Buffett Reduces Apple Holdings: A 13% Decrease And The Reasoning Behind It

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett Reduces Apple Holdings: A 13% Decrease and the Reasoning Behind It

Warren Buffett's Berkshire Hathaway significantly reduced its Apple holdings in the first quarter of 2023, sparking widespread speculation and analysis amongst investors. The move, representing a 13% decrease in Apple shares, marks a notable shift in the investment giant's portfolio and has sent ripples through the financial markets. What prompted this significant reduction, and what does it mean for both Berkshire Hathaway and Apple's future?

This article delves into the details surrounding this substantial divestment, exploring the potential reasons behind Buffett's decision and its implications for investors.

A 13% Reduction: The Numbers Speak Volumes

Berkshire Hathaway offloaded approximately 61.3 million shares of Apple stock during Q1 2023, leaving them with a still substantial holding, but significantly less than before. This represents a considerable reduction in their overall Apple investment and a departure from their previously steadfast commitment to the tech giant. The sheer scale of the reduction immediately caught the attention of market analysts and investors worldwide, raising questions about the future of Berkshire Hathaway's tech investments.

Possible Reasons Behind the Downgrade: Speculation and Analysis

While Berkshire Hathaway hasn't explicitly stated the precise reasoning behind the sale, several plausible explanations are circulating:

-

Market Diversification: Buffett is known for his focus on diversification. This reduction could simply reflect a strategic reallocation of assets to other promising investment opportunities. The current economic climate presents both challenges and new potential areas for growth, prompting a review of the portfolio's composition.

-

Valuation Concerns: Apple's stock price, while still strong, might have reached a level considered less attractive by Berkshire Hathaway's valuation metrics. The company might be seeking more undervalued assets elsewhere.

-

Shifting Market Dynamics: The tech sector, as a whole, has faced increased volatility recently. This reduction might reflect a cautious approach to managing risk within the increasingly uncertain tech market.

-

Strategic Rebalancing: This could be a simple rebalancing of the portfolio, moving funds from a mature, albeit still valuable, holding like Apple to potentially higher-growth sectors.

-

Cash Reserves: The sale could have simply been a strategic move to bolster Berkshire Hathaway's considerable cash reserves, allowing for greater flexibility in future investment decisions.

Implications for Apple and Berkshire Hathaway

The impact of this decision is multifaceted:

-

Apple Stock Price: While the immediate effect on Apple's stock price was relatively muted, the long-term implications remain to be seen. The sustained strength of Apple's products and market position should mitigate any significant negative effects.

-

Berkshire Hathaway's Strategy: This reduction signals a potential shift in Berkshire Hathaway's investment strategy, possibly suggesting a more active approach to portfolio management and a greater willingness to adjust holdings based on dynamic market conditions.

-

Investor Sentiment: The move has undoubtedly impacted investor sentiment towards both Apple and Berkshire Hathaway. Many investors are closely watching to see if further reductions will occur and what investments will replace Apple’s decreased presence in Berkshire's portfolio.

Conclusion: A Cautious Watch

Warren Buffett's reduction in Apple holdings is a significant event in the financial world. While the precise reasoning remains unclear, the potential factors discussed above highlight the complexities of long-term investment strategies in a rapidly evolving market. The decision serves as a reminder that even seemingly unshakeable investments are subject to review and adjustment based on market conditions and strategic considerations. Investors should closely follow Berkshire Hathaway's future moves for further insights into their evolving investment philosophy and market outlook. The coming quarters will be crucial in understanding the full implications of this significant shift.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett Reduces Apple Holdings: A 13% Decrease And The Reasoning Behind It. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba Playoffs Can Jokic And The Nuggets Conquer Shai Gilgeous Alexander And The Thunder

May 06, 2025

Nba Playoffs Can Jokic And The Nuggets Conquer Shai Gilgeous Alexander And The Thunder

