Buffett Defends, Then Deploys: The Evolution Of His Cash Position

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett Defends, Then Deploys: The Evolution of His Cash Position

Warren Buffett, the Oracle of Omaha, has long been known for his shrewd investment strategies and his sometimes perplexing cash hoard. Recently, however, his approach to managing Berkshire Hathaway's massive cash reserves has undergone a noticeable shift, sparking renewed interest and debate among investors. This article delves into the evolution of Buffett's cash position, examining his past justifications for holding significant cash and his recent, significant deployment of those funds.

The Rationale Behind the Cash Hoard:

For years, Buffett defended Berkshire Hathaway's substantial cash pile, often exceeding $100 billion, citing a lack of attractive investment opportunities. He famously stated that he would rather hold cash than invest in overpriced assets, a philosophy deeply rooted in his value investing principles. This approach was particularly prominent during periods of market exuberance and inflated valuations.

- Market Volatility: Buffett consistently highlighted market volatility as a key reason for maintaining a high cash position. He argued that waiting for compelling investment opportunities, rather than rushing into overpriced assets, was a crucial aspect of long-term value creation.

- Strategic Acquisitions: While seemingly conservative, the large cash reserves served as a war chest for potential acquisitions. Buffett emphasized the importance of having the financial firepower to seize attractive takeover targets when they emerged, regardless of market conditions.

- Uncertainty and Economic Downturns: Buffett's cautious approach also reflected his awareness of potential economic downturns. A substantial cash reserve provides a safety net during periods of market uncertainty and allows for opportunistic buying when asset prices decline significantly.

A Shift in Strategy: Deploying the Cash Reserves:

Recently, however, Berkshire Hathaway has significantly deployed its cash reserves, making substantial investments across various sectors. This strategic shift suggests a change in Buffett's assessment of the market landscape. Several factors could explain this change:

- Attractive Valuations: After a period of market correction, some previously overpriced assets might now be trading at more attractive valuations, aligning with Buffett's value investing principles. This could explain the increased investment activity.

- Strategic Opportunities: The emergence of compelling acquisition targets might have prompted Buffett to deploy his cash reserves. Specific deals, such as the recent investments in Occidental Petroleum, demonstrate a willingness to engage in larger-scale acquisitions.

- Interest Rate Environment: The current interest rate environment, while fluctuating, may have also influenced Buffett's decision. While holding cash provides a degree of safety, low interest rates reduce the return on cash holdings, potentially incentivizing deployment into other assets.

Analyzing the Impact:

This shift in strategy has significant implications for investors and the broader market. It signals a potential change in the overall market sentiment and could indicate that Buffett sees improved investment opportunities. This increased investment activity could contribute to market stability and further drive economic growth. However, it also leaves room for speculation on future investment decisions and the potential impact of economic shifts.

Conclusion:

The evolution of Buffett's cash position demonstrates the dynamic nature of investment strategies. His initial emphasis on holding cash reflected a cautious approach to market volatility and a focus on value investing. However, his recent deployment of reserves suggests a change in market outlook and a renewed confidence in identifying attractive investment opportunities. Monitoring Berkshire Hathaway's investment decisions in the coming months will provide further insight into the long-term implications of this shift. The Oracle of Omaha remains a compelling figure, and his actions continue to shape market trends and investor sentiment worldwide.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett Defends, Then Deploys: The Evolution Of His Cash Position. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kenan Thompson Discusses Future With Saturday Night Live

