Can Warren Buffett's Principles Guide Successful Cryptocurrency Trading?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can Warren Buffett's Principles Guide Successful Cryptocurrency Trading?

The Oracle of Omaha, Warren Buffett, is renowned for his value investing strategies, built on patience, long-term vision, and a deep understanding of a company's fundamentals. But can these time-tested principles, typically applied to stocks and bonds, actually guide successful cryptocurrency trading? The volatile and often unpredictable nature of the crypto market presents a significant challenge, sparking a lively debate among investors.

While Buffett himself has famously dismissed Bitcoin as "rat poison squared," his core tenets of prudent financial management offer surprisingly relevant insights for navigating the crypto landscape. Let's examine how his principles might – and might not – apply to the world of digital assets.

Buffett's Principles: A Framework for Crypto?

-

Value Investing: Buffett's focus on intrinsic value is crucial. While assessing the "value" of a cryptocurrency is complex compared to a traditional company, looking at factors like market capitalization, adoption rates, technological innovation, and the overall utility of the coin can offer a framework. Speculative bubbles, a common feature of the crypto market, directly contradict this principle.

-

Long-Term Perspective: Buffett famously advocates for long-term holding. While some cryptocurrencies experience rapid growth, the market is known for its dramatic swings. A long-term approach, focusing on fundamental advancements and technological developments, can potentially mitigate some of the risks associated with short-term trading. This requires significant patience and a tolerance for volatility.

-

Understanding the Business: Buffett stresses understanding the underlying business of a company before investing. Similarly, understanding the technology behind a cryptocurrency, its purpose, and its potential applications is vital. Researching the team, the whitepaper, and the overall ecosystem becomes crucial.

-

Risk Management: Perhaps Buffett's most applicable principle is risk management. Diversification across different cryptocurrencies, careful allocation of capital, and setting stop-loss orders are essential to minimize losses. Never invest more than you can afford to lose – a cornerstone of sound financial advice, universally applicable.

-

Avoiding Speculation: Buffett steers clear of speculative bubbles. The crypto market, often driven by hype and FOMO (fear of missing out), is rife with speculative ventures. Focusing on projects with solid fundamentals and a clear utility rather than chasing the next "moon shot" is vital for long-term success.

Where Buffett's Principles Fall Short:

While some parallels exist, significant differences between traditional markets and the crypto world limit the direct applicability of Buffett's strategies.

-

Regulation and Volatility: The lack of consistent regulation and the extreme volatility of the crypto market make long-term predictions far more challenging. Buffett's emphasis on predictable, stable investments clashes sharply with the inherent uncertainty of cryptocurrencies.

-

Decentralization: The decentralized nature of cryptocurrencies contradicts Buffett's preference for understanding the management and governance of a company. The lack of a central authority makes assessing risk and value substantially more complex.

-

Technological Disruption: The rapid pace of technological change within the crypto space renders traditional valuation methods less effective. New technologies and innovations can dramatically alter the landscape, rendering previous analyses obsolete.

Conclusion:

While Warren Buffett's principles of prudent financial management offer valuable lessons, applying them directly to cryptocurrency trading requires careful consideration and adaptation. A long-term perspective, robust risk management, and a deep understanding of the underlying technology are crucial. However, the inherent volatility, lack of regulation, and rapid technological advancements make direct application challenging. Cryptocurrency trading demands a unique approach, blending Buffett's wisdom with a keen awareness of the specific risks and opportunities present in this rapidly evolving digital frontier. Successful crypto trading requires a blend of careful research, risk management, and an understanding of the unique characteristics of this dynamic market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can Warren Buffett's Principles Guide Successful Cryptocurrency Trading?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How College Students Use Chat Gpt Sam Altmans Insights On Age And Decision Making

May 15, 2025

How College Students Use Chat Gpt Sam Altmans Insights On Age And Decision Making

