Bullock Dashes Hopes For Steep Interest Rate Cuts Following Trump's Actions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bullock Dashes Hopes for Steep Interest Rate Cuts Following Trump's Actions

Markets reel as Treasury Secretary Bullock's comments quell expectations of aggressive Fed easing.

The financial markets experienced a significant downturn today following comments from Treasury Secretary Steven Bullock, who poured cold water on widespread expectations of imminent and substantial interest rate cuts by the Federal Reserve. Bullock's statements, delivered during a press conference following a series of controversial executive actions by President Trump, effectively dashed hopes for a swift and aggressive response to the current economic slowdown.

The anticipation of steep interest rate cuts had been building for weeks, fueled by concerns about slowing global growth, trade tensions, and the ongoing uncertainty surrounding the Trump administration's economic policies. Many analysts predicted a half-point or even a full-point cut at the upcoming Federal Open Market Committee (FOMC) meeting. However, Bullock's remarks significantly altered this outlook.

Bullock's Cautious Tone Shifts Market Sentiment

Bullock emphasized the need for a "measured and data-driven" approach to monetary policy, stressing the importance of carefully assessing the economic landscape before implementing any significant changes. He highlighted the resilience of the US labor market and pointed to certain positive economic indicators as reasons for caution. This contrasted sharply with the more urgent tone adopted by some market participants who had been clamoring for immediate action.

"While we acknowledge the challenges facing the economy," Bullock stated, "we believe that precipitous action could have unintended consequences. The Federal Reserve will continue to monitor the situation closely and respond appropriately based on the available data."

This emphasis on a data-driven approach, coupled with the lack of any explicit commitment to a rate cut, sent shockwaves through the markets. Stock prices tumbled, bond yields rose, and the dollar strengthened against other major currencies.

Trump's Actions Exacerbate Economic Uncertainty

The backdrop to Bullock's comments was the recent series of controversial executive actions by President Trump, which have further destabilized an already fragile economic climate. These actions, including [insert specific example of Trump's actions and their market impact, e.g., new tariffs on imported goods], have introduced additional uncertainty into the equation, making it more difficult for the Fed to predict the future trajectory of the economy. This uncertainty, Bullock implied, is a key factor in the administration's cautious approach to advocating for immediate rate cuts.

What Happens Next? The FOMC Meeting in Focus

The upcoming FOMC meeting will be crucial in determining the Fed's next move. While Bullock's statements significantly reduced expectations of a large rate cut, a smaller reduction remains a possibility. However, the market is now bracing for a more nuanced and potentially less decisive response than previously anticipated. Analysts will be closely scrutinizing the FOMC's statement for clues about the future direction of monetary policy.

Key Takeaways:

- Market expectations for steep interest rate cuts have been significantly dampened.

- Treasury Secretary Bullock advocates for a measured and data-driven approach to monetary policy.

- President Trump's recent actions have added to economic uncertainty.

- The upcoming FOMC meeting will be crucial in determining the Fed's next steps.

- The market is now pricing in a less aggressive response from the Federal Reserve.

The situation remains fluid, and the coming days and weeks will be critical in determining how the markets react to this unexpected shift in the narrative surrounding interest rates. The ongoing interplay between political actions, economic data, and the Fed's response will continue to shape the financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bullock Dashes Hopes For Steep Interest Rate Cuts Following Trump's Actions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hingga April 2025 Jalur Pendakian Gunung Gede Pangrango Tetap Ditutup

