Broadcom (AVGO): Analyzing Wall Street's Optimism And Investment Prospects.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom (AVGO): Wall Street's Bullish Outlook and the Investment Landscape

Broadcom (AVGO) has consistently captured the attention of Wall Street analysts, with a recent surge in optimism surrounding the tech giant's future performance. But is this bullish sentiment justified? This in-depth analysis delves into the factors driving investor enthusiasm and explores the investment prospects for Broadcom in the current market climate.

H2: The Drivers of Wall Street's Optimism

Several key factors contribute to the positive outlook surrounding Broadcom's stock:

-

Strong Financial Performance: Broadcom's recent financial reports have showcased impressive revenue growth and profitability, exceeding analysts' expectations. This robust performance demonstrates the company's ability to navigate the challenging economic landscape and maintain its competitive edge. Keywords like revenue growth, profitability, and earnings per share (EPS) are crucial for SEO.

-

Diversified Product Portfolio: Broadcom's success stems from its diversified product portfolio, spanning infrastructure software, semiconductor solutions, and wireless communications. This diversification mitigates risk and positions the company for growth across various market sectors. Mentioning semiconductor solutions, infrastructure software, and wireless communications improves search visibility.

-

Strategic Acquisitions: Broadcom's history of strategic acquisitions, like the recent VMware deal, showcases its ambition to expand its market reach and technological capabilities. These acquisitions often lead to significant revenue synergies and enhance long-term growth potential. The inclusion of terms like M&A, mergers and acquisitions, and synergies is beneficial for SEO.

-

AI-Driven Growth: The burgeoning Artificial Intelligence (AI) market presents a significant opportunity for Broadcom. The company's semiconductor solutions are crucial components in AI infrastructure, positioning it to benefit significantly from the ongoing AI boom. Keywords like Artificial Intelligence, AI, and semiconductors are essential for attracting relevant searches.

H2: Potential Risks and Challenges

Despite the overwhelmingly positive sentiment, potential challenges remain:

-

Global Economic Uncertainty: The global economic outlook remains uncertain, posing a risk to Broadcom's growth trajectory. Geopolitical instability and potential economic slowdowns could impact demand for the company's products.

-

Increased Competition: The semiconductor industry is intensely competitive. Broadcom faces competition from established players and emerging startups, potentially impacting market share and profitability.

-

Supply Chain Disruptions: Global supply chain disruptions can affect Broadcom's ability to produce and deliver its products, potentially leading to delays and reduced revenue.

H2: Investment Prospects for AVGO

Considering the strong financial performance, diversification, strategic acquisitions, and AI growth potential, Broadcom presents a compelling investment opportunity for long-term investors. However, potential risks related to global economic uncertainty, competition, and supply chain disruptions should be carefully considered. Investors should conduct thorough due diligence and diversify their portfolios accordingly.

H3: Conclusion:

Broadcom (AVGO) enjoys a positive outlook driven by strong financials and strategic moves. While risks exist, the company’s diversified portfolio and position within the growing AI market suggest substantial long-term growth potential. Investors should weigh these factors carefully before making any investment decisions. Remember to consult with a financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom (AVGO): Analyzing Wall Street's Optimism And Investment Prospects.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Great Bristol Run Road Closures Your Complete Guide

May 12, 2025

Great Bristol Run Road Closures Your Complete Guide

May 12, 2025 -

Ufc 315 Zahabi Explains The Motivations Behind His Weight Class Jump Against Aldo

May 12, 2025

Ufc 315 Zahabi Explains The Motivations Behind His Weight Class Jump Against Aldo

May 12, 2025 -

Dani Dyer Comments On The Heated Greggs Mc Donalds Competition

May 12, 2025

Dani Dyer Comments On The Heated Greggs Mc Donalds Competition

May 12, 2025 -

Atp Rome Open R3 In Depth Preview And Predictions For Sinner De Jong Mensik And Marozsan

May 12, 2025

Atp Rome Open R3 In Depth Preview And Predictions For Sinner De Jong Mensik And Marozsan

May 12, 2025 -

Sony Xperia 1 Vii Leaked Design Colors And Features Revealed

May 12, 2025

Sony Xperia 1 Vii Leaked Design Colors And Features Revealed

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

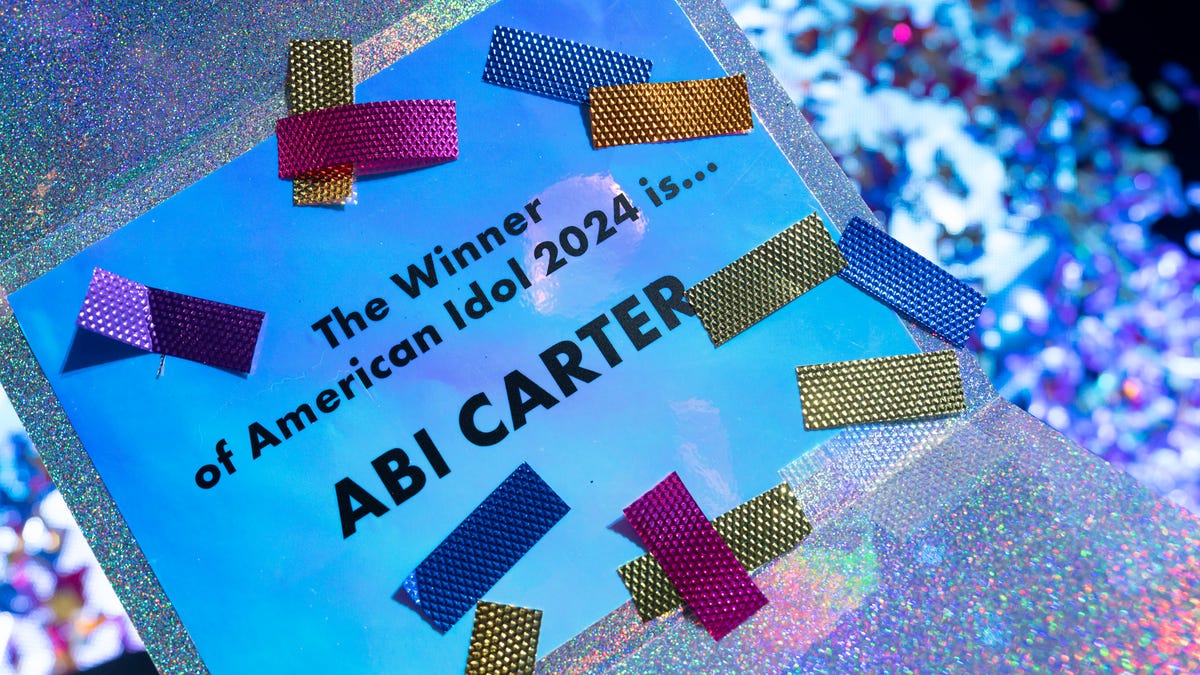

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025