Can MicroStrategy Stock (MSTR) Surpass Bitcoin (BTC) In 2025? A Detailed Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can MicroStrategy Stock (MSTR) Surpass Bitcoin (BTC) in 2025? A Detailed Market Analysis

MicroStrategy (MSTR), the business intelligence company known for its significant Bitcoin holdings, has become a fascinating case study for investors. While Bitcoin (BTC) remains the dominant cryptocurrency, many are wondering: could MSTR stock potentially outperform BTC by 2025? This detailed market analysis explores the possibility, weighing the factors that could contribute to either outcome.

The Bitcoin Bet: A Cornerstone of MSTR's Strategy

MicroStrategy's aggressive Bitcoin acquisition strategy has undeniably shaped its trajectory. CEO Michael Saylor's unwavering belief in Bitcoin as a store of value has positioned the company as a major player in the crypto space. This bold move, however, makes MSTR’s stock price heavily reliant on Bitcoin's performance. A surge in BTC's value directly benefits MSTR, while a downturn significantly impacts its valuation.

Factors Favoring MSTR Outperforming BTC by 2025:

-

Increased Institutional Adoption of Bitcoin: As institutional investors continue to embrace Bitcoin, MSTR, as a major holder, could benefit disproportionately. This increased institutional interest could drive up demand for MSTR stock, potentially exceeding BTC's price appreciation.

-

MSTR's Business Operations: While Bitcoin is a significant factor, MSTR still maintains its core business operations in business intelligence software. If this sector performs strongly and generates significant revenue growth, it could bolster MSTR's stock price independently of Bitcoin's performance.

-

Regulatory Clarity and Bitcoin ETF Approval: Increased regulatory clarity surrounding Bitcoin and the potential approval of a Bitcoin ETF could lead to a massive influx of capital into the cryptocurrency market. This could benefit both BTC and MSTR, but MSTR might see a more pronounced effect due to its established position and institutional interest.

-

Market Sentiment and Investor Perception: Investor sentiment towards Bitcoin and MSTR can significantly influence their respective prices. Positive news and increased investor confidence in both assets could lead to a surge in value, but the unique narrative surrounding MSTR’s Bitcoin holdings might drive disproportionate gains.

Factors Favoring BTC Outperforming MSTR by 2025:

-

Bitcoin's Intrinsic Value Proposition: Bitcoin's inherent value as a decentralized digital currency, independent of any specific company's performance, remains a powerful driver of its price. Technological advancements and wider adoption could propel BTC's value significantly.

-

Market Volatility: The cryptocurrency market is notoriously volatile. While MSTR benefits from Bitcoin's gains, it's also susceptible to its volatility. A significant correction in the cryptocurrency market could hurt MSTR more than BTC, especially if its software business underperforms.

-

Competition in the Business Intelligence Market: MSTR faces competition from other established players in the business intelligence software market. Failure to innovate and maintain market share could negatively impact its stock price, regardless of Bitcoin's performance.

-

Bitcoin's Network Effects: Bitcoin's robust network effects, meaning its value increases as more people use it, provide a strong foundation for its long-term growth potential, potentially surpassing MSTR's growth trajectory.

Conclusion: A Complex Prediction

Whether MSTR stock will surpass Bitcoin in 2025 is a complex question with no definitive answer. Both assets are subject to various market forces and inherent risks. While MSTR's significant Bitcoin holdings provide a strong correlation with BTC's price, its underlying business operations and investor sentiment play crucial roles. A bullish Bitcoin market coupled with strong performance from MSTR's software business is needed for MSTR to outperform BTC. However, Bitcoin's inherent value proposition and the volatility of the cryptocurrency market suggest that BTC could retain its lead. Investors should carefully consider these factors and diversify their portfolio accordingly before making any investment decisions. This analysis is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can MicroStrategy Stock (MSTR) Surpass Bitcoin (BTC) In 2025? A Detailed Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Homeland Securitys Coast Guard Overhaul A New Secretary And Enhanced Operational Efficiency

May 24, 2025

Homeland Securitys Coast Guard Overhaul A New Secretary And Enhanced Operational Efficiency

