Can Bitcoin Reach $1.5 Million? ARK Invest Weighs In On Global Factors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can Bitcoin Reach $1.5 Million? ARK Invest Weighs In on Global Factors

Bitcoin's price volatility has always captivated investors, sparking endless debates about its future value. Could the king of cryptocurrencies truly reach the astronomical figure of $1.5 million? Investment firm ARK Invest, known for its bold predictions, has recently weighed in, considering a range of global factors that could propel—or hinder—Bitcoin's ascent. This article delves into ARK Invest's analysis and examines the key elements shaping Bitcoin's potential future price.

ARK Invest's Bullish Outlook: A Model-Driven Prediction

ARK Invest, led by the renowned Cathie Wood, isn't shy about its bullish Bitcoin stance. Their model, which factors in network effects, adoption rates, and regulatory developments, suggests a significant upside potential. While they haven't explicitly stated a timeline, their projections hint at a possible $1.5 million Bitcoin price in the future. This bold prediction rests on several key assumptions, including widespread institutional adoption and continued technological advancements.

Factors Fueling the $1.5 Million Prediction:

- Increased Institutional Adoption: The growing acceptance of Bitcoin by large corporations and institutional investors is a significant driver of price appreciation. As more institutional money flows into the market, demand naturally increases, pushing prices higher.

- Network Effects and Scarcity: Bitcoin's decentralized nature and limited supply (only 21 million coins will ever exist) create inherent scarcity. This scarcity, combined with increasing network effects (the value of the network increases with each new user), is a powerful driver of long-term price growth.

- Global Macroeconomic Uncertainty: Many investors see Bitcoin as a hedge against inflation and macroeconomic instability. In times of economic uncertainty, Bitcoin's decentralized and non-inflationary nature could attract significant investment, pushing the price upward.

- Technological Advancements: The ongoing development of the Bitcoin network, including advancements in scalability and security, further strengthens its appeal to both investors and users. These improvements enhance the overall functionality and usability of Bitcoin.

Challenges and Counterarguments:

While ARK Invest's projections are optimistic, it's crucial to acknowledge potential challenges:

- Regulatory Uncertainty: Government regulations around the world remain a significant variable. Stringent regulations could stifle growth and negatively impact Bitcoin's price.

- Market Volatility: Bitcoin's history is marked by periods of extreme volatility. Sudden price drops, driven by market sentiment or unforeseen events, are a possibility.

- Competition from Altcoins: The emergence of competing cryptocurrencies could divert investment away from Bitcoin and slow its price appreciation.

Conclusion: A Long-Term Perspective

The possibility of Bitcoin reaching $1.5 million is undeniably ambitious. While ARK Invest's model provides a compelling case, realizing such a price requires a confluence of favorable factors and overcoming significant hurdles. The journey to such a high price is likely to be a long and volatile one, characterized by periods of both substantial growth and significant corrections. Investors considering Bitcoin should adopt a long-term perspective, carefully assess their risk tolerance, and diversify their portfolios accordingly. The ultimate question remains: will the global factors align to propel Bitcoin to this unprecedented level? Only time will tell. However, ARK Invest's analysis provides a valuable framework for understanding the potential drivers of Bitcoin's future price movements. Keep an eye on global economic trends, regulatory developments, and technological advancements – these factors will ultimately determine the trajectory of Bitcoin’s price.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can Bitcoin Reach $1.5 Million? ARK Invest Weighs In On Global Factors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nuclear Powers Potential Devastation A Threat To Australias Aluminium Sector

