Bull Flag Pattern Emerges Amidst Trump's Recent Legal Setbacks: What Does It Mean?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bull Flag Pattern Emerges Amidst Trump's Recent Legal Setbacks: What Does it Mean?

Donald Trump's recent legal woes have sent shockwaves through the political and financial landscapes. However, amidst the turmoil, a surprising technical pattern has emerged in the stock market: a bull flag. This potentially bullish signal has investors wondering: what does this mean for the markets, and is it a reliable indicator? Let's delve into the details.

Understanding the Bull Flag Pattern

The bull flag is a short-term continuation pattern characterized by a sharp upward move (the "flagpole") followed by a period of consolidation (the "flag"). This consolidation typically takes the form of a pennant or a rectangle, characterized by lower trading volume than the preceding surge. The pattern suggests a temporary pause in the upward trend before a potential resumption of the rally. Think of it as a brief rest for a bull before it charges again.

Trump's Legal Troubles and Market Reactions

Trump's indictments and ongoing legal battles have undoubtedly created uncertainty in the market. Some investors view these developments negatively, fearing potential market instability. Others, however, see opportunities amidst the chaos. The emergence of the bull flag pattern, particularly during this period of heightened political and legal drama, is intriguing and warrants closer examination.

Technical Analysis: Deciphering the Bull Flag's Implications

- The Flagpole: This represents the initial strong upward movement in the market, potentially driven by factors unrelated to Trump's legal issues, such as positive economic data or strong corporate earnings.

- The Flag: The consolidation phase (the flag) shows a temporary slowdown, often attributed to profit-taking or investors waiting for further confirmation before committing to new positions. This period of sideways trading is usually characterized by relatively low volume.

- The Breakout: A decisive break above the flag's upper trendline is considered a bullish confirmation, signaling a potential continuation of the upward trend. This breakout is often accompanied by an increase in trading volume.

Is This a Reliable Indicator?

While the bull flag pattern is a recognized technical indicator, it's crucial to remember that it's not foolproof. Its reliability depends on several factors, including:

- Volume: A significant increase in volume accompanying the breakout confirms the strength of the move. Low volume breakouts can be deceptive.

- Context: The broader market context is vital. A bullish flag in a bearish market is less reliable than one appearing within an established uptrend.

- Confirmation: It's best to consider the bull flag in conjunction with other technical indicators and fundamental analysis.

What it Means for Investors

The emergence of a bull flag pattern amidst Trump's legal issues doesn't necessarily mean these events are unrelated. The market is complex, and various factors influence price movements. However, the pattern itself suggests a potential for further upward movement. Investors should monitor the situation closely, paying attention to volume changes and the overall market sentiment. A confirmed breakout above the flag's upper trendline could signal a buying opportunity, but caution and careful risk management are always recommended. Consider consulting with a financial advisor before making any significant investment decisions.

Keywords: Bull Flag Pattern, Stock Market, Donald Trump, Legal Setbacks, Technical Analysis, Trading Strategy, Investment, Market Trends, Political Risk, Economic Uncertainty, Breakout, Pennant, Rectangle, Volume, Stock Market Prediction.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bull Flag Pattern Emerges Amidst Trump's Recent Legal Setbacks: What Does It Mean?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