May 06, 2025 -

Westbrooks Fiery Retort Clippers Guarding Strategy Backfires

May 06, 2025

Westbrooks Fiery Retort Clippers Guarding Strategy Backfires

May 06, 2025 -

A Commencement Tale Of Perseverance Grant Hills Inspiring Journey

May 06, 2025

A Commencement Tale Of Perseverance Grant Hills Inspiring Journey

May 06, 2025 -

Sbagliare Per Imparare L Insegnamento Di Galiano Nel Chiostro Di Piazza Duomo

May 06, 2025

Sbagliare Per Imparare L Insegnamento Di Galiano Nel Chiostro Di Piazza Duomo

May 06, 2025 -

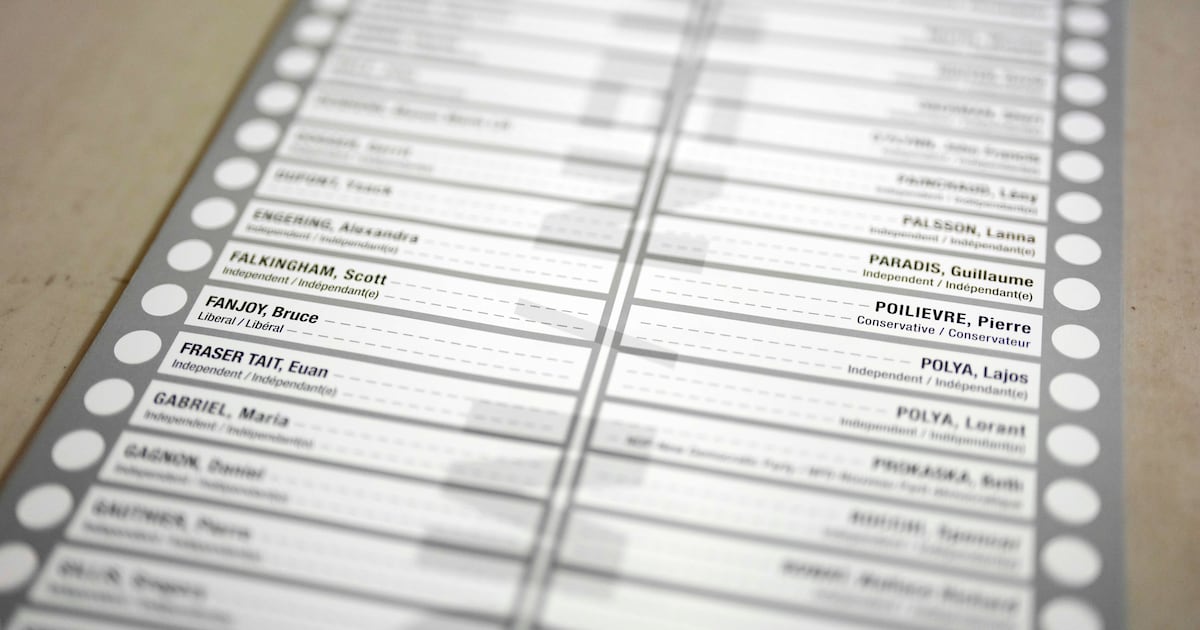

200 Candidate Names Protest Groups Bold Move Against Poilievre In Alberta

May 06, 2025

200 Candidate Names Protest Groups Bold Move Against Poilievre In Alberta

May 06, 2025

Latest Posts

-

Westbrooks Skills On Full Display Outsmarting The Clippers Defense

May 06, 2025

Westbrooks Skills On Full Display Outsmarting The Clippers Defense

May 06, 2025 -

Decoding The Met Gala 2025 Theme Ticket Costs And Live Streaming Information

May 06, 2025

Decoding The Met Gala 2025 Theme Ticket Costs And Live Streaming Information

May 06, 2025 -

Near Useless Nasa Spending Can 7 Billion Annually Be Saved

May 06, 2025

Near Useless Nasa Spending Can 7 Billion Annually Be Saved

May 06, 2025 -

Garrison Browns Death Janelle Brown Speaks Out On Sons Suicide

May 06, 2025

Garrison Browns Death Janelle Brown Speaks Out On Sons Suicide

May 06, 2025 -

Marvels Thunderbolts Renamed Details On The Bold Marketing Campaign

May 06, 2025

Marvels Thunderbolts Renamed Details On The Bold Marketing Campaign

May 06, 2025