Can't Defend Your Crypto In Russian Court? Tax Service Disclosure Is Key

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can't Defend Your Crypto in Russian Court? Tax Service Disclosure is Key

Navigating the Complexities of Crypto Taxation and Legal Disputes in Russia

The Russian legal landscape surrounding cryptocurrency is notoriously complex and rapidly evolving. For individuals holding or trading crypto assets, facing legal action, especially concerning tax evasion, can feel like navigating a minefield. One crucial element often overlooked is the strategic disclosure of cryptocurrency holdings to the Russian tax service. While it might seem counterintuitive, proactive disclosure can significantly strengthen your defense and potentially mitigate penalties.

The Challenges of Crypto Litigation in Russia

Russia's regulatory framework for digital currencies remains underdeveloped, leading to inconsistencies in legal interpretation and enforcement. This ambiguity often leaves crypto owners vulnerable, especially when facing accusations of tax evasion. The lack of clear legal precedents regarding cryptocurrency transactions creates significant uncertainty for both individuals and the courts. This is further complicated by the decentralized and pseudonymous nature of many cryptocurrencies, making tracing transactions and proving ownership challenging for both sides of a legal dispute.

Why Tax Service Disclosure is a Powerful Defense

While seemingly paradoxical, proactive disclosure to the Federal Tax Service (FTS) of Russia offers several key advantages:

- Demonstrates Good Faith: Openly declaring your crypto holdings and transactions showcases your willingness to comply with the law, even within the grey areas of current legislation. This can significantly influence the court's perception of your actions.

- Mitigates Penalties: While still subject to taxation, voluntary disclosure often leads to reduced penalties compared to situations where tax evasion is discovered through an investigation. The FTS may offer leniency to those who come forward proactively.

- Establishes a Clear Record: A documented history of your crypto transactions, submitted to the FTS, provides a concrete record that can be used to defend against accusations of illicit activity. This documented trail counters the inherent difficulty in tracing cryptocurrency transactions.

- Facilitates a Structured Negotiation: Open communication with the FTS allows for a more structured negotiation regarding any outstanding tax liabilities, potentially leading to a more favorable settlement.

Strategies for Effective Disclosure

Effective disclosure requires meticulous documentation and careful legal counsel. Here's what you need to consider:

- Accurate Record Keeping: Maintain detailed records of all cryptocurrency transactions, including dates, amounts, and involved parties. This should include exchange transactions, staking rewards, and any other relevant activity.

- Professional Legal Assistance: Navigating Russian tax law regarding cryptocurrencies requires expertise. Engaging a lawyer specializing in cryptocurrency and tax law is crucial to ensure compliance and maximize your defense.

- Understanding Applicable Regulations: Stay updated on the evolving Russian regulations concerning cryptocurrency taxation. The legal landscape is constantly changing, and understanding current laws is paramount.

Conclusion: Proactive Approach is Crucial

Facing legal challenges concerning cryptocurrency in Russia can be daunting. However, proactive disclosure to the FTS, coupled with meticulous record-keeping and expert legal counsel, significantly improves your chances of a favorable outcome. By demonstrating good faith and cooperating with the authorities, you can strengthen your defense and potentially avoid severe penalties. Remember, prevention is always better than cure, and maintaining transparent records is crucial for navigating the complexities of crypto taxation in Russia. Don't wait until you're facing legal action; take control of your crypto assets and ensure compliance with Russian tax laws today.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can't Defend Your Crypto In Russian Court? Tax Service Disclosure Is Key. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Hollywood To The Octagon The Rock Channels Mark Colemans Knockout Power