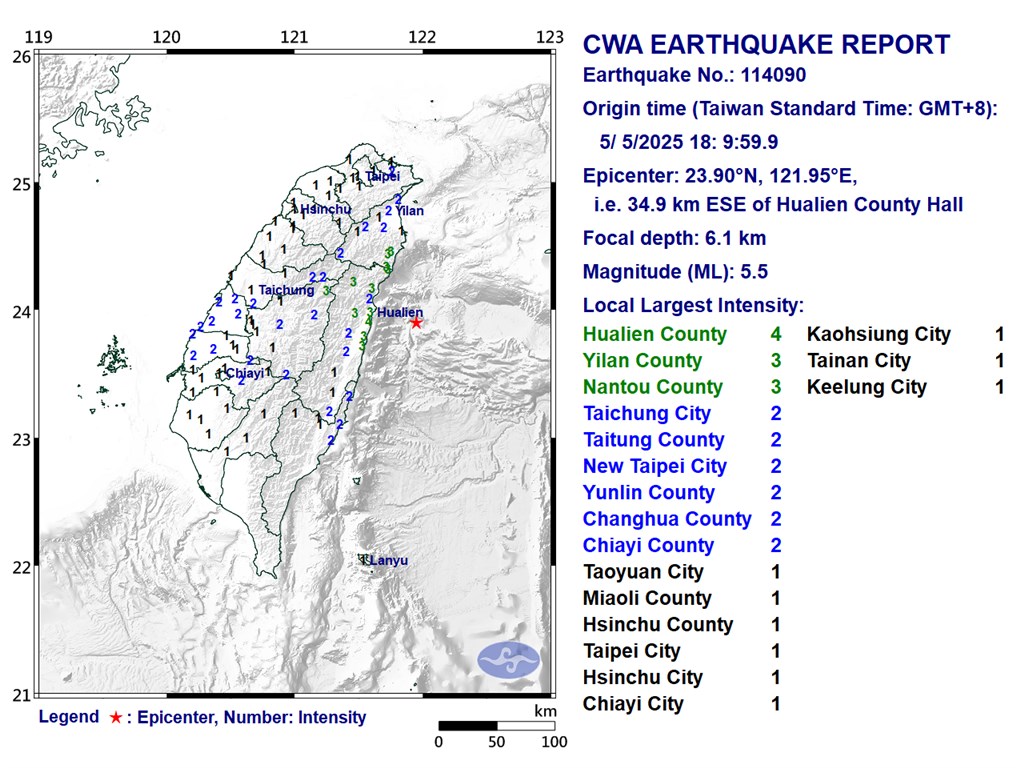

5 5 Magnitude Earthquake Shakes Eastern Taiwan Latest Updates And Reports

May 06, 2025

5 5 Magnitude Earthquake Shakes Eastern Taiwan Latest Updates And Reports

May 06, 2025 -

A Conservatives Critique Of Sesame Street

May 06, 2025

A Conservatives Critique Of Sesame Street

May 06, 2025 -

Cubs Vs Giants Game Prediction Betting Odds And Expert Picks May 5th

May 06, 2025

Cubs Vs Giants Game Prediction Betting Odds And Expert Picks May 5th

May 06, 2025 -

Chaos At House Party One Fatality 14 Injuries Reported

May 06, 2025

Chaos At House Party One Fatality 14 Injuries Reported

May 06, 2025 -

Trumps 100 Tariff Proposal On Foreign Films A Response To Voight

May 06, 2025

Trumps 100 Tariff Proposal On Foreign Films A Response To Voight

May 06, 2025

Latest Posts

-

Dinner Meeting Revelation Ong Ye Kung And Chee Hong Tat On Su Haijin

May 07, 2025

Dinner Meeting Revelation Ong Ye Kung And Chee Hong Tat On Su Haijin

May 07, 2025 -

Travel Chaos More Strikes Announced At Gatwick Airport

May 07, 2025

Travel Chaos More Strikes Announced At Gatwick Airport

May 07, 2025 -

Keoghans Met Gala 2025 Look A Ringo Starr Tribute

May 07, 2025

Keoghans Met Gala 2025 Look A Ringo Starr Tribute

May 07, 2025 -

Thunder Nuggets Nba Playoffs Series Key Players And Predictions

May 07, 2025

Thunder Nuggets Nba Playoffs Series Key Players And Predictions

May 07, 2025 -

Ac Milan Secures 2 1 Win Against Genoa Despite Heavy Rain

May 07, 2025

Ac Milan Secures 2 1 Win Against Genoa Despite Heavy Rain

May 07, 2025