Broadcom (AVGO) Stock Forecast: Bullish Predictions And Investor Considerations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom (AVGO) Stock Forecast: Bullish Predictions and Investor Considerations

Broadcom (AVGO), a leading designer, developer, and global supplier of a wide range of semiconductor and infrastructure software solutions, has seen its stock price fluctuate significantly in recent months. While market volatility remains a factor, several analysts are issuing bullish predictions for AVGO stock, prompting investors to carefully consider the potential upside and inherent risks. This article delves into the current forecasts, highlighting key factors driving the optimism and the crucial considerations for investors before making any decisions.

H2: Why the Bullish Sentiment Surrounding AVGO?

Several factors contribute to the positive outlook for Broadcom's stock:

-

Strong Financial Performance: Broadcom consistently delivers robust financial results, exceeding expectations in revenue and earnings. Their diversification across various sectors, including networking, wireless communications, and enterprise storage, provides a strong foundation for future growth. Recent quarterly reports have showcased impressive year-over-year growth, reinforcing investor confidence.

-

Strategic Acquisitions: Broadcom's history of strategic acquisitions, like the takeover of VMware, demonstrates their commitment to expanding their market share and technological capabilities. These acquisitions significantly bolster their portfolio and open doors to new revenue streams.

-

Artificial Intelligence (AI) Boom: The burgeoning AI sector is a significant catalyst for Broadcom's growth. Their semiconductor solutions are integral to the infrastructure powering AI applications, positioning them to benefit greatly from the continued expansion of this rapidly evolving market. This burgeoning sector is widely seen as a major driver of future growth.

-

Dominant Market Position: Broadcom holds a dominant position in several key markets, providing them with significant pricing power and competitive advantages. This entrenched position translates to stable revenue streams and higher profit margins.

-

5G Deployment and Expansion: The global rollout of 5G networks provides a significant tailwind for Broadcom. Their infrastructure solutions are essential for building and maintaining these next-generation networks, offering long-term growth opportunities.

H2: Investor Considerations: Navigating the Opportunities and Risks

While the bullish forecasts are encouraging, investors should carefully consider several factors:

-

Valuation: With the recent price increases, AVGO's valuation has become a crucial point of discussion. Some analysts argue it may be slightly overvalued, potentially limiting further upside potential in the short term.

-

Geopolitical Risks: The semiconductor industry is susceptible to geopolitical risks, including trade wars and supply chain disruptions. These factors could negatively impact Broadcom's operations and financial performance.

-

Competition: Although Broadcom holds a dominant position, intense competition from other semiconductor manufacturers remains a constant challenge. Innovative competitors could potentially erode their market share over time.

-

Economic Slowdown: A potential economic slowdown could impact demand for Broadcom's products, affecting their revenue growth and profitability. Investors should monitor macroeconomic indicators carefully.

-

Integration Challenges: The integration of acquired companies, such as VMware, can be complex and challenging. Successful integration is crucial for realizing the full benefits of these acquisitions.

H2: Broadcom (AVGO) Stock Forecast: The Bottom Line

The bullish predictions for Broadcom (AVGO) are largely justified by their strong financial performance, strategic acquisitions, and positioning within high-growth sectors like AI and 5G. However, investors must approach this with a balanced perspective, considering the potential risks associated with valuation, geopolitical factors, competition, and economic conditions. Thorough due diligence and a long-term investment strategy are crucial for navigating the opportunities and challenges associated with this promising but complex stock. Consult with a financial advisor before making any investment decisions. This article provides information for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom (AVGO) Stock Forecast: Bullish Predictions And Investor Considerations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Quordle Game 1203 May 11th Answers And Strategy Hints

May 13, 2025

Quordle Game 1203 May 11th Answers And Strategy Hints

May 13, 2025 -

Crise No Rs Gerdau Suspende Producao Em Sua Regiao De Origem Devido As Chuvas

May 13, 2025

Crise No Rs Gerdau Suspende Producao Em Sua Regiao De Origem Devido As Chuvas

May 13, 2025 -

Eva Longoria On Past Relationships Impact On A Potential Desperate Housewives Comeback

May 13, 2025

Eva Longoria On Past Relationships Impact On A Potential Desperate Housewives Comeback

