Buffett's $300 Billion: The Shift In Investment Strategy Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's $300 Billion Shift: A Deep Dive into Berkshire Hathaway's Evolving Investment Strategy

Warren Buffett, the Oracle of Omaha, and his investment vehicle, Berkshire Hathaway, recently crossed the staggering $300 billion mark in cash reserves. This monumental sum represents a significant shift in Berkshire's investment strategy, sparking widespread debate and analysis among financial experts and investors alike. This article delves into the reasons behind this massive cash hoard and explores the potential implications for the future of Berkshire Hathaway and the broader market.

The Enigma of the $300 Billion:

Buffett, renowned for his value investing approach and long-term perspective, has traditionally deployed capital aggressively. The current substantial cash position, however, signals a departure from this historical norm. Several factors contribute to this strategic shift:

-

Lack of Attractive Opportunities: Buffett has repeatedly emphasized the difficulty in finding compelling investment opportunities that meet his rigorous standards. In a market characterized by inflated valuations and high levels of uncertainty, identifying undervalued assets suitable for Berkshire's scale proves challenging. He's famously stated that he'd rather hold cash than invest in overvalued companies.

-

Economic Uncertainty: Global economic headwinds, including geopolitical tensions, rising inflation, and potential recessionary pressures, have created a climate of heightened uncertainty. This cautious approach allows Berkshire to wait for more favorable investment conditions to emerge.

-

Strategic Acquisitions: While not explicitly stated, a significant portion of the cash reserves may be earmarked for potential large-scale acquisitions. Berkshire has a history of strategically acquiring undervalued companies with strong fundamentals, and this substantial cash pile suggests a readiness to capitalize on significant opportunities when they arise.

A Change in Pace, Not Necessarily a Change in Philosophy:

Despite the substantial cash position, it's crucial to understand that this doesn't signify a fundamental change in Buffett's investment philosophy. Value investing remains central to Berkshire's strategy. The current situation reflects a temporary pause, a strategic waiting game for the right moment to deploy capital effectively.

Implications for Investors:

The implications of Berkshire's massive cash reserves are multifaceted:

-

Market Sentiment: The sheer size of Berkshire's cash holdings influences market sentiment. Many view it as a barometer of economic conditions, with Buffett's caution interpreted as a potential signal of looming market corrections.

-

Future Investments: The potential deployment of this capital has significant implications for the target companies and the broader market. Major acquisitions by Berkshire can significantly impact industry dynamics and investor confidence.

-

Dividend Expectations: Some investors have called for Berkshire to distribute a portion of its cash reserves as dividends. However, Buffett has consistently opposed this, preferring to reinvest profits for long-term growth.

Looking Ahead:

The $300 billion in cash held by Berkshire Hathaway is a significant development in the investment world. It represents a strategic response to current market conditions rather than a rejection of core investment principles. While the exact timing and nature of future investments remain uncertain, the potential impact of this capital deployment is undeniable. Investors and market analysts alike will be keenly watching Berkshire's moves for clues about the future direction of the market and the economy. The Oracle of Omaha's next move is eagerly awaited.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's $300 Billion: The Shift In Investment Strategy Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tron Ares Trailer A Glimpse Into Jared Letos Off Grid Sci Fi Adventure

