Buffett's Apple Sell-Off: Why He Reduced His Holdings By 13%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Apple Sell-Off: A 13% Reduction Shakes Investor Confidence

Warren Buffett's Berkshire Hathaway has significantly reduced its Apple holdings, sparking considerable speculation and concern among investors. The move, representing a 13% decrease in the company's Apple stock, marks a notable shift in Buffett's long-standing bullish stance on the tech giant and has sent ripples throughout the financial markets. This article delves into the potential reasons behind this significant sell-off and its implications for both Apple and the broader investment landscape.

<h3>Unpacking the Apple Sell-Off: Possible Reasons</h3>

While Berkshire Hathaway hasn't explicitly stated its reasons for the divestment, several factors are likely contributing to this decision. Analysts point to a confluence of circumstances, including:

-

Market Volatility: The current economic climate is characterized by high inflation, rising interest rates, and geopolitical uncertainty. These factors can make even the most stable investments appear less attractive, prompting adjustments in investment portfolios. This aligns with Buffett's generally cautious approach to risk management.

-

Apple's Valuation: Despite its strong performance, Apple's stock price has seen some fluctuation recently. Buffett is known for his value investing philosophy, focusing on purchasing undervalued assets. It's possible that he deemed Apple's current valuation less compelling compared to other investment opportunities.

-

Diversification Strategy: Berkshire Hathaway's vast portfolio includes a diverse range of holdings across various sectors. The reduction in Apple shares might simply reflect a strategic decision to rebalance the portfolio and allocate capital to other promising sectors or companies. This strategy isn’t unusual for a company of Berkshire Hathaway's size and scope.

-

Shifting Market Trends: The technology sector, while still robust, faces evolving challenges. Increasing competition, regulatory scrutiny, and potential shifts in consumer demand could have influenced Buffett's decision. He may be anticipating future market adjustments and adapting his portfolio accordingly.

<h3>The Impact on Apple and Investor Sentiment</h3>

The news of Buffett's reduced stake in Apple has understandably caused a stir. While Apple remains a highly profitable company with a loyal customer base, the sell-off has raised questions about its future growth prospects. The impact on investor confidence is significant, as Buffett's investment decisions are closely watched and often interpreted as market indicators. This sell-off could lead to some short-term volatility in Apple's stock price, although the long-term implications remain to be seen.

<h3>What's Next for Berkshire Hathaway and Apple?</h3>

The future remains uncertain. While this significant sell-off is noteworthy, it's important to remember that Berkshire Hathaway still holds a substantial amount of Apple stock. The reduction represents a strategic adjustment rather than a complete abandonment of Apple as an investment. Furthermore, Buffett's long-term investment strategy often involves patient holding, and future decisions could easily reverse this trend. This situation warrants continued observation and analysis as market conditions evolve and more information becomes available. The financial community is anxiously awaiting further clarifications from Berkshire Hathaway regarding their investment strategy moving forward.

Keywords: Warren Buffett, Berkshire Hathaway, Apple, Apple stock, stock market, investment, sell-off, portfolio, valuation, diversification, market volatility, investor sentiment, value investing, tech sector, economic uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Apple Sell-Off: Why He Reduced His Holdings By 13%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Teslas Driverless Robotaxi Plans Austin Launch And Nationwide Expansion

May 22, 2025

Teslas Driverless Robotaxi Plans Austin Launch And Nationwide Expansion

May 22, 2025 -

How To Bet The Knicks Vs Pacers Eastern Conference Finals 2025 Series Odds And Expert Tips

May 22, 2025

How To Bet The Knicks Vs Pacers Eastern Conference Finals 2025 Series Odds And Expert Tips

May 22, 2025 -

100 Rotten Tomatoes Rating Unpacking The Success Of Netflixs Secrets We Keep

May 22, 2025

100 Rotten Tomatoes Rating Unpacking The Success Of Netflixs Secrets We Keep

May 22, 2025 -

Dawn Richards Shocking Testimony Allegations Of Threats Against Singer By Sean Combs

May 22, 2025

Dawn Richards Shocking Testimony Allegations Of Threats Against Singer By Sean Combs

May 22, 2025 -

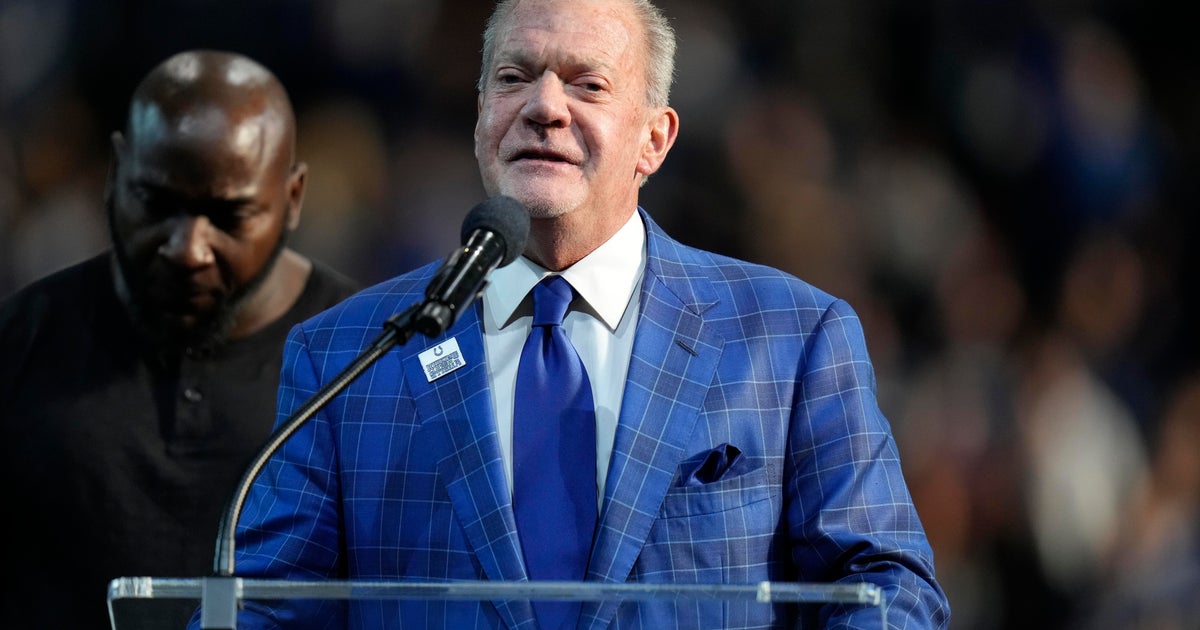

Jim Irsay Dead At 65 Colts Owners Legacy Remembered

May 22, 2025

Jim Irsay Dead At 65 Colts Owners Legacy Remembered

May 22, 2025