May 24, 2025 -

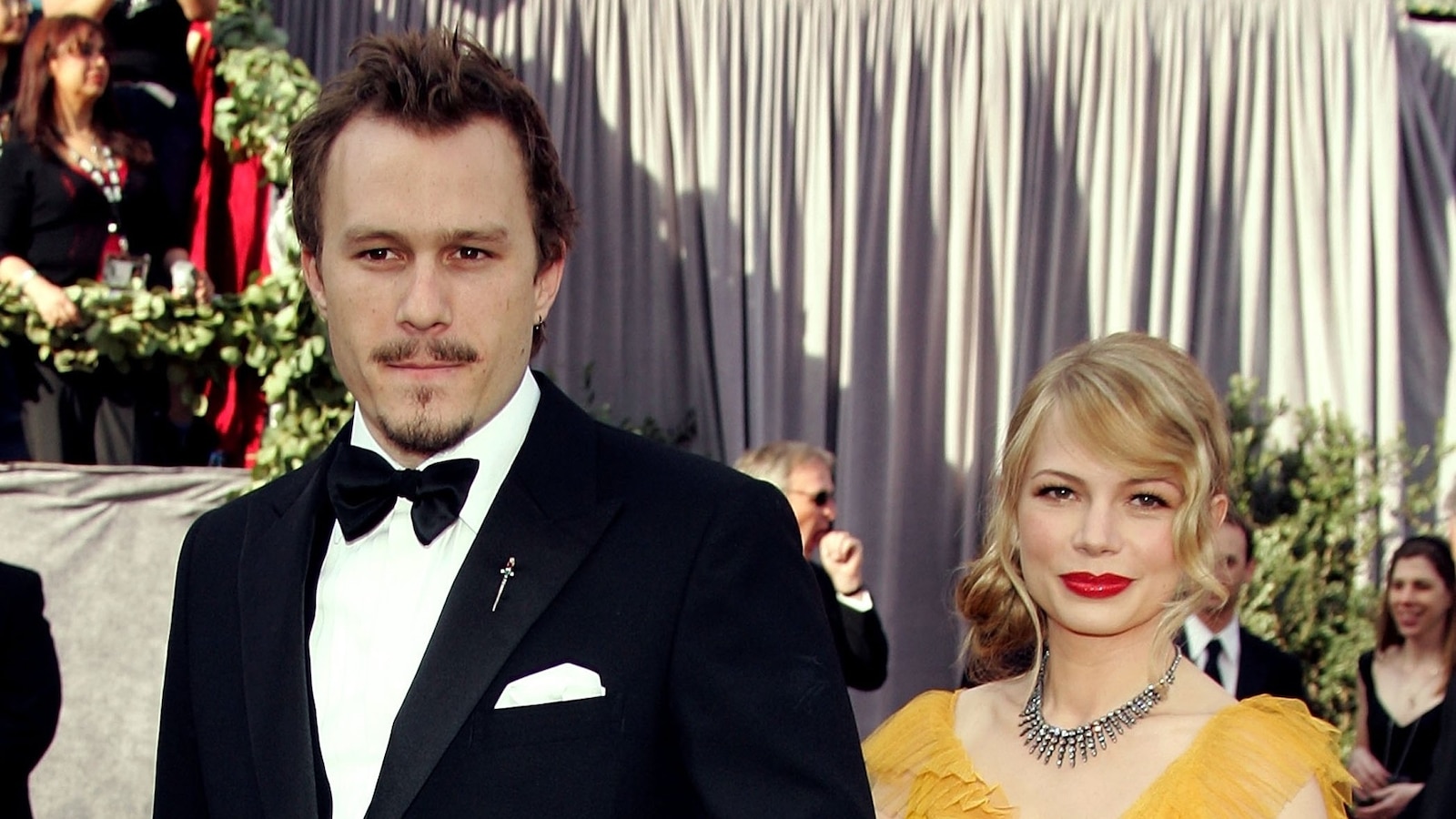

Michelle Williams Discusses Heath Ledgers Legacy And Their Child

May 24, 2025

Michelle Williams Discusses Heath Ledgers Legacy And Their Child

May 24, 2025 -

Star Players Future And Young Talents Development A City Manager Update

May 24, 2025

Star Players Future And Young Talents Development A City Manager Update

May 24, 2025 -

Was A Robert Tesla Video The Catalyst For Luminar Ceos Exit Investigation Needed

May 24, 2025

Was A Robert Tesla Video The Catalyst For Luminar Ceos Exit Investigation Needed

May 24, 2025 -

Where To Watch Mickey 17 Streaming Options For The Sci Fi Thriller

May 24, 2025

Where To Watch Mickey 17 Streaming Options For The Sci Fi Thriller

May 24, 2025