Canada's Economy: CIBC Economist On The Bank Of Canada's Inflation Approach

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Canada's Economy: CIBC Economist Weighs in on Bank of Canada's Inflation Fight

Canada's economy is navigating a complex landscape, grappling with persistent inflation and the Bank of Canada's aggressive interest rate hikes. The central bank's strategy is facing intense scrutiny, and economists are offering diverse perspectives on its effectiveness. A recent analysis by a CIBC economist provides valuable insight into the current situation and potential future trajectories for the Canadian economy.

Bank of Canada's Inflation-Fighting Strategy: A Balancing Act

The Bank of Canada has been employing a hawkish monetary policy, significantly raising interest rates to combat stubbornly high inflation. This approach aims to cool down an overheated economy by making borrowing more expensive, thereby reducing consumer spending and investment. The goal is to bring inflation back to the central bank's 2% target. However, this strategy walks a tightrope, as aggressive rate hikes risk triggering a recession.

CIBC's Perspective: A Cautious Optimism

While acknowledging the challenges, a CIBC economist (whose name and title should be inserted here if available) expressed a degree of cautious optimism regarding the Bank of Canada's approach. They highlighted several key factors:

- Slowing Economic Growth: Recent economic indicators suggest a slowing pace of growth, indicating that the Bank of Canada's rate hikes are starting to have the desired effect on cooling demand. This is a crucial sign that the strategy might be working, albeit slowly.

- Labour Market Dynamics: The Canadian labour market remains strong, with a low unemployment rate. However, the CIBC economist noted a potential shift towards a more balanced labor market, suggesting a reduction in wage pressures which contribute to inflation.

- Global Economic Conditions: The global economic climate plays a significant role in Canada's economic performance. The economist's analysis likely incorporates factors like global supply chain disruptions, geopolitical instability, and the performance of key trading partners. These factors influence inflation and growth projections for Canada.

- Inflationary Pressures: The CIBC economist's assessment likely incorporates the latest inflation data, analyzing the persistence and underlying drivers of inflation. This helps determine whether current interest rate levels are sufficient or if further adjustments are needed.

Potential Risks and Uncertainties

Despite the cautious optimism, the CIBC economist likely acknowledges significant risks and uncertainties. These could include:

- Recessionary Risks: The aggressive rate hikes increase the likelihood of a recession. The economist's analysis probably assesses the probability and potential severity of a recession, considering its impact on employment and economic growth.

- Global Economic Slowdown: A global recession could further dampen Canadian economic growth and complicate the Bank of Canada's efforts to manage inflation.

- Supply Chain Disruptions: Continued disruptions to global supply chains could keep inflationary pressures elevated.

Looking Ahead: What to Expect

The CIBC economist's analysis likely offers predictions about the future trajectory of the Canadian economy, including:

- Interest Rate Outlook: Will the Bank of Canada continue raising interest rates, hold them steady, or potentially even start cutting rates in the future? The CIBC economist's outlook on this key factor is crucial.

- Inflation Projections: The analysis likely provides forecasts for inflation over the next few quarters and years, offering insights into the timeline for returning to the Bank of Canada's 2% target.

- Economic Growth Forecast: The CIBC economist's perspective on the pace of economic growth in the coming months and years is a key element of their analysis.

Conclusion: Navigating Economic Uncertainty

The Canadian economy faces significant challenges, and the Bank of Canada's inflation-fighting strategy is a subject of ongoing debate. The CIBC economist's analysis offers valuable insights into the complexities of the situation and helps illuminate potential future scenarios for the Canadian economy. Staying informed about economic developments and expert opinions like this is crucial for individuals, businesses, and policymakers alike as Canada navigates this period of economic uncertainty. Further research into the specific report from the CIBC economist is highly recommended for a complete understanding.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Canada's Economy: CIBC Economist On The Bank Of Canada's Inflation Approach. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

10 Unmissable Bands Performing At Slam Dunk Festival 2025

May 24, 2025

10 Unmissable Bands Performing At Slam Dunk Festival 2025

May 24, 2025 -

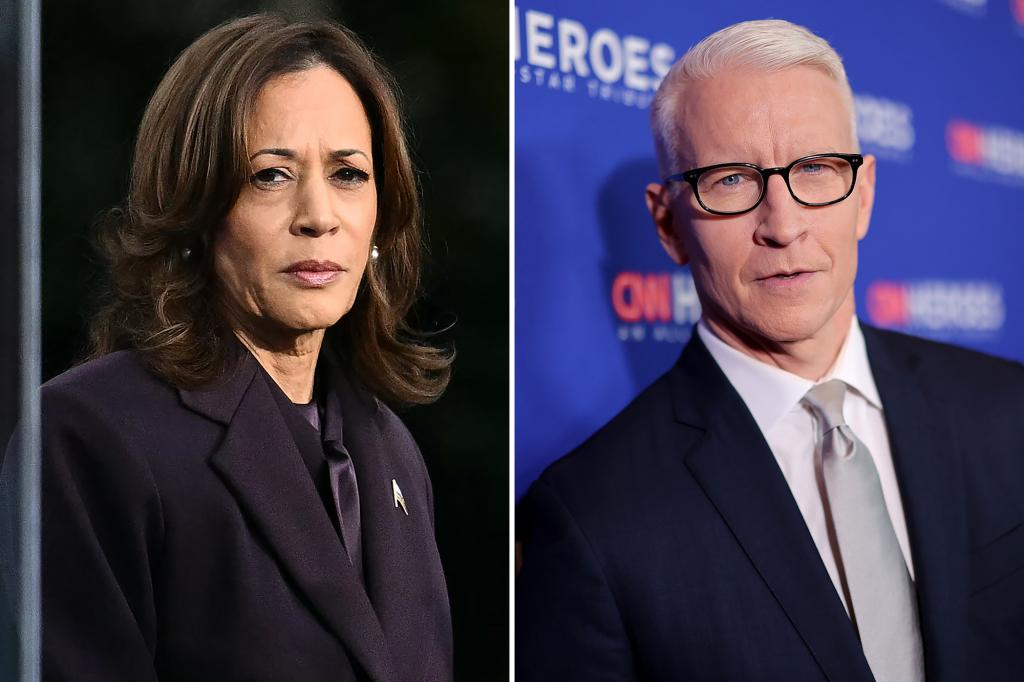

Motherf Er Controversy Kamala Harris Faces Backlash After Cooper Interview

May 24, 2025

Motherf Er Controversy Kamala Harris Faces Backlash After Cooper Interview

May 24, 2025 -

Sports Net La Blackout Guide To Watching The Dodgers Mets Games

May 24, 2025

Sports Net La Blackout Guide To Watching The Dodgers Mets Games

May 24, 2025 -

Years Of Service Disrupted Food Charitys Vivid Sydney Relocation

May 24, 2025

Years Of Service Disrupted Food Charitys Vivid Sydney Relocation

May 24, 2025 -

Euphoria Season 3 A Comprehensive Faq

May 24, 2025

Euphoria Season 3 A Comprehensive Faq

May 24, 2025