Bridging The Gap: Modernizing Crypto Tax Codes For A Mature Market.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bridging the Gap: Modernizing Crypto Tax Codes for a Mature Market

The cryptocurrency market has exploded in recent years, transitioning from a niche technological experiment to a multi-trillion dollar global phenomenon. This rapid growth, however, has left many governments scrambling to catch up, resulting in outdated and often confusing tax codes that hinder the maturation of the crypto ecosystem. The urgent need to modernize crypto tax codes is no longer a debate; it's a necessity for fostering innovation, attracting investment, and ensuring fair treatment of crypto users.

The Current Landscape: A Patchwork of Regulations

Currently, the regulatory landscape for cryptocurrency taxation is a fragmented mess. Different countries employ vastly different approaches, leading to significant inconsistencies and uncertainty for both businesses and individual investors. Some jurisdictions treat crypto as property, others as currency, and still others apply a confusing mix of both, creating a minefield of potential tax liabilities. This lack of clarity discourages participation, inhibits legitimate business operations, and ultimately stifles innovation.

Challenges Faced by Crypto Taxpayers:

- Defining Capital Gains: The fluctuating nature of cryptocurrency makes accurately calculating capital gains extremely complex. The lack of standardized reporting mechanisms makes tracking transactions and determining taxable events a significant burden.

- Staking and Lending: The rise of DeFi (Decentralized Finance) introduces new complexities. Income generated through staking and lending activities is often unclear under existing tax laws, leaving taxpayers unsure of their obligations.

- Cross-Border Transactions: International crypto transactions pose additional hurdles, especially in determining residency and applicable tax laws. This uncertainty often leads to significant compliance challenges and potential penalties.

- Lack of Clear Guidance: Many tax authorities have yet to issue comprehensive guidance on crypto taxation, leaving taxpayers reliant on interpretations and often conflicting advice from tax professionals. This uncertainty is detrimental to investor confidence and market stability.

The Path Forward: Towards Clear and Consistent Crypto Tax Regulations

Modernizing crypto tax codes requires a multi-pronged approach:

- International Collaboration: Harmonizing tax regulations across borders is crucial. International organizations like the OECD should play a leading role in establishing consistent guidelines for taxing crypto assets.

- Clear Definitions: Tax authorities need to provide clear definitions of crypto assets and related activities, explicitly addressing issues like staking, lending, and DeFi protocols.

- Simplified Reporting Mechanisms: Implementing user-friendly reporting mechanisms, potentially leveraging blockchain technology itself, can significantly reduce the administrative burden on taxpayers.

- Targeted Education Initiatives: Governments need to invest in educational resources to help taxpayers understand their obligations and navigate the complexities of crypto taxation.

The Benefits of Modernization:

A clearer and more consistent regulatory framework would:

- Boost Investor Confidence: Reduce uncertainty and encourage greater investment in the crypto market.

- Promote Innovation: Facilitate the development and adoption of new crypto technologies and applications.

- Enhance Tax Revenue: Improve tax compliance and increase government revenue from crypto-related activities.

- Level the Playing Field: Ensure fair treatment of all participants in the crypto ecosystem.

Conclusion:

Modernizing crypto tax codes is not just about catching up with technology; it's about fostering a healthy and sustainable crypto ecosystem. By embracing collaboration, clear definitions, simplified reporting, and robust education, governments can bridge the gap between outdated regulations and the dynamic realities of the modern cryptocurrency market, paving the way for a more mature and globally integrated digital economy. The time for action is now; the future of finance depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bridging The Gap: Modernizing Crypto Tax Codes For A Mature Market.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Las Confesiones De Cerundolo Como La Ansiedad Afecto Su Carrera

May 03, 2025

Las Confesiones De Cerundolo Como La Ansiedad Afecto Su Carrera

May 03, 2025 -

Meghan Markle Comment Celebrity Chef Faces Netflix Legal Threat

May 03, 2025

Meghan Markle Comment Celebrity Chef Faces Netflix Legal Threat

May 03, 2025 -

New College Softball Power 10 Oklahoma And Arkansas Reign Supreme

May 03, 2025

New College Softball Power 10 Oklahoma And Arkansas Reign Supreme

May 03, 2025 -

Experience The Future Triple Screen Expansion For A Powerful Laptop Quad Display

May 03, 2025

Experience The Future Triple Screen Expansion For A Powerful Laptop Quad Display

May 03, 2025 -

El Partido De Ruud 15 Break Points Salvados Ante Cerundolo En El Madrid Open

May 03, 2025

El Partido De Ruud 15 Break Points Salvados Ante Cerundolo En El Madrid Open

May 03, 2025

Latest Posts

-

Suomalaisten Maali Ilo Ei Riittaenyt Dallas Stars Ja Colorado Avalanche Seitsemaennen Ottelun Taisteluun

May 04, 2025

Suomalaisten Maali Ilo Ei Riittaenyt Dallas Stars Ja Colorado Avalanche Seitsemaennen Ottelun Taisteluun

May 04, 2025 -

Yana Santos Ufc Des Moines Showdown Against Miesha Tate A Defining Moment

May 04, 2025

Yana Santos Ufc Des Moines Showdown Against Miesha Tate A Defining Moment

May 04, 2025 -

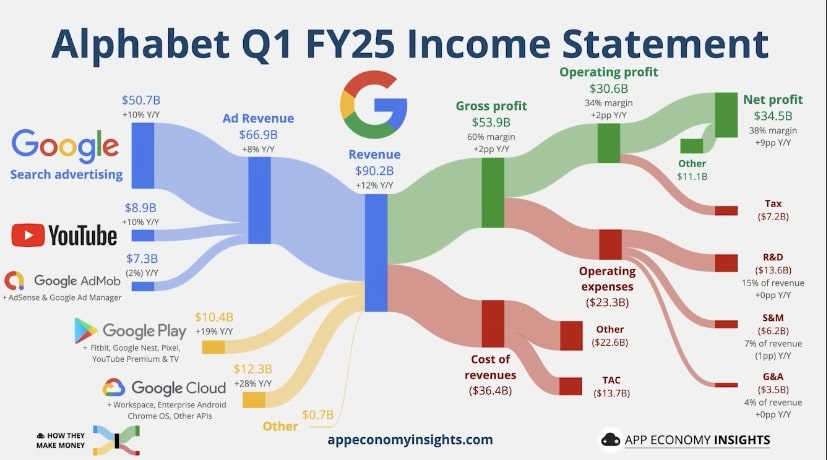

Googles Profitability Examining The Tech Giants Continued Financial Success

May 04, 2025

Googles Profitability Examining The Tech Giants Continued Financial Success

May 04, 2025 -

Ge 2025 A Look At The Workers Partys East Coast Grc Rally In Bedok

May 04, 2025

Ge 2025 A Look At The Workers Partys East Coast Grc Rally In Bedok

May 04, 2025 -

Game 7 Nuggets Outlook Addressing Referee Concerns And Jokics Potential

May 04, 2025

Game 7 Nuggets Outlook Addressing Referee Concerns And Jokics Potential

May 04, 2025