Buffett's Apple Sell-Off: Why The Oracle Reduced His Holding

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Apple Sell-Off: Why the Oracle Reduced His Holding

Warren Buffett's Berkshire Hathaway recently revealed a significant reduction in its Apple holdings, sparking widespread speculation and analysis amongst investors. The move, a departure from Berkshire's traditionally long-term investment strategy in the tech giant, has sent ripples through the market and begs the question: why did the Oracle of Omaha lessen his Apple bet?

The recent 1Q 2024 filings showed Berkshire Hathaway offloaded roughly 3.9% of its Apple stock, a substantial decrease from its previous position as Apple's largest shareholder. While the exact reasoning remains shrouded in some mystery, several plausible explanations have emerged from market analysts and financial experts.

Diversification and Portfolio Rebalancing

One primary theory centers on portfolio diversification. While Apple has been a phenomenal investment for Berkshire Hathaway, delivering substantial returns over the years, maintaining such a concentrated position in a single stock, however lucrative, presents inherent risk. Buffett, known for his emphasis on risk management and diversification, might have chosen to reduce his Apple stake to rebalance his portfolio and spread investments across various sectors. This strategy minimizes the impact of potential downturns in any one specific sector.

Market Conditions and Valuation Concerns

The tech sector, and particularly the mega-cap tech companies like Apple, experienced significant volatility in recent months. Concerns over rising interest rates, inflation, and a potential recession have weighed heavily on tech valuations. Buffett, ever the astute value investor, may have viewed the current Apple valuation as less attractive than other potential investment opportunities, prompting the sell-off. He might be strategically repositioning funds into sectors he perceives as undervalued and poised for future growth.

Strategic Redeployment of Capital

Another possibility involves the strategic deployment of capital towards other investment prospects. Berkshire Hathaway is known for its opportunistic approach, constantly scanning the market for undervalued assets and compelling investment options. The proceeds from the Apple sale could be allocated to more lucrative opportunities, be it acquiring other companies, investing in promising startups, or increasing holdings in different sectors.

The Importance of Long-Term Perspective

It's crucial to remember that Buffett's investment decisions are typically long-term oriented. While this sell-off might seem significant, it's important not to overreact. Berkshire Hathaway still holds a substantial Apple stake, reflecting continued confidence in the company's long-term prospects. This partial reduction could simply be a strategic adjustment within a broader long-term investment strategy.

What This Means for Investors

Buffett's moves always garner intense scrutiny from investors. This sell-off serves as a reminder that even the most successful investors adjust their portfolios in response to changing market dynamics. It emphasizes the importance of diversifying investments, carefully monitoring market conditions, and making informed decisions based on long-term strategic goals.

While the exact motivations behind the Apple sell-off remain somewhat opaque, the event underscores the dynamic nature of investing and the importance of adapting strategies to evolving market landscapes. The Oracle's decision, though sparking discussion, doesn't necessarily signal a negative outlook for Apple itself, but rather reflects the ongoing adjustments in Berkshire Hathaway's portfolio management. Further analysis and observation will be needed to fully understand the implications of this significant market move.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Apple Sell-Off: Why The Oracle Reduced His Holding. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