Apr 08, 2025

Tron Ares Trailer A Glimpse Into Jared Letos Off Grid Sci Fi Adventure

Apr 08, 2025 -

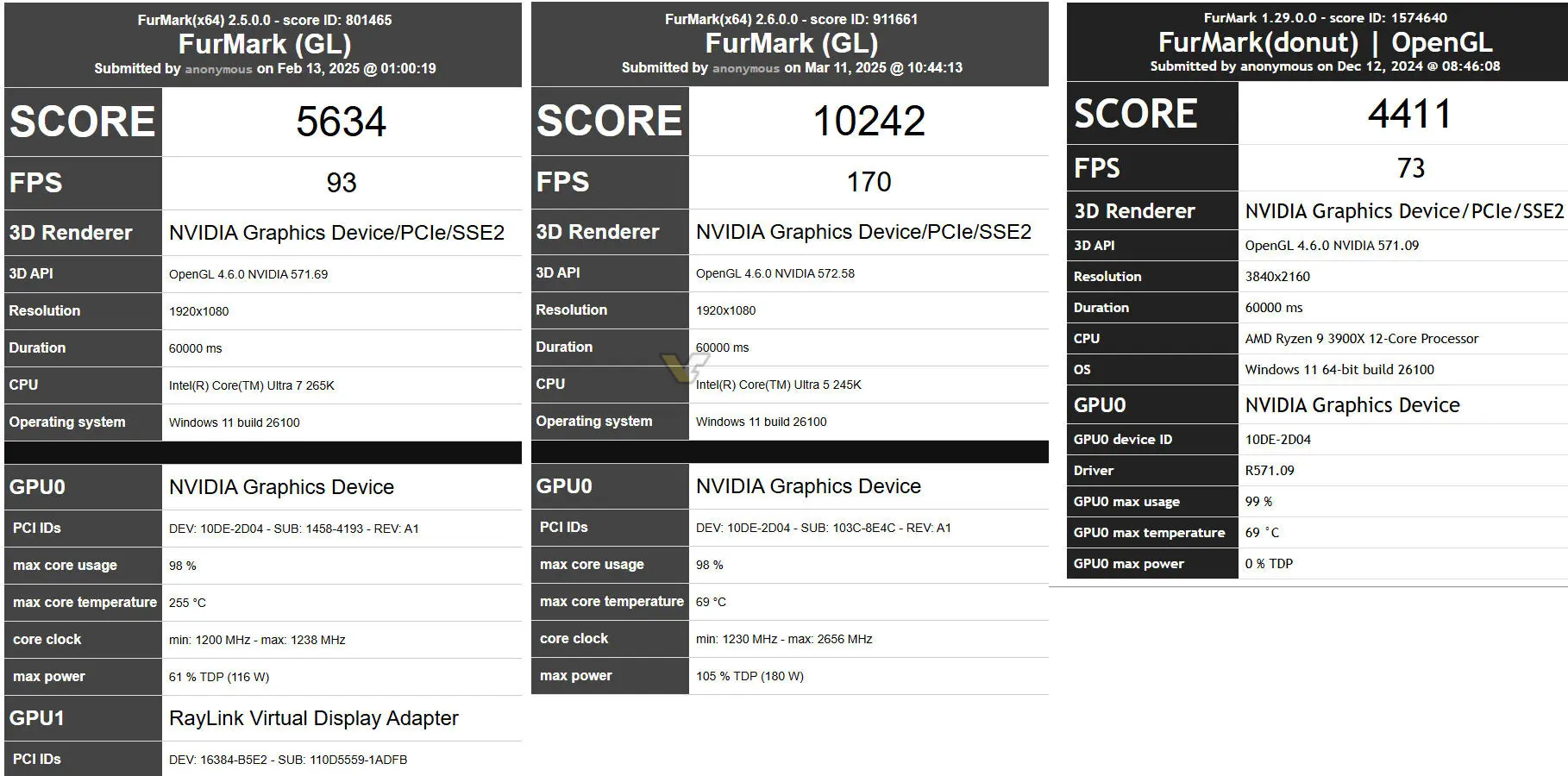

180 W Tdp Nvidia Rtx 5060 Ti Fur Mark Benchmark Results Unveiled

Apr 08, 2025

180 W Tdp Nvidia Rtx 5060 Ti Fur Mark Benchmark Results Unveiled

Apr 08, 2025 -

Augusta National Postpones Patron Entry Due To Inclement Weather

Apr 08, 2025

Augusta National Postpones Patron Entry Due To Inclement Weather

Apr 08, 2025 -

English Premier League Powerhouses Real Madrid And Psgs Quarterfinal Hurdles

Apr 08, 2025

English Premier League Powerhouses Real Madrid And Psgs Quarterfinal Hurdles

Apr 08, 2025 -

Qodrat 2 Dan Jumbo Analisis Box Office Dan Persaingan Film Horor

Apr 08, 2025

Qodrat 2 Dan Jumbo Analisis Box Office Dan Persaingan Film Horor

Apr 08, 2025