silence Amidst Criticism

Mar 18, 2025

Latest Posts

-

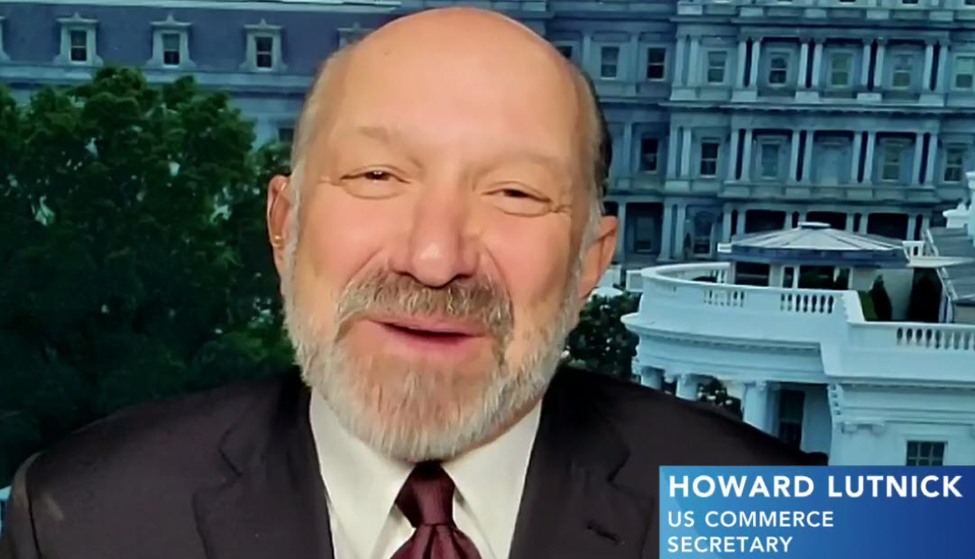

Lutnick Confirms Pending Agreement Awaits Foreign Parliament Vote

Apr 30, 2025

Lutnick Confirms Pending Agreement Awaits Foreign Parliament Vote

Apr 30, 2025 -

Beyond The Lion King And Dark Knight Hans Zimmers Underestimated Score

Apr 30, 2025

Beyond The Lion King And Dark Knight Hans Zimmers Underestimated Score

Apr 30, 2025 -

Champions League Arsenal And Barcelona Fight For The Final Semi Final Matchups

Apr 30, 2025

Champions League Arsenal And Barcelona Fight For The Final Semi Final Matchups

Apr 30, 2025 -

Stronghold Fire Emergency 3 000 Acres And Growing Urgent Action Needed

Apr 30, 2025

Stronghold Fire Emergency 3 000 Acres And Growing Urgent Action Needed

Apr 30, 2025 -

Sunil Narines Dominant Performance Powers Kolkata Knight Riders Past Delhi Capitals In Ipl Clash

Apr 30, 2025

Sunil Narines Dominant Performance Powers Kolkata Knight Riders Past Delhi Capitals In Ipl Clash

Apr 30, 2025