First T20 I United Arab Emirates Vs Bangladesh Live Score And Highlights

May 18, 2025

First T20 I United Arab Emirates Vs Bangladesh Live Score And Highlights

May 18, 2025 -

Champions League Bvbs Packender Sieg Alle Highlights Im Video

May 18, 2025

Champions League Bvbs Packender Sieg Alle Highlights Im Video

May 18, 2025 -

Tactical Battle At Ferraris Genoa Vs Atalanta Match Analysis

May 18, 2025

Tactical Battle At Ferraris Genoa Vs Atalanta Match Analysis

May 18, 2025 -

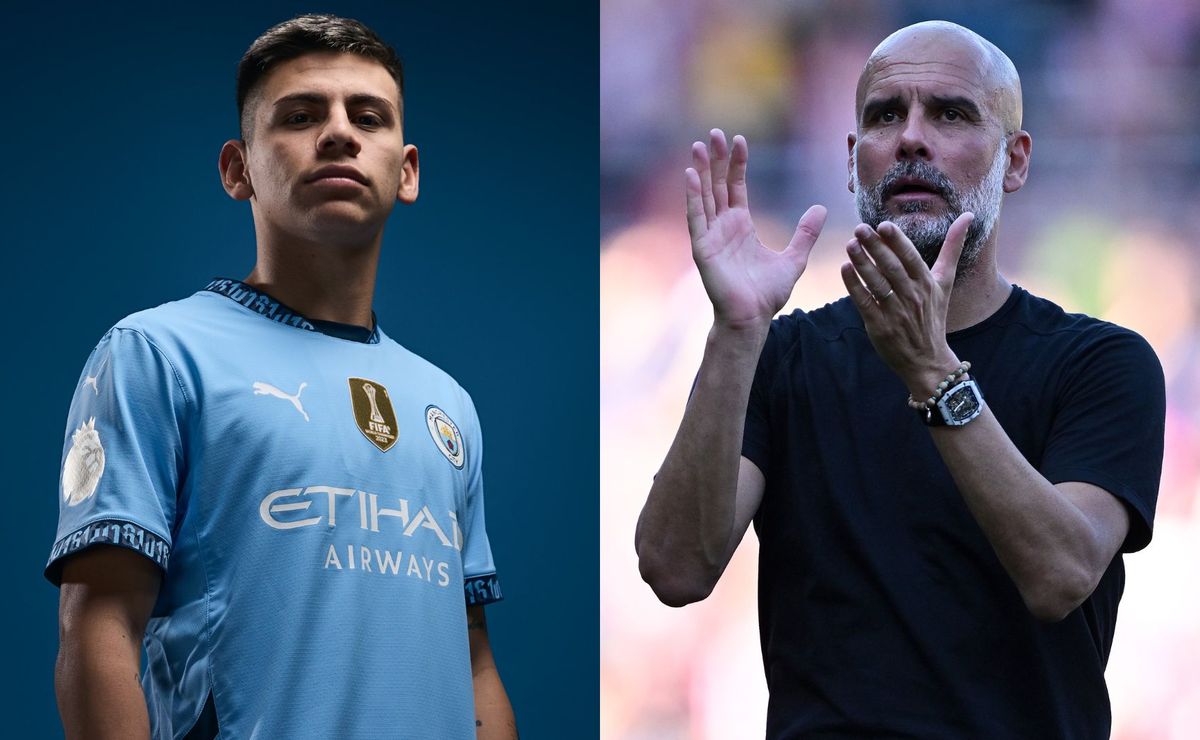

Guardiolas Manchester City Team News Echeverris Debut Impact And Benching

May 18, 2025

Guardiolas Manchester City Team News Echeverris Debut Impact And Benching

May 18, 2025 -

Live Fa Cup Final 2025 Man City Vs Crystal Palace

May 18, 2025

Live Fa Cup Final 2025 Man City Vs Crystal Palace

May 18, 2025

Latest Posts

-

Increased Security At Ottawa City Hall New Measures Begin May 26th

May 18, 2025

Increased Security At Ottawa City Hall New Measures Begin May 26th

May 18, 2025 -

China Lowers Tariffs By 11 2 Us Raises By 9 2 Analyzing The Latest Trade Deal

May 18, 2025

China Lowers Tariffs By 11 2 Us Raises By 9 2 Analyzing The Latest Trade Deal

May 18, 2025 -

Enttaeuschung Und Erleichterung Hoffenheims Gefuehlsachterbahn Nach Der Pleite

May 18, 2025

Enttaeuschung Und Erleichterung Hoffenheims Gefuehlsachterbahn Nach Der Pleite

May 18, 2025 -

Late Knockdown Saves Till From Misfits 21 Upset Against Stewart

May 18, 2025

Late Knockdown Saves Till From Misfits 21 Upset Against Stewart

May 18, 2025 -

The Story Behind Jason Puncheons Memorable Crystal Palace Fa Cup Final Goal

May 18, 2025

The Story Behind Jason Puncheons Memorable Crystal Palace Fa Cup Final Goal

May 18, 2025