Apr 30, 2025

From Hollywood To The Octagon The Rock Channels Mark Colemans Knockout Power

Apr 30, 2025 -

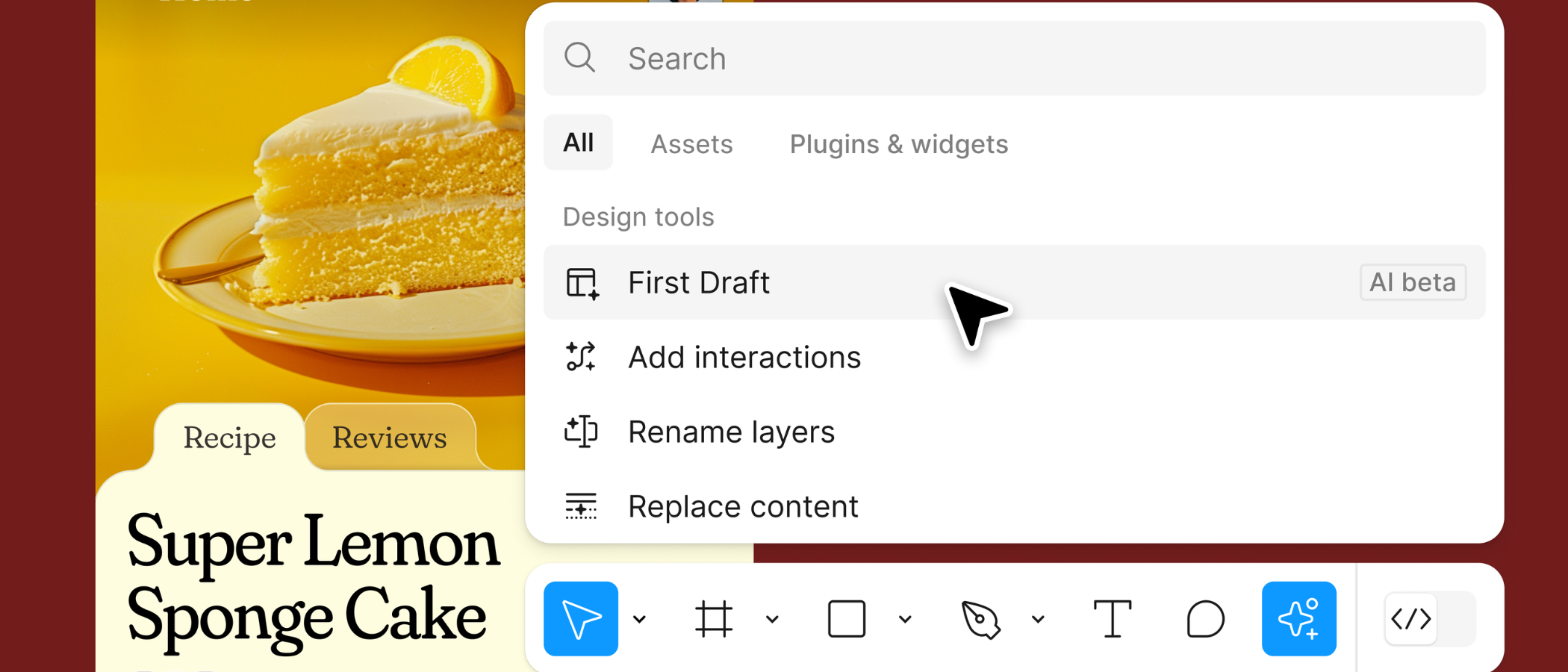

The Hype Vs Reality Of Ai Findings From Figmas User Survey

Apr 30, 2025

The Hype Vs Reality Of Ai Findings From Figmas User Survey

Apr 30, 2025 -

Delhi Capitals Suffer Third Home Defeat Kkrs Dominant Display

Apr 30, 2025

Delhi Capitals Suffer Third Home Defeat Kkrs Dominant Display

Apr 30, 2025 -

Data Breach Medical Software Firm Exposes Tens Of Thousands Of Patient Records

Apr 30, 2025

Data Breach Medical Software Firm Exposes Tens Of Thousands Of Patient Records

Apr 30, 2025 -

Unnamed Country Holds Up Trade Deal Says Commerce Secretary

Apr 30, 2025

Unnamed Country Holds Up Trade Deal Says Commerce Secretary

Apr 30, 2025

Latest Posts

-

Blackout In Spain Minister Warns Against Misplacing Blame On Renewables

May 01, 2025

Blackout In Spain Minister Warns Against Misplacing Blame On Renewables

May 01, 2025 -

Barcelonas Champions League Goalkeeping Dilemma Szczesny Vs Ter Stegen

May 01, 2025

Barcelonas Champions League Goalkeeping Dilemma Szczesny Vs Ter Stegen

May 01, 2025 -

Bonus Episode Redefining Black History And Cultural Narratives

May 01, 2025

Bonus Episode Redefining Black History And Cultural Narratives

May 01, 2025 -

Barcelona Vs Inter Milan Live Score Updates And Highlights From The Champions League

May 01, 2025

Barcelona Vs Inter Milan Live Score Updates And Highlights From The Champions League

May 01, 2025 -

Xrp Surges To 2 35 Following Futures Etf Approval

May 01, 2025

Xrp Surges To 2 35 Following Futures Etf Approval

May 01, 2025