Buy Now, Pay Never: Are Klarna Loans Fueling The US Consumer Debt Crisis?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Never: Are Klarna Loans Fueling the US Consumer Debt Crisis?

The allure of "buy now, pay later" (BNPL) services like Klarna is undeniable. Instant gratification, easy online checkout, and seemingly manageable payment plans have made them wildly popular, especially among younger generations. But as the US grapples with rising consumer debt, a crucial question emerges: are services like Klarna contributing to the problem, or are they simply a symptom of a deeper economic malaise?

The rapid growth of BNPL platforms is undeniable. Klarna, in particular, boasts millions of users and a significant market share. Their straightforward application process and widespread acceptance by online retailers have made them a convenient payment option for everything from clothing and electronics to groceries and furniture. However, this convenience comes at a cost, and critics argue that it's a cost that's increasingly burdening already stretched household budgets.

The Hidden Costs of "Buy Now, Pay Later"

While often advertised as interest-free, many BNPL services charge late fees, which can quickly accumulate. These fees, coupled with the potential for missed payments and the psychological impact of accumulating debt without the traditional structure of a loan, contribute to a cycle of debt that can be difficult to escape. The lack of transparency surrounding the true cost of these services is also a major concern. Consumers may not fully understand the implications of their purchases until it's too late.

Klarna's Response and Industry Regulation

Klarna, aware of the growing concerns, has implemented measures to improve transparency and responsible lending practices. They emphasize their commitment to financial literacy and offer tools to help users manage their payments. However, critics argue these measures are insufficient and call for stricter regulation of the entire BNPL industry. The lack of consistent oversight across states creates a patchwork of regulations, making it challenging to effectively address the potential for widespread financial harm.

Is BNPL the Problem, or Just a Symptom?

While BNPL services like Klarna undeniably contribute to consumer debt, it's crucial to consider the broader economic context. Factors such as stagnant wages, rising inflation, and limited access to traditional credit contribute significantly to the debt crisis. BNPL services, therefore, might be exacerbating an existing problem rather than being its sole cause.

What Can Consumers Do?

- Budget carefully: Before using BNPL, create a realistic budget to ensure you can afford the repayments.

- Understand the terms and conditions: Read the fine print carefully to avoid unexpected fees.

- Use BNPL responsibly: Only use it for essential purchases you can comfortably afford to repay.

- Explore alternatives: Consider saving up for purchases or using traditional credit cards with responsible spending habits.

The Future of BNPL and Consumer Debt

The future of buy now, pay later services remains uncertain. Increased regulation is inevitable, and the industry will need to adapt to ensure sustainable and responsible practices. Consumers, armed with knowledge and responsible financial habits, will play a critical role in mitigating the risks associated with this increasingly popular payment method. The question remains whether BNPL will be a tool for convenient purchasing or a catalyst for a deeper consumer debt crisis. Only time will tell.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Never: Are Klarna Loans Fueling The US Consumer Debt Crisis?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Positive Crypto Trend Year To Date Inflows Top 7 5 Billion Recovering Early 2025 Losses

May 21, 2025

Positive Crypto Trend Year To Date Inflows Top 7 5 Billion Recovering Early 2025 Losses

May 21, 2025 -

Beyond Autopilot How Teslas Ai Chips Are Shaping The Future Of Ai

May 21, 2025

Beyond Autopilot How Teslas Ai Chips Are Shaping The Future Of Ai

May 21, 2025 -

Analyzing The Transformations Stars And Oilers Prepare For Conference Finals Rematch

May 21, 2025

Analyzing The Transformations Stars And Oilers Prepare For Conference Finals Rematch

May 21, 2025 -

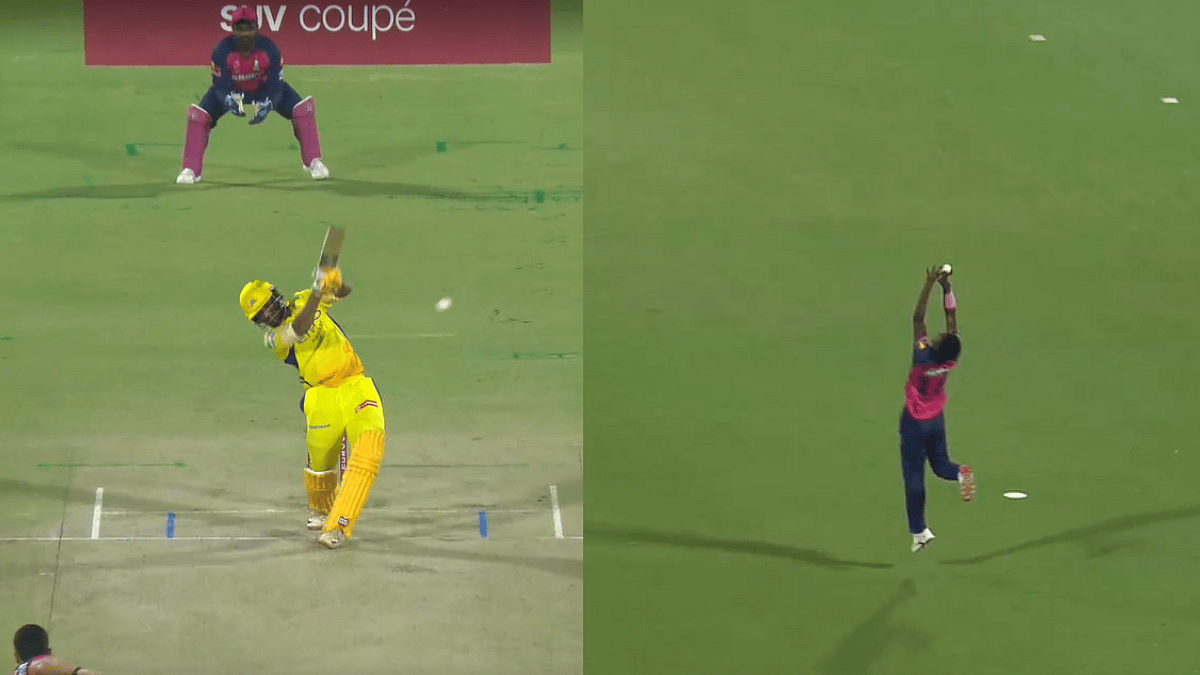

Ipl 2025 Kwena Maphakas Spectactular Catch Removes Urvil Patel In Csk Vs Rr Thriller

May 21, 2025

Ipl 2025 Kwena Maphakas Spectactular Catch Removes Urvil Patel In Csk Vs Rr Thriller

May 21, 2025 -

White Sox At Mariners Head To Head Stats Betting Odds And Gameday Preview

May 21, 2025

White Sox At Mariners Head To Head Stats Betting Odds And Gameday Preview

May 21, 2025