Buffett's Apple Sell-Off: Details On The 13% Stake Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Apple Sell-Off: Berkshire Hathaway Reduces Stake by 13%, Sending Shockwaves Through the Market

Warren Buffett's Berkshire Hathaway has sent shockwaves through the financial world with the announcement of a significant reduction in its Apple holdings. The investment conglomerate, known for its long-term, value-oriented investment strategy, has shed a considerable 13% stake in the tech giant, prompting speculation and analysis across the market. This move marks a significant shift in Berkshire's portfolio and raises questions about the future of its Apple investment.

This unexpected sell-off, detailed in recent SEC filings, reveals a decrease from 915.6 million shares to approximately 802 million shares, representing a substantial decrease in Berkshire's overall Apple investment. The financial impact of this divestment is massive, reflecting billions of dollars in reduced holdings. The timing of the sale, coupled with recent market volatility, has fueled considerable debate amongst financial experts.

Why the Sell-Off? Unpacking the Mystery

The precise reasons behind this dramatic reduction remain somewhat shrouded in mystery. While Berkshire Hathaway hasn't issued a formal statement explicitly explaining the decision, several theories are circulating:

-

Profit-Taking: One prevalent theory suggests that Berkshire may have simply decided to take profits from its massive Apple investment. Given Apple's impressive run over the past decade, a partial liquidation could be seen as a strategic move to secure substantial gains.

-

Portfolio Diversification: Another possibility is a shift in Berkshire's overall portfolio diversification strategy. While Apple remains a significant holding, the sell-off could reflect a desire to re-allocate capital to other promising investment opportunities.

-

Market Conditions: The current economic climate, marked by inflation and rising interest rates, might have influenced Berkshire's decision. Reducing exposure to a single, albeit highly valuable, stock could be seen as a risk-mitigation strategy in an uncertain market.

-

Internal Rebalancing: Finally, it's possible that this sell-off is simply part of Berkshire's ongoing portfolio rebalancing efforts. This is a common practice for large investment firms to maintain a desired asset allocation.

Impact on Apple and the Broader Market

The news of Berkshire's reduced stake has naturally impacted Apple's stock price, causing some initial volatility. However, the long-term impact remains to be seen. Apple's fundamental strength and continued growth prospects are still considered positive factors by many analysts.

The broader market has also reacted to this news, with some seeing it as a potential indicator of a broader market correction. However, it's crucial to avoid drawing overly simplistic conclusions. The sell-off should be viewed within the context of Berkshire Hathaway's long-term investment strategy and broader market dynamics.

What's Next for Berkshire Hathaway and Apple?

The future trajectory of Berkshire Hathaway's Apple investment remains uncertain. Further disclosures from Berkshire Hathaway will be critical in understanding the complete picture. Analysts are closely monitoring Berkshire's subsequent moves, watching for any further changes to its Apple holdings or shifts in its overall investment strategy. The development will undoubtedly remain a significant talking point within the financial community for some time to come. This situation underscores the dynamic nature of the investment world and the importance of continuous monitoring of market trends. The impact of this sell-off will be analyzed for months to come. Stay tuned for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Apple Sell-Off: Details On The 13% Stake Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solve Todays Nyt Connections Sports Puzzle April 25th 214

Apr 25, 2025

Solve Todays Nyt Connections Sports Puzzle April 25th 214

Apr 25, 2025 -

Secure Your Spot Singapore Football Festival Tickets On Sale April 25

Apr 25, 2025

Secure Your Spot Singapore Football Festival Tickets On Sale April 25

Apr 25, 2025 -

Inzaghi Expresses Worry Inter Milans Mental Exhaustion And Future Challenges

Apr 25, 2025

Inzaghi Expresses Worry Inter Milans Mental Exhaustion And Future Challenges

Apr 25, 2025 -

Is Donald Trumps Bitcoin Plan A Game Changer For Cryptocurrency

Apr 25, 2025

Is Donald Trumps Bitcoin Plan A Game Changer For Cryptocurrency

Apr 25, 2025 -

Balancing Act For Ge 2025 Nsps Stance On Opposition Unity And Party Politics

Apr 25, 2025

Balancing Act For Ge 2025 Nsps Stance On Opposition Unity And Party Politics

Apr 25, 2025

Latest Posts

-

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025 -

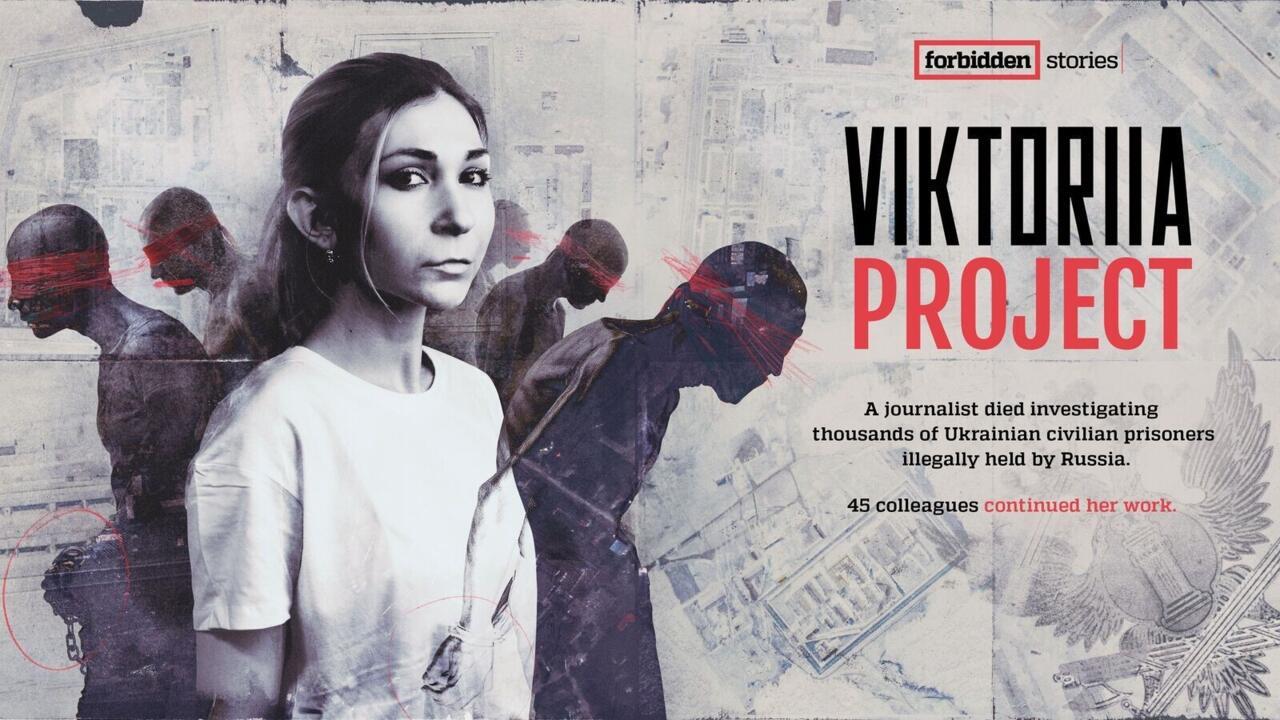

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025 -

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025 -

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025 -

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025