Canada's Economic Future: CIBC's Perspective On The BoC's Proactive Inflation Policy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Canada's Economic Future: CIBC's Cautious Optimism on the Bank of Canada's Inflation Fight

Canada's economy is navigating a complex landscape, grappling with persistent inflation and the Bank of Canada's (BoC) aggressive interest rate hikes. While the central bank's proactive approach aims to curb inflation, its impact on economic growth remains a key concern. CIBC, one of Canada's leading financial institutions, offers a nuanced perspective on the nation's economic trajectory, tempering initial optimism with cautionary notes.

The BoC's Proactive Stance: A Necessary Evil?

The Bank of Canada has been aggressively raising interest rates throughout 2023, aiming to bring inflation back to its 2% target. This proactive policy, while necessary to cool down an overheated economy, carries significant risks. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing down economic activity and even triggering a recession. CIBC analysts acknowledge the BoC's commitment to price stability, recognizing the long-term benefits of controlling inflation. However, they also highlight the short-term pain associated with this strategy.

CIBC's Outlook: A Balancing Act

CIBC's economic forecast paints a picture of cautious optimism. While they anticipate a slowdown in economic growth, they don't foresee a deep or prolonged recession. Their analysis suggests that the Canadian economy possesses underlying strength, driven by factors such as:

- Strong Labor Market: Despite recent job losses in certain sectors, the overall labor market remains relatively robust. Low unemployment rates and high labor force participation contribute to sustained consumer spending.

- Resilient Housing Market (with caveats): While the housing market has cooled significantly due to higher interest rates, CIBC believes it has stabilized, avoiding a catastrophic crash. However, they warn of continued price adjustments and potential regional variations.

- Government Spending and Infrastructure Investments: Government initiatives aimed at infrastructure development and social programs provide a cushion against economic downturn, supporting aggregate demand.

Challenges Remain: Navigating the Inflationary Storm

Despite these positive indicators, CIBC highlights several significant challenges:

- Persistent Inflation: While inflation is expected to gradually decline, CIBC cautions against complacency. Global supply chain disruptions and persistent energy price volatility could prolong inflationary pressures.

- Global Economic Uncertainty: The global economic environment remains uncertain, with potential geopolitical risks and economic slowdowns in major trading partners impacting Canada's export sector.

- Household Debt Levels: High levels of household debt remain a vulnerability, making Canadian consumers more susceptible to higher interest rates and potential economic shocks.

CIBC's Recommendations: A Measured Approach

CIBC advocates for a measured and data-driven approach by the Bank of Canada. They recommend a careful assessment of the impact of existing interest rate hikes before further increases, emphasizing the need to avoid overtightening monetary policy. The bank also urges the government to maintain fiscal discipline and support initiatives that promote long-term economic growth and productivity.

Conclusion: A Path to Sustainable Growth

Canada's economic future hinges on navigating the delicate balance between controlling inflation and supporting sustainable economic growth. CIBC's perspective offers a realistic appraisal of the situation, highlighting both the challenges and opportunities ahead. By adopting a cautious yet proactive approach, Canada can potentially steer clear of a severe recession while effectively addressing persistent inflationary pressures. The coming months will be crucial in determining the effectiveness of the BoC's policy and the overall trajectory of the Canadian economy. Continuous monitoring of key economic indicators and a flexible policy response will be vital to securing a positive economic outlook.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Canada's Economic Future: CIBC's Perspective On The BoC's Proactive Inflation Policy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Klarna Funding Easy Payment Plans For Electronics Purchases Tvs And Air Pods

May 25, 2025

Klarna Funding Easy Payment Plans For Electronics Purchases Tvs And Air Pods

May 25, 2025 -

Game Features Revealed Chrono Odysseys First Developer Diary

May 25, 2025

Game Features Revealed Chrono Odysseys First Developer Diary

May 25, 2025 -

Beat Nyt Wordle Today May 23 1434 Solution And Strategies

May 25, 2025

Beat Nyt Wordle Today May 23 1434 Solution And Strategies

May 25, 2025 -

Analyzing Game Stops Strategic Shift Profits 6 B Balance Sheet And Bitcoin Investment

