CDL AGM Fallout: Shareholder Conflict Erupts Over Director Appointments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CDL AGM Fallout: Shareholder Conflict Erupts Over Director Appointments

The annual general meeting (AGM) of CDL (City Developments Limited), a prominent real estate giant, ended in a storm of controversy, leaving investors reeling from a heated clash over director appointments. The fallout reveals simmering tensions amongst shareholders and raises questions about corporate governance within the company. This unprecedented display of shareholder dissent highlights the increasing scrutiny faced by large corporations regarding transparency and leadership.

High-Stakes Battle for Boardroom Control

The main source of contention centered around the proposed appointments of several new directors to CDL's board. While the specific details of the nominees remain partially undisclosed, sources suggest the conflict stemmed from differing opinions on the candidates' experience and alignment with the company's long-term strategic goals. This led to a vocal and protracted debate amongst shareholders, with some expressing strong opposition to the proposed appointments.

Disagreement Over Strategic Direction

The disagreement went beyond simple personal preferences. Several shareholders voiced concerns about the potential impact of the new directors on CDL's investment strategy, particularly regarding its future development projects and international expansion plans. This suggests a deeper divide regarding the company's future trajectory and raises questions about the existing board's ability to effectively guide CDL's growth. The lack of clear communication regarding the nominees' qualifications exacerbated the situation, fueling suspicion and distrust amongst dissenting shareholders.

Impact on CDL's Share Price

The AGM fallout has already had a noticeable impact on CDL's share price, with a slight dip observed following the contentious meeting. Market analysts are closely monitoring the situation, as continued uncertainty could lead to further volatility. Investor confidence is crucial for CDL's success, and the recent events have undoubtedly shaken this confidence to some degree. The company's response to this crisis will be pivotal in restoring stability and rebuilding trust with its shareholders.

Corporate Governance Under Scrutiny

This incident shines a harsh light on CDL's corporate governance practices. The intense shareholder conflict underscores the need for increased transparency and more robust communication channels between the board and its investors. Experts suggest that CDL should review its nomination process and improve its engagement with shareholders to prevent similar controversies in the future. The episode serves as a cautionary tale for other publicly listed companies, highlighting the importance of proactive shareholder engagement and a clear articulation of strategic goals.

Key Takeaways:

- Increased Shareholder Activism: The AGM highlights a growing trend of shareholder activism, with investors becoming more assertive in voicing their concerns and demanding greater accountability from corporate boards.

- Importance of Transparency: The lack of clear communication surrounding director appointments fueled the conflict, emphasizing the crucial role of transparency in maintaining shareholder trust.

- Impact on Investor Confidence: The event negatively impacted investor confidence and CDL's share price, underscoring the potential financial consequences of internal corporate disputes.

- Need for Improved Corporate Governance: CDL needs to address the issues raised and implement measures to improve its corporate governance practices to prevent future conflicts.

The CDL AGM fallout serves as a stark reminder of the delicate balance between effective corporate leadership and the rights and concerns of its shareholders. The coming weeks will be crucial in determining how CDL navigates this crisis and restores investor confidence. The long-term impact on the company's reputation and market standing remains to be seen.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CDL AGM Fallout: Shareholder Conflict Erupts Over Director Appointments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

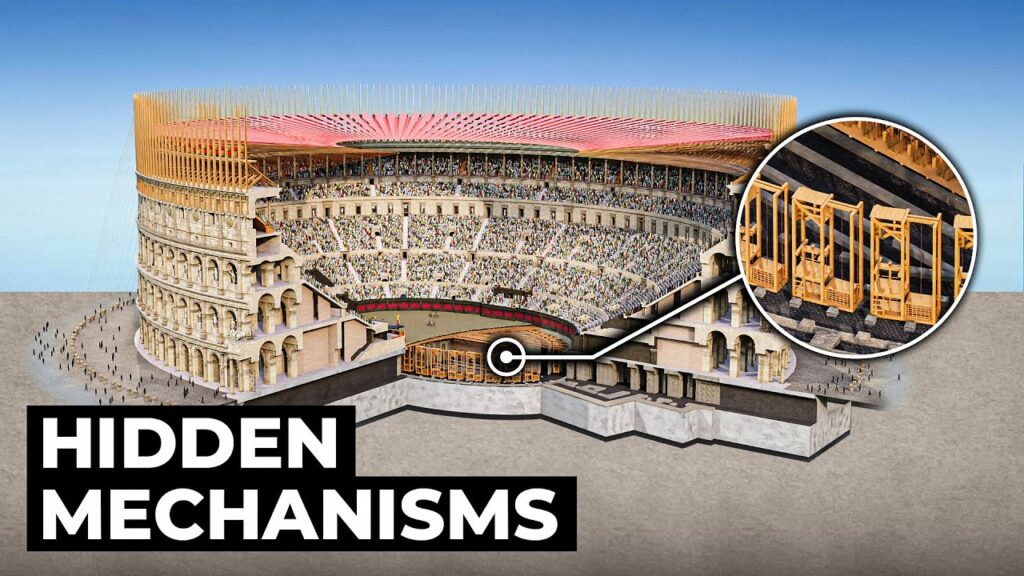

Ancient Roman Engineering The Colosseums Hidden Mechanisms In 3 D

Apr 26, 2025

Ancient Roman Engineering The Colosseums Hidden Mechanisms In 3 D

Apr 26, 2025 -

Travel Smarter With Ray Ban Metas Enhanced Live Translation

Apr 26, 2025

Travel Smarter With Ray Ban Metas Enhanced Live Translation

Apr 26, 2025 -

New Video Shows Prince Louiss Uncanny Likeness To A Young Prince William

Apr 26, 2025

New Video Shows Prince Louiss Uncanny Likeness To A Young Prince William

Apr 26, 2025 -

Ny Giants Draft 2024 How Experts Graded The Teams Round 1 Selections

Apr 26, 2025

Ny Giants Draft 2024 How Experts Graded The Teams Round 1 Selections

Apr 26, 2025 -

Ostapenko Secures 2025 Porsche Tennis Grand Prix Title

Apr 26, 2025

Ostapenko Secures 2025 Porsche Tennis Grand Prix Title

Apr 26, 2025