Bullock: No Deep Interest Rate Cuts Expected Despite Trump Developments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bullock: No Deep Interest Rate Cuts Expected Despite Trump Developments

Former Treasury Secretary Steve Mnuchin's recent comments suggesting further interest rate cuts haven't swayed Federal Reserve Chair Jerome Powell's apparent stance on monetary policy. Despite the ongoing political turmoil surrounding former President Donald Trump's legal battles, experts believe the Federal Reserve will maintain its cautious approach to interest rate adjustments. This follows comments from prominent economist and financial commentator, David Bullock, who anticipates only incremental changes, if any, in the near future.

The financial markets have been closely watching the interplay between political developments and monetary policy. Trump's indictments and ongoing investigations have injected uncertainty into the economic outlook, leading some to speculate about potential intervention by the Federal Reserve to mitigate risks. However, Bullock's analysis suggests a different narrative.

Why Deep Cuts Are Unlikely, According to Bullock

Bullock's assessment centers on several key factors:

-

Inflation Remains a Concern: While inflation has cooled slightly, it remains stubbornly above the Federal Reserve's target rate. Aggressive interest rate cuts risk reigniting inflationary pressures, undermining years of effort to stabilize the economy. Bullock emphasizes that the Fed's primary mandate is price stability, and drastic cuts would contradict this goal.

-

Economic Data Remains Mixed: Recent economic indicators paint a mixed picture. While the labor market remains strong, some sectors are showing signs of slowing growth. Bullock argues that this uncertainty makes a dramatic shift in monetary policy premature and potentially destabilizing. He highlights the need for the Fed to carefully monitor the evolving economic landscape before making significant adjustments.

-

Powell's Stance: Federal Reserve Chair Jerome Powell has consistently emphasized a data-dependent approach to monetary policy. This indicates that any future interest rate changes will be based on concrete economic data rather than political pressures. Bullock believes Powell will stick to this strategy, resisting calls for immediate and significant cuts.

Mnuchin's Influence: A Limited Impact?

Steve Mnuchin's recent public statements advocating for deeper interest rate cuts have added to the market's uncertainty. However, Bullock downplays the significance of these comments, suggesting that they are not likely to sway the Federal Reserve's independent decision-making process. The Fed, Bullock stresses, operates with a high degree of autonomy, and political influence is generally considered minimal in shaping its monetary policy decisions.

Looking Ahead: Incremental Adjustments More Likely

Bullock's analysis suggests that rather than deep cuts, the Federal Reserve is more likely to pursue a strategy of incremental adjustments to interest rates. This cautious approach aims to balance the need to support economic growth with the imperative to control inflation. He anticipates that future decisions will hinge on upcoming economic data releases and their implications for inflation and overall economic health. The ongoing situation warrants close monitoring, and investors are advised to remain vigilant as the economic picture continues to evolve. The coming months will be crucial in determining the Fed's next move. The market will be closely scrutinizing inflation figures, employment data, and other key economic indicators for any signs of a shift in the Fed's strategy. Bullock's prediction of a cautious approach suggests a period of relative stability, though the potential for unexpected changes remains.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bullock: No Deep Interest Rate Cuts Expected Despite Trump Developments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

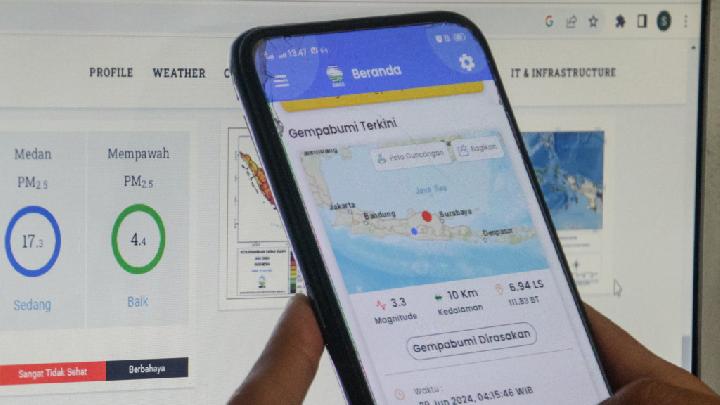

Bmkg 5 9 Magnitude Earthquake Hits Indian Ocean No Tsunami Danger Detected

Apr 11, 2025

Bmkg 5 9 Magnitude Earthquake Hits Indian Ocean No Tsunami Danger Detected

Apr 11, 2025 -

Mukesh Kumars Match Winning Performance Joins Elite Club With Jofra Archer

Apr 11, 2025

Mukesh Kumars Match Winning Performance Joins Elite Club With Jofra Archer

Apr 11, 2025 -

Aaron Rais Double Glove And Iron Cover A Telling Insight Into His Game

Apr 11, 2025

Aaron Rais Double Glove And Iron Cover A Telling Insight Into His Game

Apr 11, 2025 -

Live Updates Lyon Vs Manchester United Europa League Clash Score And Team News

Apr 11, 2025

Live Updates Lyon Vs Manchester United Europa League Clash Score And Team News

Apr 11, 2025 -

Tech Giants Under Scrutiny Senate Sets April 21 Deadline For Ai Justification

Apr 11, 2025

Tech Giants Under Scrutiny Senate Sets April 21 Deadline For Ai Justification

Apr 11, 2025