Apr 11, 2025

Hingga April 2025 Jalur Pendakian Gunung Gede Pangrango Tetap Ditutup

Apr 11, 2025 -

Is A New Valve Vr Headset Coming Sooner Than Expected Leak Points To Yes

Apr 11, 2025

Is A New Valve Vr Headset Coming Sooner Than Expected Leak Points To Yes

Apr 11, 2025 -

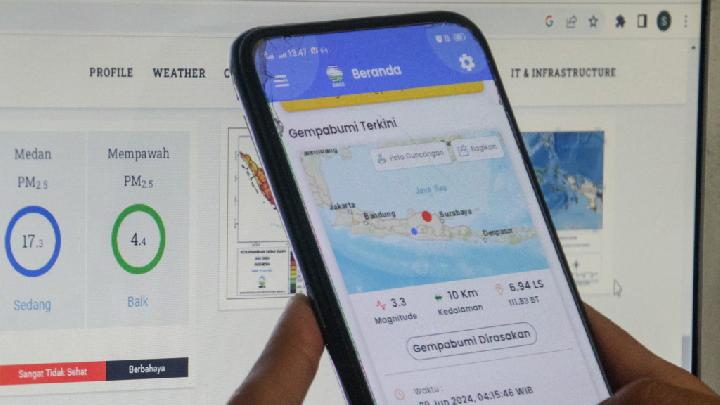

Indian Ocean Earthquake Bmkg Reports M5 9 Magnitude Tsunami Warning Unnecessary

Apr 11, 2025

Indian Ocean Earthquake Bmkg Reports M5 9 Magnitude Tsunami Warning Unnecessary

Apr 11, 2025 -

The Transformation Of Kit Connor A Study In Character Development

Apr 11, 2025

The Transformation Of Kit Connor A Study In Character Development

Apr 11, 2025 -

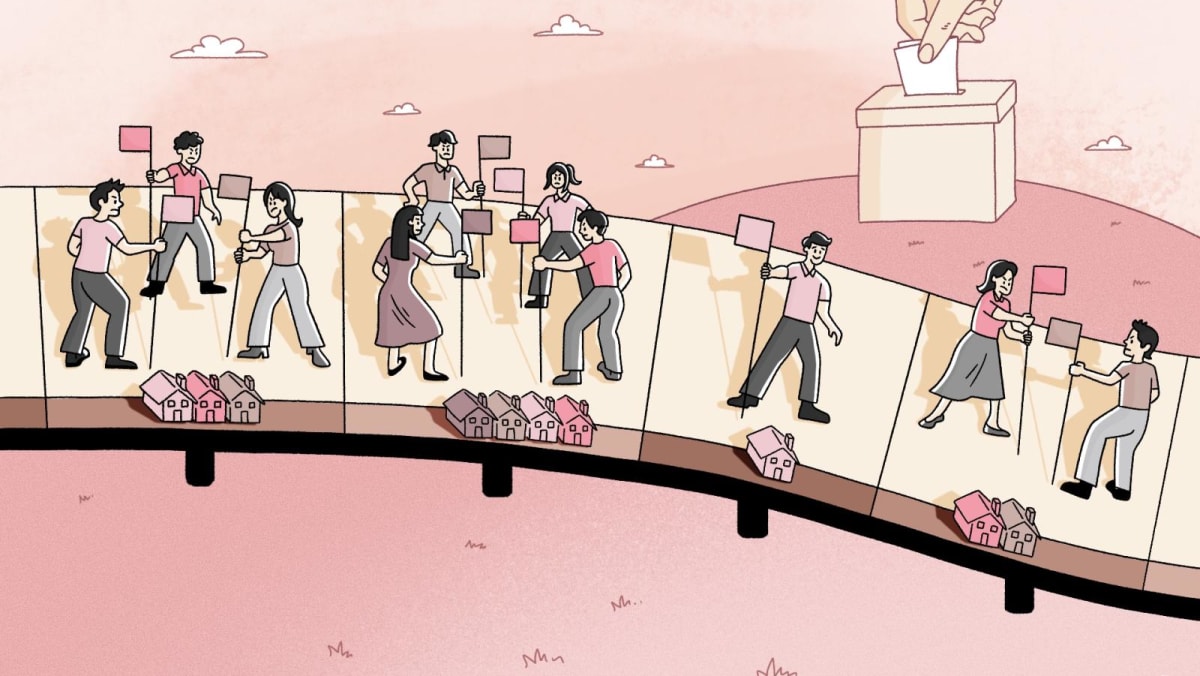

Singapores Ge 2025 What More Competitive Elections Mean For The Nation

Apr 11, 2025

Singapores Ge 2025 What More Competitive Elections Mean For The Nation

Apr 11, 2025