Chainlink (LINK) Price Plunges: $10 Support Level Tested Amidst 300K Exchange Inflows

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chainlink (LINK) Price Plunges: $10 Support Level Tested Amidst 300K Exchange Inflows

The price of Chainlink (LINK) has taken a significant hit, plunging and testing the crucial $10 support level. This downturn coincides with a notable influx of 300,000 LINK tokens into cryptocurrency exchanges, sparking concern among investors. The cryptocurrency market, already experiencing volatility, is closely watching LINK's performance, as it's a prominent player in the decentralized finance (DeFi) space.

The recent price drop has sent ripples through the crypto community, with many speculating on the reasons behind this sudden decline. While a definitive cause remains unclear, several factors are likely contributing to the current situation. Let's delve deeper into the potential catalysts for this significant price plunge.

Major Factors Contributing to LINK's Price Decline:

-

Increased Exchange Inflows: The movement of 300,000 LINK tokens onto exchanges is a significant indicator. This suggests that a considerable number of holders are either looking to sell their LINK holdings or are preparing for potential future sales. This increased supply on exchanges can exert downward pressure on the price.

-

Overall Market Sentiment: The broader cryptocurrency market is currently experiencing a period of uncertainty. Bitcoin's price movements often influence altcoins like LINK, and a negative market sentiment can easily trigger sell-offs across the board. The current macroeconomic climate, with persistent inflation and economic uncertainty, also plays a significant role in investor risk appetite.

-

Lack of Significant Catalysts: Without substantial positive news or developments for Chainlink, the price may be more susceptible to market fluctuations. The absence of major partnerships, upgrades, or significant adoption increases can leave the token vulnerable to sell-offs driven by profit-taking or fear.

-

Technical Analysis: Technical indicators might also be contributing to the downward pressure. A break below crucial support levels like $10 can trigger further selling, especially among traders employing stop-loss orders. This can lead to a cascading effect, exacerbating the price decline.

What Does This Mean for LINK Investors?

The current situation presents a challenge for LINK investors. While the $10 support level has historically proven to be resilient, its breach could signal further downward movement. However, it's important to note that price fluctuations are common in the volatile cryptocurrency market.

Investors should:

- Conduct thorough research: Before making any investment decisions, it's crucial to carefully assess the current market conditions and the long-term prospects of Chainlink.

- Consider diversification: Diversifying your crypto portfolio can help mitigate risks associated with individual token price volatility.

- Avoid panic selling: Emotional decisions based on short-term price fluctuations are often detrimental. Long-term investors should carefully consider their investment strategy and risk tolerance.

The Future of Chainlink (LINK):

Despite the current price plunge, Chainlink's underlying technology and its position in the DeFi ecosystem remain strong. Many experts still see long-term potential for LINK. However, the short-term outlook remains uncertain, and investors need to carefully monitor market developments and news related to Chainlink's technological advancements and adoption. The $10 support level will continue to be a crucial point to watch. A break below this level could signify further bearish pressure, while a successful defense could signal a potential rebound. Only time will tell the ultimate impact of this recent price drop on Chainlink's future trajectory. The coming weeks will be critical in determining whether this is a temporary setback or the start of a more significant downward trend.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chainlink (LINK) Price Plunges: $10 Support Level Tested Amidst 300K Exchange Inflows. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jokics Mvp Argument Beyond Statistics Leadership And Impact

May 22, 2025

Jokics Mvp Argument Beyond Statistics Leadership And Impact

May 22, 2025 -

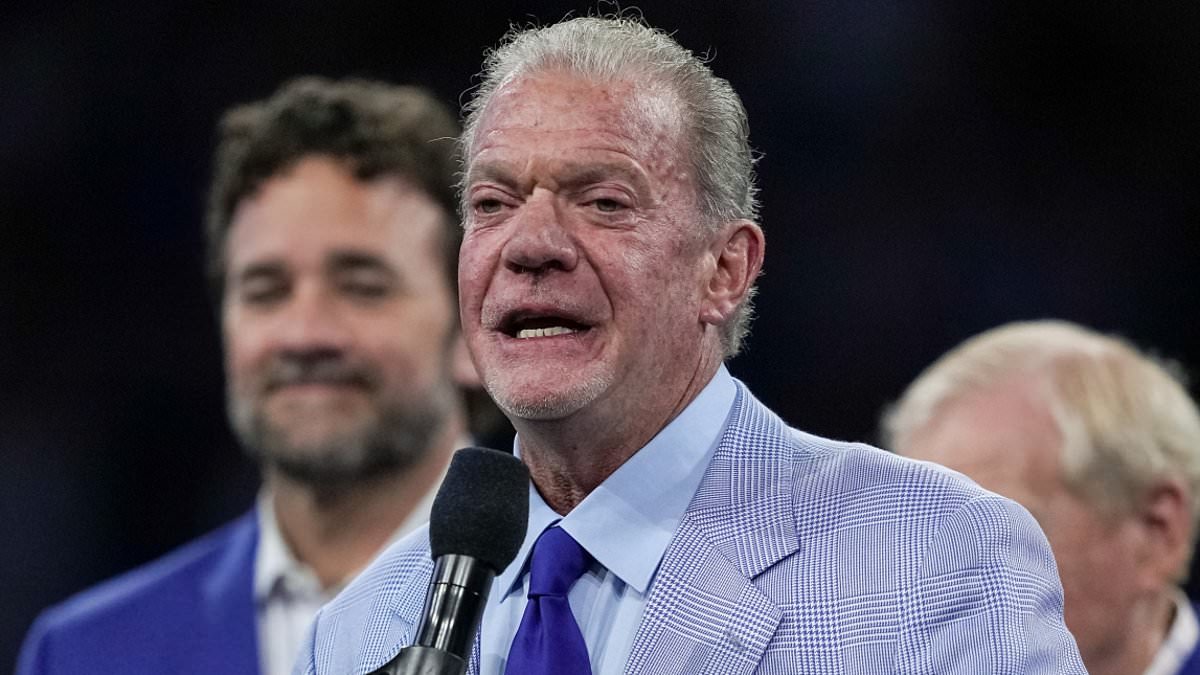

Indianapolis Colts In Mourning Owner Jim Irsay Dies Aged 65

May 22, 2025

Indianapolis Colts In Mourning Owner Jim Irsay Dies Aged 65

May 22, 2025 -

June Ipl Final Uncovering The Facts And Dates

May 22, 2025

June Ipl Final Uncovering The Facts And Dates

May 22, 2025 -

Microsofts Azure Embraces Xai Grok 3 5 Implications For Open Ai And The Future Of Ai

May 22, 2025

Microsofts Azure Embraces Xai Grok 3 5 Implications For Open Ai And The Future Of Ai

May 22, 2025 -

Volatility In Us Bond Market Trump Tax Bill Weighs On Investors

May 22, 2025

Volatility In Us Bond Market Trump Tax Bill Weighs On Investors

May 22, 2025