May 25, 2025

Analyzing Game Stops Strategic Shift Profits 6 B Balance Sheet And Bitcoin Investment

May 25, 2025 -

Tesla Vs Competitors Pricing And Market Share Analysis For Electric Vehicles

May 25, 2025

Tesla Vs Competitors Pricing And Market Share Analysis For Electric Vehicles

May 25, 2025

Latest Posts

-

Anita Rani Addresses Relationship After Husband Separation A Countryfile Update

May 25, 2025

Anita Rani Addresses Relationship After Husband Separation A Countryfile Update

May 25, 2025 -

Actor Mukul Dev Passes Away At 54 Remembering His Roles In R Rajkumar And Jai Ho

May 25, 2025

Actor Mukul Dev Passes Away At 54 Remembering His Roles In R Rajkumar And Jai Ho

May 25, 2025 -

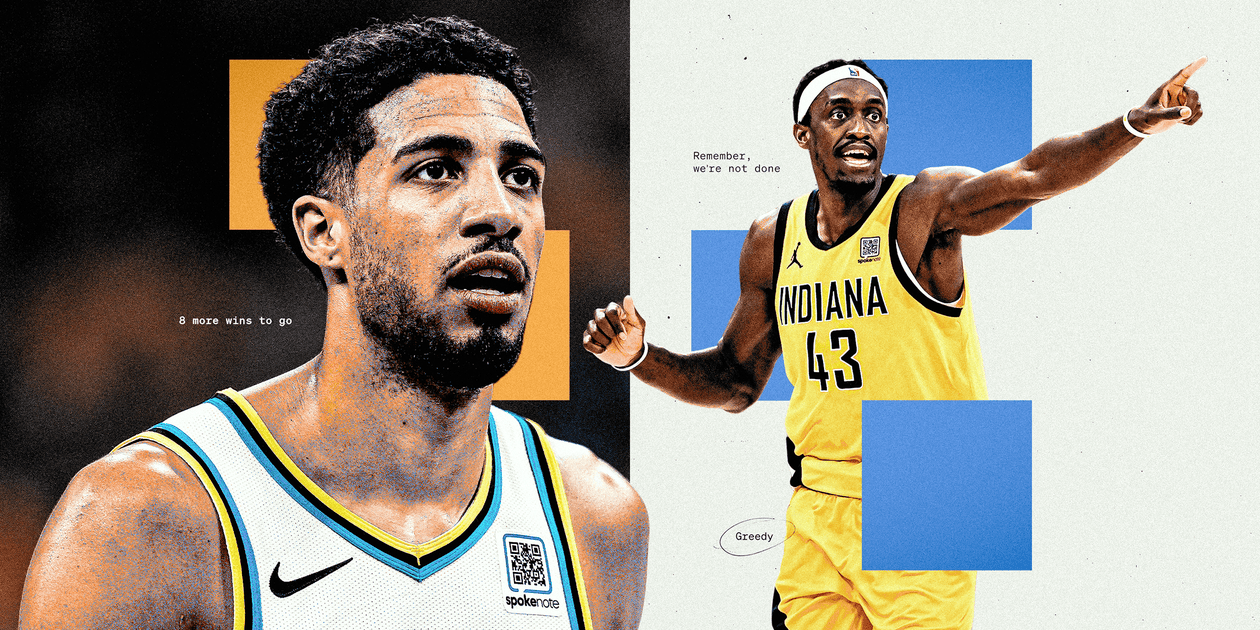

Nba Playoffs Pacers Realistic Path To A Championship

May 25, 2025

Nba Playoffs Pacers Realistic Path To A Championship

May 25, 2025 -

Pop Marts Labubu Doll Recall Fan Anger And Heated Disputes

May 25, 2025

Pop Marts Labubu Doll Recall Fan Anger And Heated Disputes

May 25, 2025 -

Warren Buffetts Fear And Greed Indicator A Practical Guide For Crypto Investors

May 25, 2025

Warren Buffetts Fear And Greed Indicator A Practical Guide For Crypto Investors

May 25, 2025