Apr 07, 2025

Kenan Thompson Discusses Future With Saturday Night Live

Apr 07, 2025 -

Best New Hulu Movies To Stream In April 2025

Apr 07, 2025

Best New Hulu Movies To Stream In April 2025

Apr 07, 2025 -

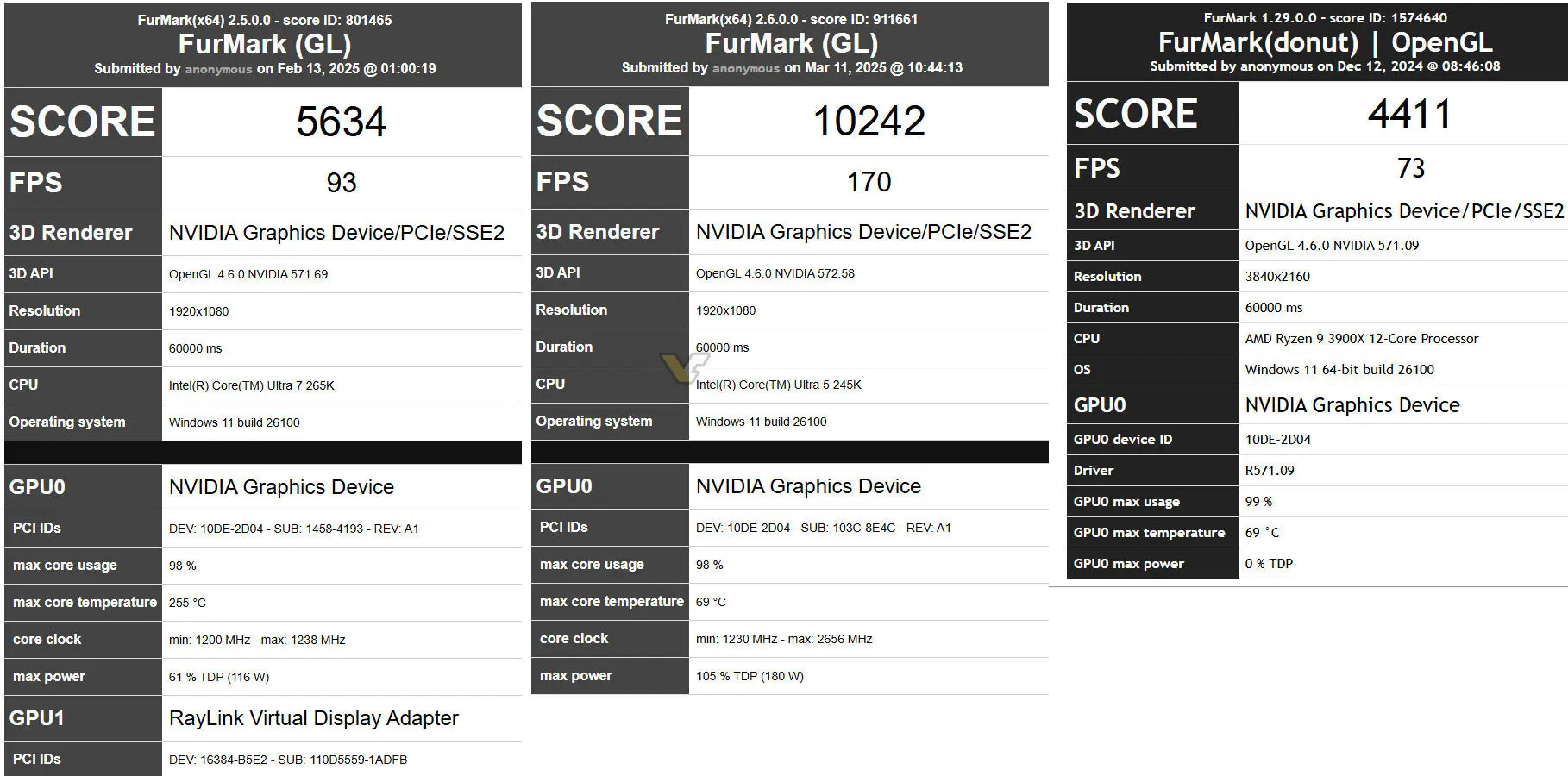

Fur Mark Database Leaks Rtx 5060 Ti Performance At 180 W Tdp

Apr 07, 2025

Fur Mark Database Leaks Rtx 5060 Ti Performance At 180 W Tdp

Apr 07, 2025 -

Investing In Tech 3 Bargain Stocks For The Next Bull Run

Apr 07, 2025

Investing In Tech 3 Bargain Stocks For The Next Bull Run

Apr 07, 2025 -

Ge 2025 Peoples Power Party Challenges Pap In Ang Mo Kio Grc

Apr 07, 2025

Ge 2025 Peoples Power Party Challenges Pap In Ang Mo Kio Grc

Apr 07, 2025