Broadcom (AVGO) Stock: Is It A Buy Based On Wall Street's Positive Sentiment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom (AVGO) Stock: Is Wall Street's Optimism Justified?

Broadcom (AVGO) has been a Wall Street darling lately, with analysts showering the semiconductor giant with positive ratings and price target hikes. But is this optimism justified? Should investors jump on the AVGO bandwagon, or is caution warranted? Let's delve into the factors driving this positive sentiment and assess whether Broadcom stock is a buy right now.

Strong Q2 Earnings Fuel the Rally

Broadcom's stellar second-quarter earnings report significantly boosted investor confidence. The company exceeded expectations across the board, reporting strong revenue growth driven by robust demand for its semiconductor solutions in key markets like data centers, wireless infrastructure, and artificial intelligence. This performance showcased Broadcom's resilience in the face of broader macroeconomic headwinds and reinforced its position as a leading player in the semiconductor industry. The exceeding of analyst expectations wasn't a small margin; it signaled a robust and healthy underlying business.

Positive Analyst Outlook and Price Target Increases

Following the impressive Q2 results, several Wall Street analysts upgraded their ratings on Broadcom stock, citing the company's strong financial performance, positive growth outlook, and increasing market share. Many also significantly raised their price targets, reflecting a heightened expectation for future growth. This collective bullish sentiment from analysts has further fueled the positive momentum in AVGO's stock price. These price target increases are a strong indicator of market confidence.

Key Growth Drivers for Broadcom

Several key factors are driving Broadcom's growth trajectory:

- Data Center Demand: The insatiable appetite for data center infrastructure is a major catalyst for Broadcom's success. The company's networking solutions are integral to the expansion of cloud computing and data storage capabilities.

- 5G Infrastructure: The global rollout of 5G networks provides another significant growth opportunity for Broadcom. Its chips are essential components in 5G base stations and related infrastructure.

- Artificial Intelligence (AI): The explosive growth of AI is further boosting demand for Broadcom's high-performance computing solutions. AI applications require significant processing power, making Broadcom's chips crucial for this rapidly expanding market.

- Software Defined Networking (SDN): Broadcom's position in SDN is another area of strength. As network infrastructure becomes more software-centric, Broadcom's solutions are becoming increasingly important.

Potential Risks to Consider

While the outlook for Broadcom is generally positive, investors should consider potential risks:

- Geopolitical Uncertainty: Global political instability and trade tensions could impact Broadcom's supply chain and overall business operations.

- Competition: The semiconductor industry is highly competitive, and new players could emerge to challenge Broadcom's market share.

- Economic Slowdown: A broader economic slowdown could dampen demand for Broadcom's products, impacting its revenue growth.

Is AVGO a Buy?

The positive sentiment surrounding Broadcom (AVGO) stock is largely justified by its strong financial performance and positive growth outlook. However, investors should carefully weigh the potential risks before making an investment decision. The company's strong position in key growth markets like data centers, 5G, and AI positions it well for continued growth, but external factors could impact its trajectory. Thorough due diligence and a well-diversified portfolio are always recommended. The consensus among analysts leans towards a positive outlook, but individual investor circumstances should dictate investment strategies. Consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom (AVGO) Stock: Is It A Buy Based On Wall Street's Positive Sentiment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rugby League News Taylan Mays Injury Update And Planned Return

May 12, 2025

Rugby League News Taylan Mays Injury Update And Planned Return

May 12, 2025 -

Hong Kong Stocks Year Long Winning Streak Continues Amidst Positive China Us Developments

May 12, 2025

Hong Kong Stocks Year Long Winning Streak Continues Amidst Positive China Us Developments

May 12, 2025 -

Global Markets React A New Tariff Deal In The Us China Trade War

May 12, 2025

Global Markets React A New Tariff Deal In The Us China Trade War

May 12, 2025 -

11 000 Tickets Sold Mission Impossible Dead Reckoning Part Ones Strong Pre Release

May 12, 2025

11 000 Tickets Sold Mission Impossible Dead Reckoning Part Ones Strong Pre Release

May 12, 2025 -

A12 Road Cleared After Accident Delays Resolved

May 12, 2025

A12 Road Cleared After Accident Delays Resolved

May 12, 2025

Latest Posts

-

Gary Sun On Coinbases Esports Strategy Building Trust And Expanding Cryptos Reach

May 12, 2025

Gary Sun On Coinbases Esports Strategy Building Trust And Expanding Cryptos Reach

May 12, 2025 -

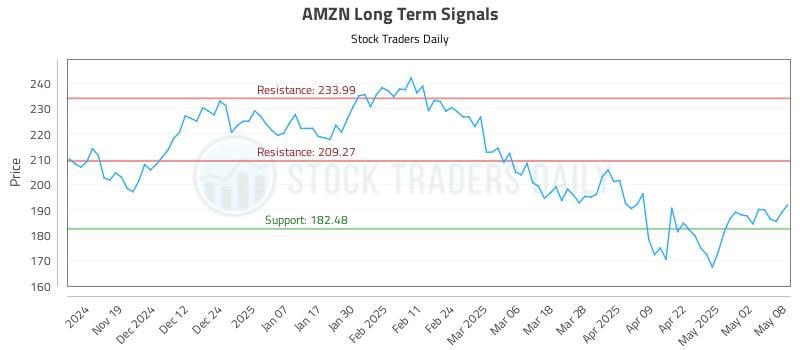

Is Amzn A Buy In Depth Investment Report And Stock Forecast

May 12, 2025

Is Amzn A Buy In Depth Investment Report And Stock Forecast

May 12, 2025 -

Ginny And Georgia I Know What You Did Last Summer Fantastic Four And Weapons Recent News And Updates

May 12, 2025

Ginny And Georgia I Know What You Did Last Summer Fantastic Four And Weapons Recent News And Updates

May 12, 2025 -

Copom Decide Analise Do Ipca E Perspectivas Para A Industria Com Foco Na China

May 12, 2025

Copom Decide Analise Do Ipca E Perspectivas Para A Industria Com Foco Na China

May 12, 2025 -

Unexpected Turn Us And China Agree To Slash Tariffs By 115

May 12, 2025

Unexpected Turn Us And China Agree To Slash Tariffs By 115

May 12, 2025