Apr 27, 2025

Nuclear Powers Potential Devastation A Threat To Australias Aluminium Sector

Apr 27, 2025 -

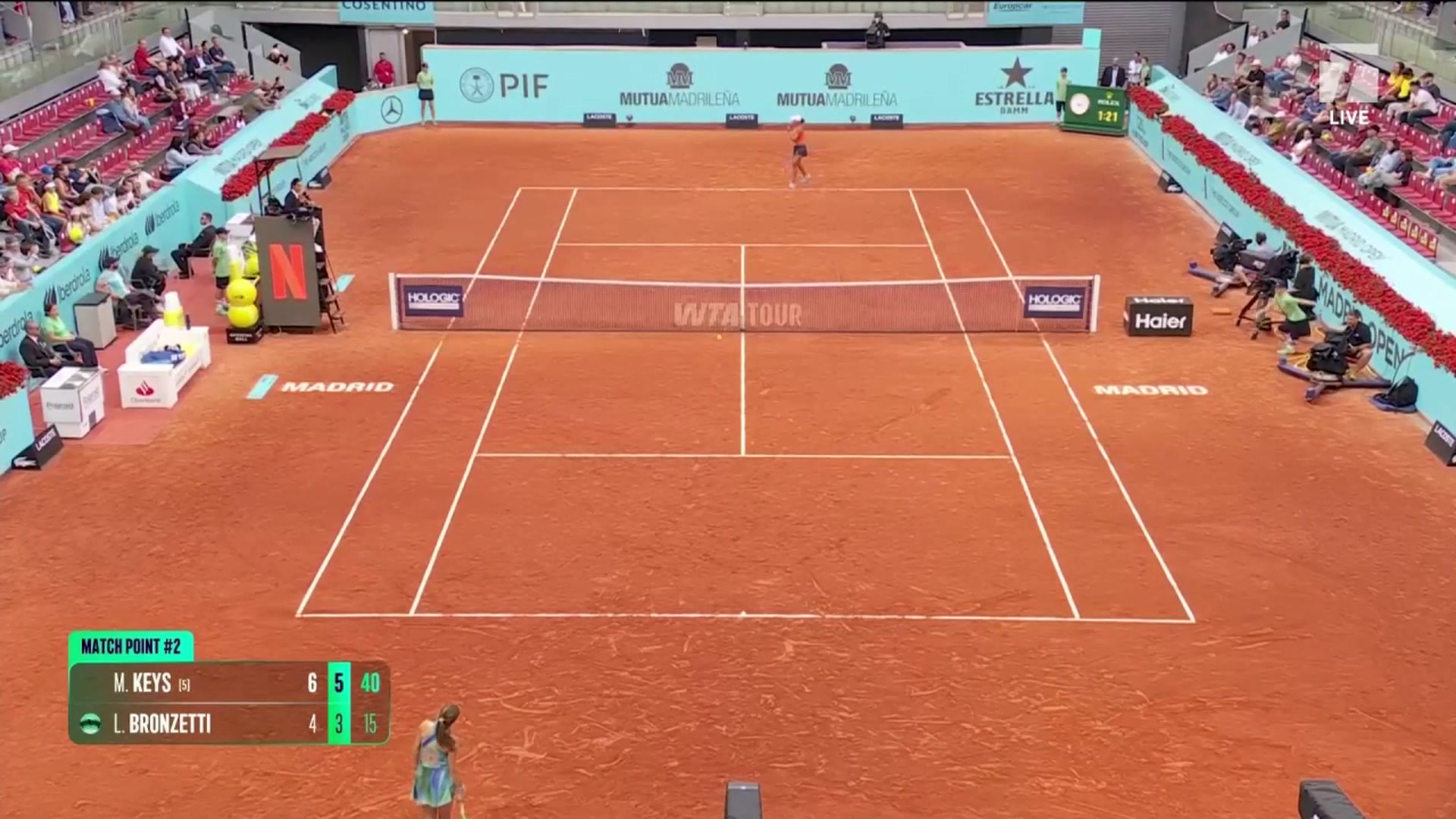

Madison Keys Advances After Dominant Win Over Lucia Bronzetti

Apr 27, 2025

Madison Keys Advances After Dominant Win Over Lucia Bronzetti

Apr 27, 2025 -

Founders Memorial Costs And Job Security Red Dot Uniteds Rally Highlights Key Issues

Apr 27, 2025

Founders Memorial Costs And Job Security Red Dot Uniteds Rally Highlights Key Issues

Apr 27, 2025 -

Todays Star Themed Puzzle Essential Constellations For Success

Apr 27, 2025

Todays Star Themed Puzzle Essential Constellations For Success

Apr 27, 2025 -

Afc Bournemouth Vs Manchester United Head To Head Stats And Team News

Apr 27, 2025

Afc Bournemouth Vs Manchester United Head To Head Stats And Team News

Apr 27, 2025