Bullock Comments On Interest Rate Cuts: Diminished Prospects After Recent Events

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bullock Comments on Interest Rate Cuts: Diminished Prospects After Recent Events

The unexpected economic downturn has cast a shadow over hopes for imminent interest rate cuts, according to prominent economist, Dr. Anya Bullock. In a press conference earlier today, Bullock expressed a significantly more cautious outlook than many analysts had predicted, citing recent geopolitical instability and unexpectedly high inflation figures as key factors dampening the prospects for immediate rate reductions.

The financial markets have been anxiously awaiting signals from central banks regarding interest rate policy. Many had anticipated rate cuts as a means to stimulate economic growth and counter the effects of slowing global trade. However, Bullock's comments suggest a shift in perspective, potentially influencing investor sentiment and market behaviour in the coming weeks.

H2: Inflation Remains a Major Hurdle

Bullock highlighted persistently high inflation as the primary obstacle to interest rate cuts. "While we acknowledge the slowdown in economic activity," she stated, "the current inflation rates remain stubbornly high, eroding consumer purchasing power and posing a significant challenge to monetary policy." She emphasized the need for a balanced approach, cautioning against premature rate reductions that could exacerbate inflationary pressures.

The recent surge in energy prices, coupled with ongoing supply chain disruptions, has significantly contributed to the inflationary environment. Bullock pointed out that these factors are largely beyond the immediate control of central banks, requiring a more nuanced strategy than simply lowering interest rates.

H2: Geopolitical Uncertainty Adds to Complexity

Adding further complexity to the situation is the ongoing geopolitical uncertainty. The recent escalation of tensions in [mention specific geopolitical event, e.g., Eastern Europe] has introduced significant volatility into global markets, impacting investor confidence and hindering economic recovery. Bullock argued that this instability makes it even more critical for central banks to proceed cautiously with interest rate decisions.

"Premature rate cuts in this volatile environment risk further destabilizing markets and undermining the fragile economic recovery," Bullock explained. "A measured and data-driven approach is essential to navigate these unprecedented challenges."

H2: What Lies Ahead for Interest Rates?

Bullock's assessment suggests that any potential interest rate cuts are likely to be delayed until there are clearer signs of easing inflationary pressures and greater stability in global markets. She emphasized the importance of monitoring key economic indicators closely, advocating for a flexible approach that allows central banks to adapt their strategies as the situation evolves.

- Key Takeaways from Bullock's Statement:

- High inflation remains the biggest obstacle to interest rate cuts.

- Geopolitical uncertainty adds significant complexity to the economic outlook.

- A cautious and data-driven approach is necessary for monetary policy decisions.

- Any rate cuts are likely to be delayed until there is greater economic stability.

Bullock's comments have sent ripples through the financial world, prompting renewed uncertainty about the timing and magnitude of future interest rate adjustments. The market will be closely watching for further pronouncements from central banks and other economic indicators in the coming weeks and months. The situation remains fluid, highlighting the importance of staying informed and adaptable in these turbulent economic times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bullock Comments On Interest Rate Cuts: Diminished Prospects After Recent Events. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cattea Airdrop A New Telegram Opportunity For Web3 Gamers