May 15, 2025 -

No Season 3 For Andor Exploring The Reasons Behind The Shows Conclusion

May 15, 2025

No Season 3 For Andor Exploring The Reasons Behind The Shows Conclusion

May 15, 2025 -

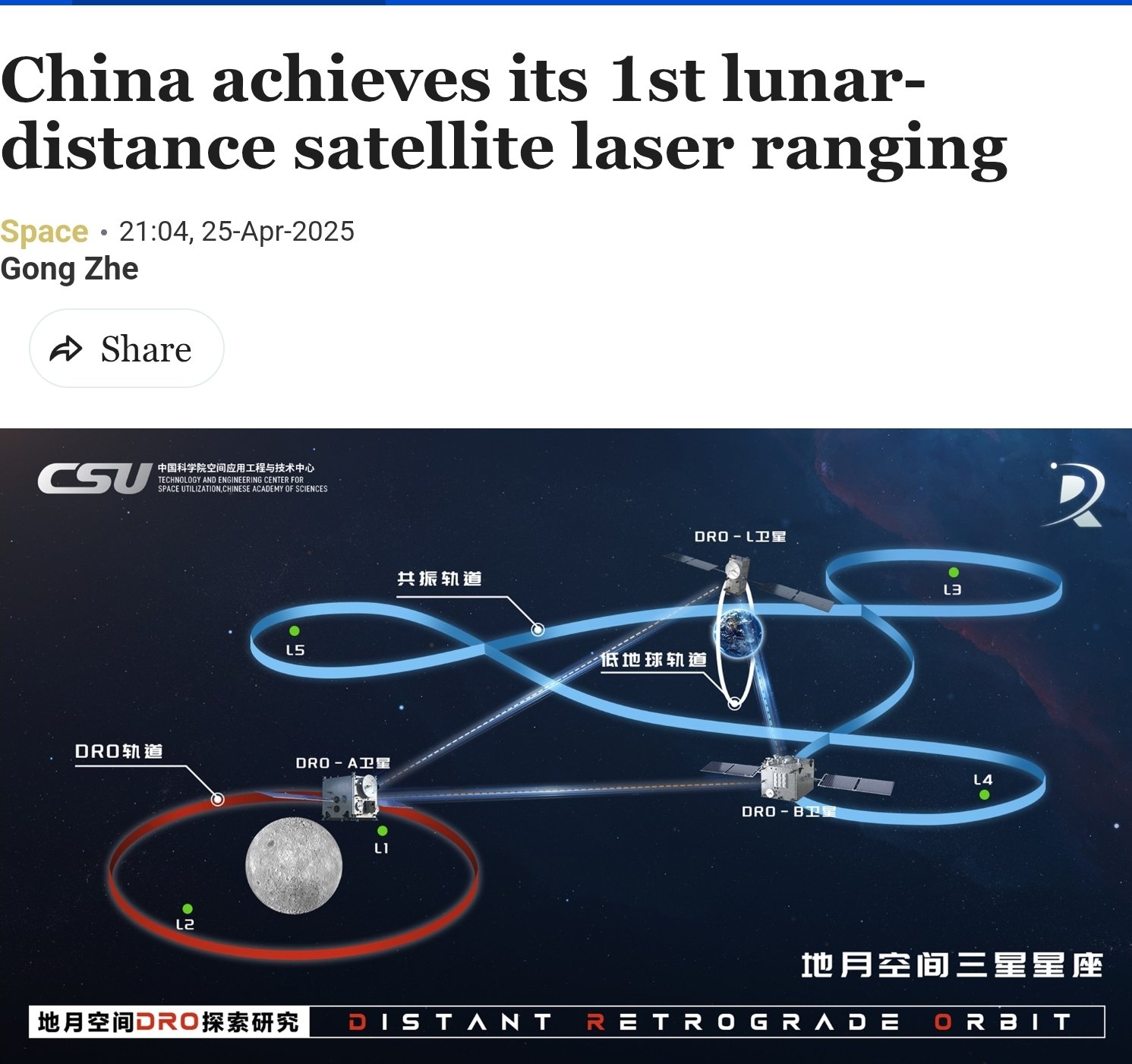

China Successfully Tests Lunar Orbit Laser Ranging From Satellite

May 15, 2025

China Successfully Tests Lunar Orbit Laser Ranging From Satellite

May 15, 2025 -

Intersect Concludes Cardano Community Elects New Governance Representatives

May 15, 2025

Intersect Concludes Cardano Community Elects New Governance Representatives

May 15, 2025 -

Improved Accessibility Features And Blazing Fast Personal Voice From Apple

May 15, 2025

Improved Accessibility Features And Blazing Fast Personal Voice From Apple

May 15, 2025

Latest Posts

-

Police Arrest Chris Brown For Alleged Assault With Tequila Bottle

May 15, 2025

Police Arrest Chris Brown For Alleged Assault With Tequila Bottle

May 15, 2025 -

Samsung Galaxy S25 One Ui 8s Enhanced Coolest Feature

May 15, 2025

Samsung Galaxy S25 One Ui 8s Enhanced Coolest Feature

May 15, 2025 -

Days Before Budget Treasurers Controversial Fire Levy Increase

May 15, 2025

Days Before Budget Treasurers Controversial Fire Levy Increase

May 15, 2025 -

News Summary For Tuesday May 13th

May 15, 2025

News Summary For Tuesday May 13th

May 15, 2025 -

General Sir Gwyn Jenkins Appointed First Sea Lord And Aide De Camp

May 15, 2025

General Sir Gwyn Jenkins Appointed First Sea Lord And Aide De Camp

May 15, 2025