May 13, 2025 -

Loving Educator Receives Special Gma Breakfast In Bed Treat

May 13, 2025

Loving Educator Receives Special Gma Breakfast In Bed Treat

May 13, 2025 -

Tina Arena St Kilda Gig Disrupted Alcohol Fueled Fight Breaks Out

May 13, 2025

Tina Arena St Kilda Gig Disrupted Alcohol Fueled Fight Breaks Out

May 13, 2025

Latest Posts

-

Palantir Stock Forecast Expert Sees Potential Pullback To 50 65 Range

May 13, 2025

Palantir Stock Forecast Expert Sees Potential Pullback To 50 65 Range

May 13, 2025 -

Live Updates Australias Coalition Grapples With Leadership Crisis Victorian Education Budget Cuts

May 13, 2025

Live Updates Australias Coalition Grapples With Leadership Crisis Victorian Education Budget Cuts

May 13, 2025 -

2025 Italian Open In Depth Preview Of Osaka Vs Stearns Round 4

May 13, 2025

2025 Italian Open In Depth Preview Of Osaka Vs Stearns Round 4

May 13, 2025 -

Solana Memecoin Comeback Three Tokens Defy Expectations

May 13, 2025

Solana Memecoin Comeback Three Tokens Defy Expectations

May 13, 2025 -

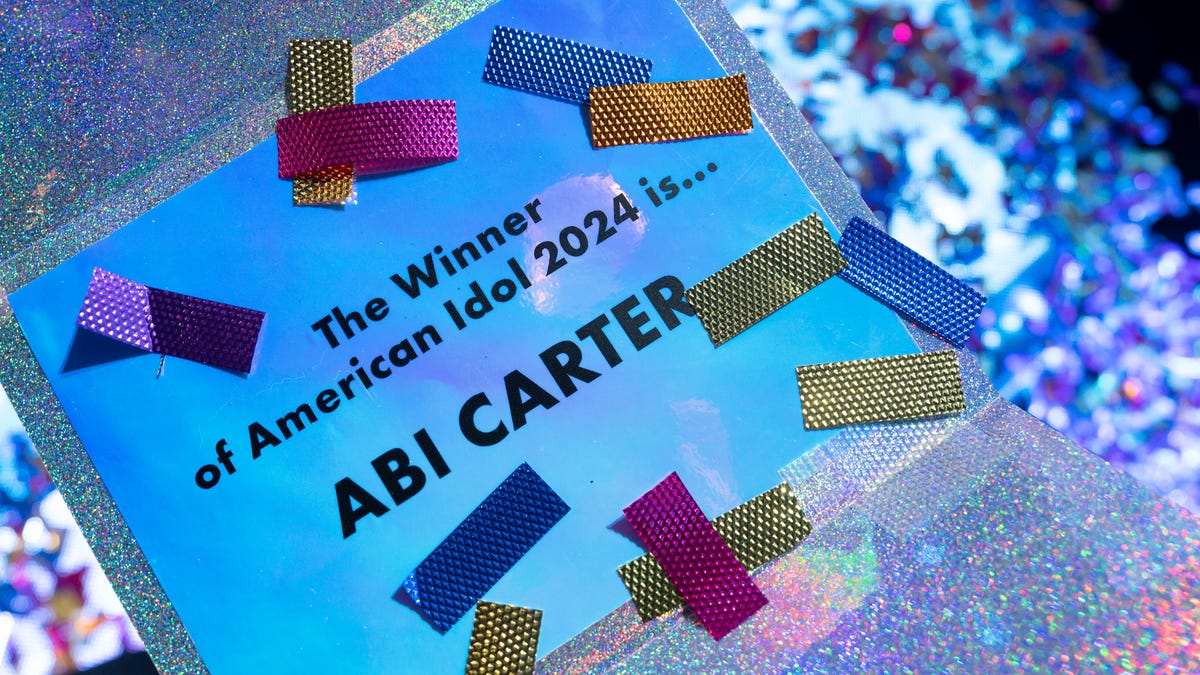

American Idol 2024 When And Where To Watch The Top 7 Perform

May 13, 2025

American Idol 2024 When And Where To Watch The Top 7 Perform

May 13, 2025