Apr 11, 2025

Cattea Airdrop A New Telegram Opportunity For Web3 Gamers

Apr 11, 2025 -

Rd 5 Team Unveils Roster Change Ahead Of Gather Round

Apr 11, 2025

Rd 5 Team Unveils Roster Change Ahead Of Gather Round

Apr 11, 2025 -

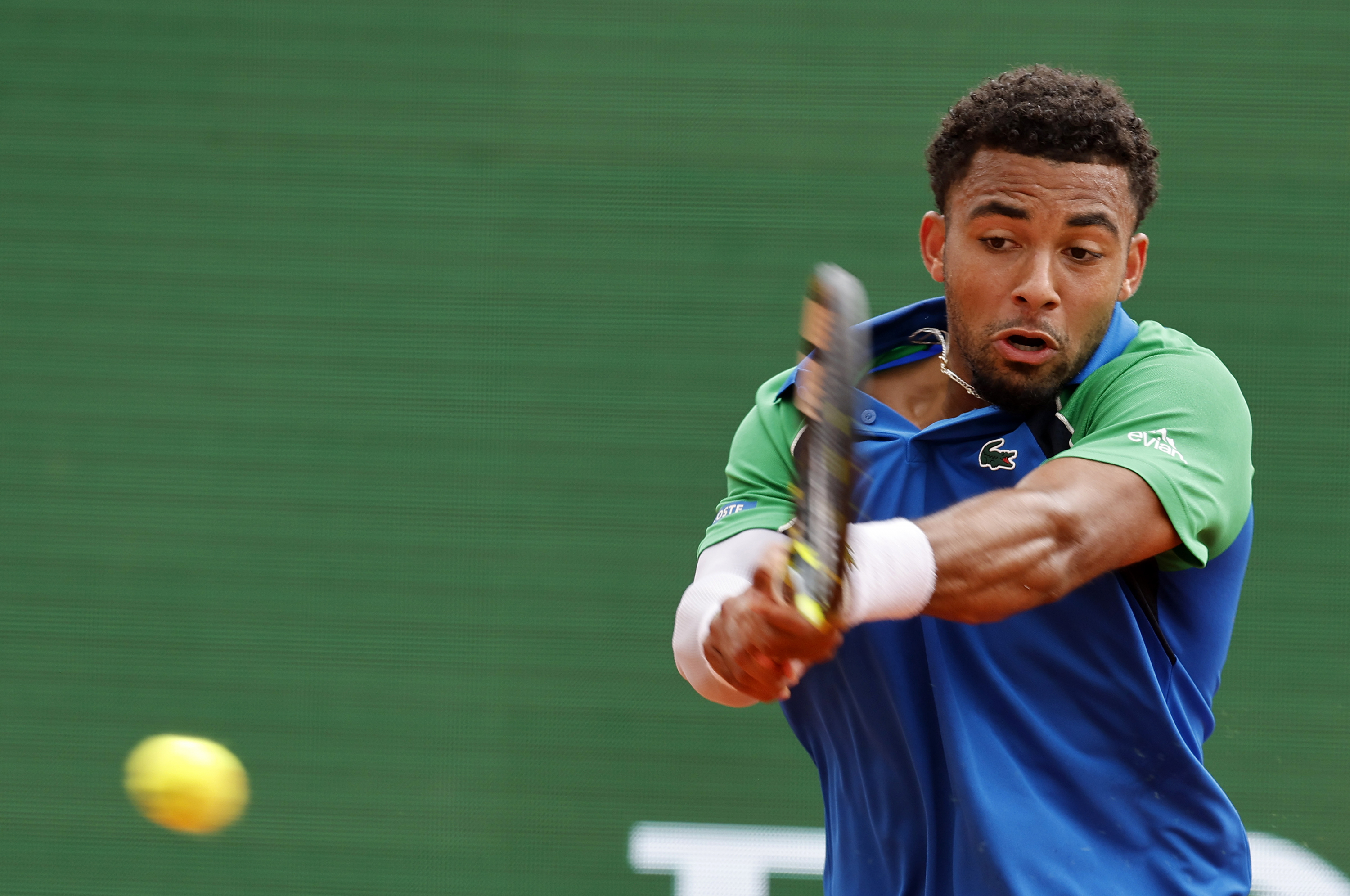

Alcaraz Vence A Fils En Montecarlo Espana Asegura Finalista En Masters 1000

Apr 11, 2025

Alcaraz Vence A Fils En Montecarlo Espana Asegura Finalista En Masters 1000

Apr 11, 2025 -

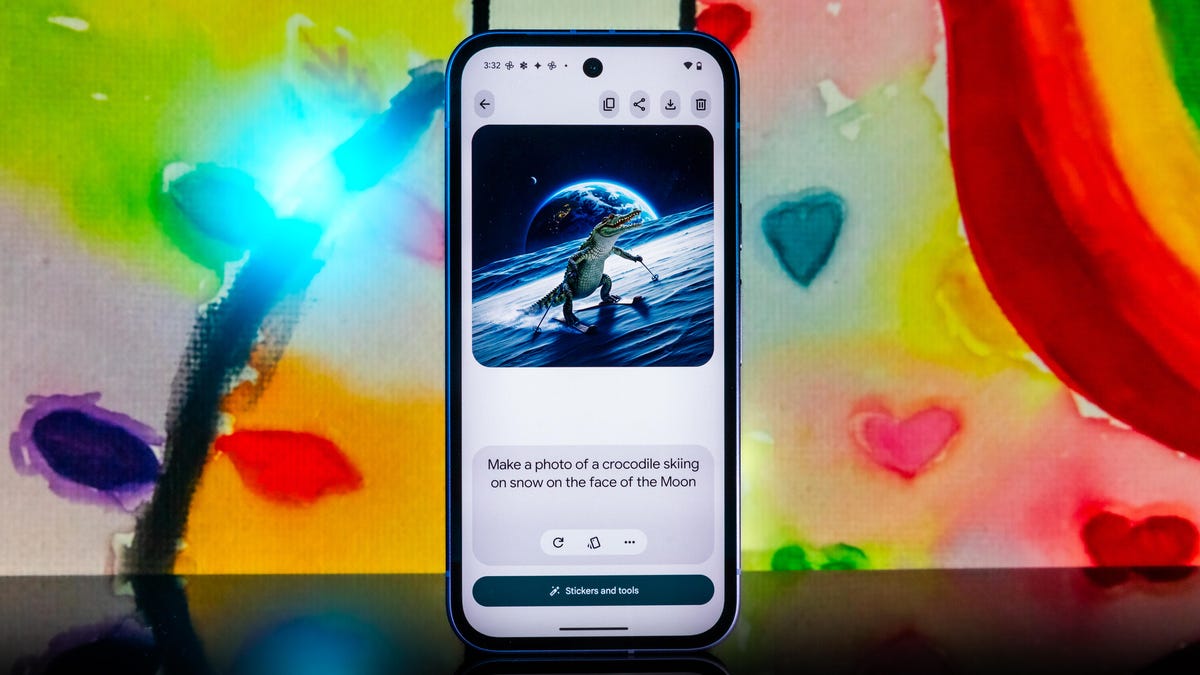

Pixel 9a Review Value Features And Potential Downsides

Apr 11, 2025

Pixel 9a Review Value Features And Potential Downsides

Apr 11, 2025 -

Augusta National Hattons Road To A First Major Win

Apr 11, 2025

Augusta National Hattons Road To A First Major Win

Apr 11, 2025